Indian Investors Duped in Fake SEBI-Registered Investment Schemes

Multiple investors in Gwalior, India, have lost significant sums after falling victim to fraudsters claiming to be representatives of firms purportedly registered with the Securities and Exchange Board of India (SEBI). In two major cases, scammers lured victims through WhatsApp groups, promising extraordinary returns and displaying fake account balances to build trust.

A 60-year-old resident was added to a WhatsApp group called ‘861 SC Wealth Hub’, run by individuals claiming links to “Standard Chartered GP,” an allegedly SEBI-registered entity. Convinced by promises of high profits, he transferred ₹1.715 million across several bank accounts. Fraudsters used a mobile app and WhatsApp messages to show his investment growing to ₹22.6 million. When he tried to withdraw, they demanded an additional ₹4.2 million as a “service charge,” exposing the scam.

In another incident, a 35-year-old victim joined a group named ‘Visionary Elite Group’ in October 2025. Claiming to be from “SEBI-registered EDEL PRO HEAD,” scammers persuaded him to invest ₹2.4 million via UPI, IMPS, NEFT, and RTGS transfers. His portfolio was falsely shown as swelling to nearly ₹120 million. When he attempted withdrawal, the fraudsters demanded a 15% service fee, revealing the deception.

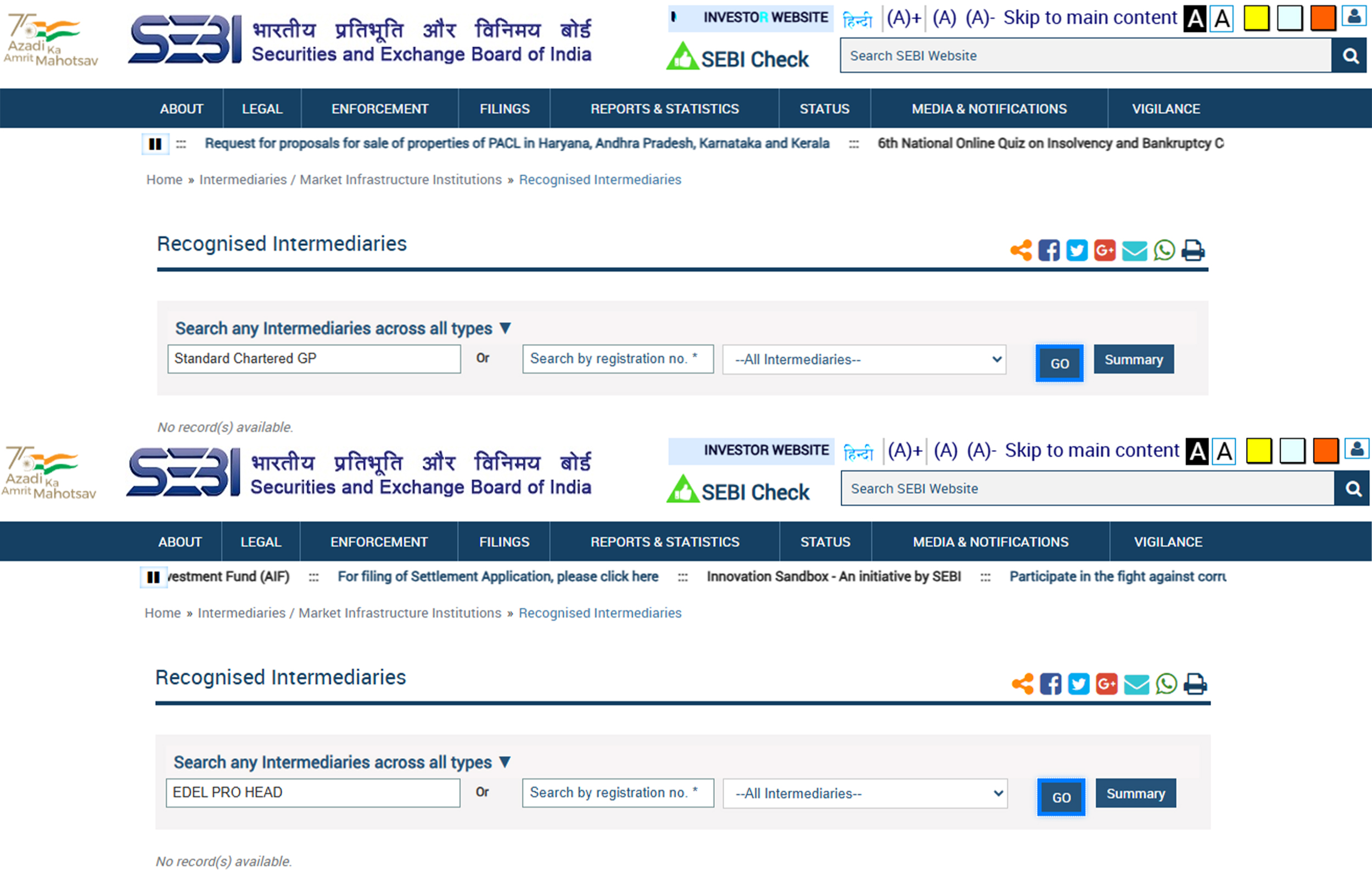

“Standard Chartered GP” is not registered with SEBI. The name appears to be fabricated by scammers to mislead investors. Standard Chartered operates in India through various SEBI-registered entities, primarily Standard Chartered Securities (India) Ltd. “EDEL PRO HEAD” likewise has no record of SEBI registration.

In the two cases, fraudsters falsely claimed regulatory approval.

Authorities urge the public to remain alert to unsolicited investment offers on messaging apps. Red flags include:

- Unrealistic promises of high returns

- Pressure to make quick payments

- Demands for extra fees to release funds

Indian investors are reminded that investments should only be made through SEBI-registered platforms and official channels. Authorities advise verifying credentials independently and avoiding unknown groups or schemes that rely on virtual profit displays.