Equiti Seychelles Client Accuses Broker of Withholding Funds and Trading Manipulation, Demands $21,533 Refund

A trader and Introducing Broker (IB) of Equiti Seychelles recently filed a complaint alleging “a series of unacceptable and suspicious actions” by the broker, including unjustified withholding of funds, deduction of trading profits, platform manipulation, disconnection, and abnormal slippage. At the same time, the client demands full payment of $21,533.65 allegedly owed by Equiti Seychelles.

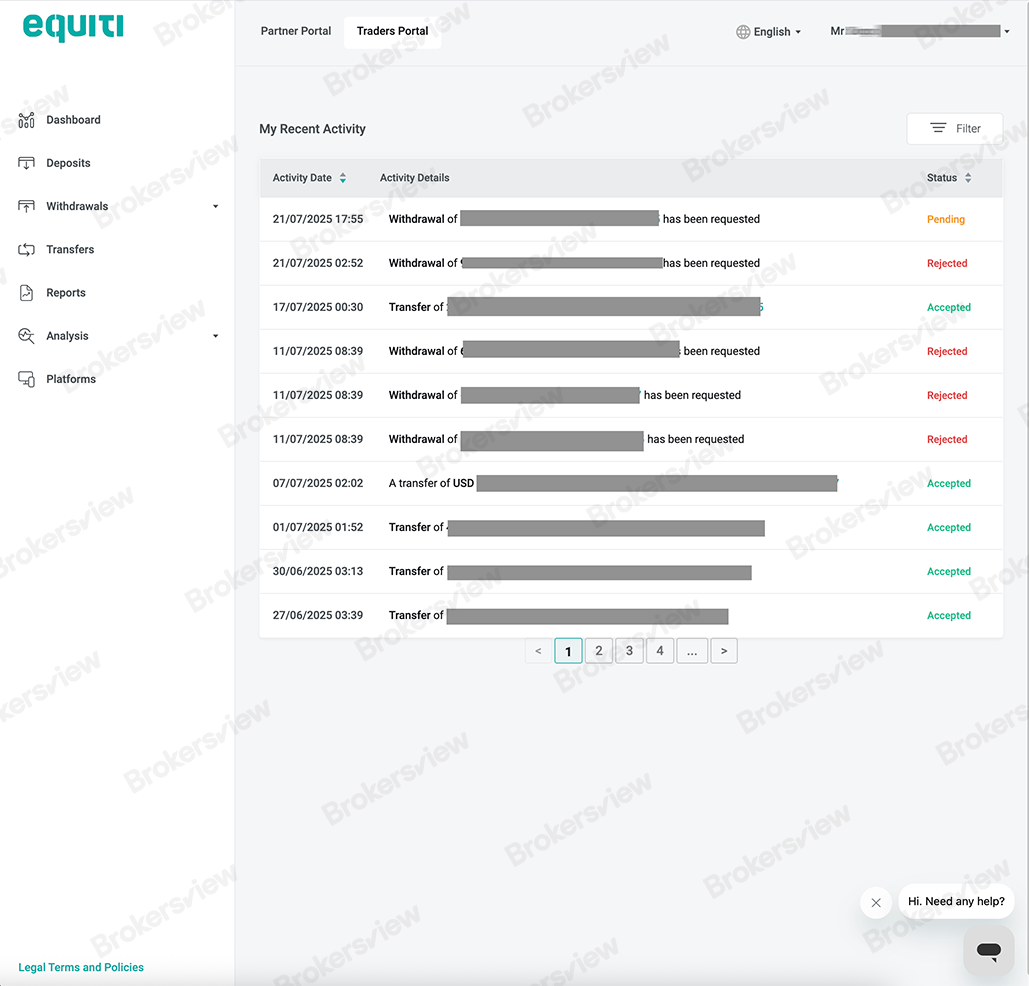

According to the complainant, he traded for more than a year through Equiti's FIX API and MT5 accounts, but the broker denied his withdrawal requests totaling $9,831.90. Following the situation, Equiti deducted $7,077.81 in profits he made after three months of trading through the FIX API, as well as a total of $11,701.72 in profits from other accounts, without proper explanation.

The client further stated that he sent Equiti a legal notice to terminate their contract. However, the broker unilaterally terminated his account while holding his $9,000+ despite the end of the contract.

Additionally, the complainant reported facing multiple issues with the Equiti platform, such as suspected platform manipulation, frequent disconnections, unexplained slippage, and even an unauthorized withdrawal, which he attributed to system-related failures.

The client's withdrawal requests were refused by the platform

Under standard procedure, accounts must be manually verified within the wallet before withdrawals are permitted. However, an unauthorized withdrawal bypassed the verification process and was executed, leaving the account without remaining funds, according to the trader. Despite the client's repeated inquiries, Equiti has not explained how it obtained the authorization.

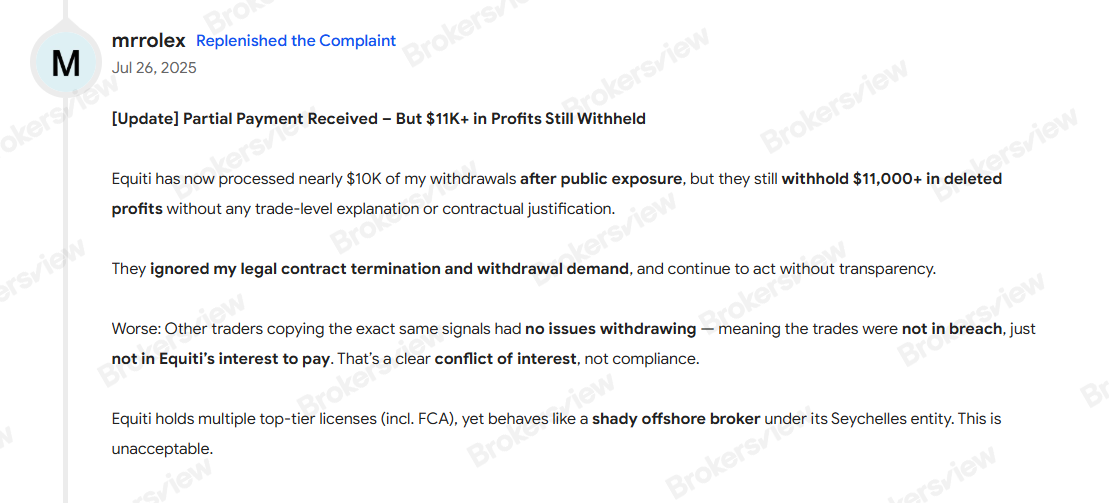

Confronted with a series of issues stemming from Equiti, the client stated that he had offered the broker multiple opportunities to resolve the matter. Having received no satisfactory resolution, he has formally complained with the Seychelles Financial Services Authority (FSA), submitting relevant documents, email correspondence, and transaction records for review.

He said: “I'm sharing this review to warn other traders and demand full payment of my funds.”

Upon receiving the complaint from this investor, the BrokersView team immediately relayed the claim to Equiti and assisted with the communication between both parties.

On July 26, the IB updated that Equiti had processed withdrawal requests totaling nearly $10,000, yet over $11,000 in erased profits remained withheld.

Moreover, he discovered that other traders employing the same copy trading strategy encountered no withdrawal issues. As a result, he believes his trades complied with the platform’s rules and that Equiti’s refusal to process his withdrawal stemmed from a conflict of interest.

BrokersView reminds you

Forex broker Equiti holds offshore regulation by the Seychelles Financial Services Authority (SD064). However, regulatory standards in offshore jurisdictions like Seychelles are typically less stringent than those of major financial centers. Investors need to be aware of the risks associated with it.

Except for the Seychelles regulation, Equiti is also regulated by the Financial Conduct Authority (FCA) in the UK and the Securities and Commodities Authority (SCA) in the UAE.

Click for more information about Equiti.