أسعار السوق

أخبار

تحليل التداول

مستخدم

24/7

التقويم الاقتصادي

تعليم

البيانات

- الاسم

- أحدث قيمة

- السابق

حسابات الإشارات للأعضاء

جميع حسابات الإشارات

جميع المسابقات

اليابان مؤشر تانكان الحركي للشركات التصنيعية الصغيرة (الربع 4)

اليابان مؤشر تانكان الحركي للشركات التصنيعية الصغيرة (الربع 4)ا:--

ا: --

ا: --

اليابان مؤشر تانكان للتوقعات الشركات غير التصنيعية الكبيرة (الربع 4)

اليابان مؤشر تانكان للتوقعات الشركات غير التصنيعية الكبيرة (الربع 4)ا:--

ا: --

ا: --

اليابان مؤشر تانكان للتوقعات الشركات التصنيعية الكبيرة (الربع 4)

اليابان مؤشر تانكان للتوقعات الشركات التصنيعية الكبيرة (الربع 4)ا:--

ا: --

ا: --

اليابان مؤشر تانكان للشركات الصناعية الصغيرة (الربع 4)

اليابان مؤشر تانكان للشركات الصناعية الصغيرة (الربع 4)ا:--

ا: --

ا: --

اليابان مؤشر تانكان للنفقات الرأسمالية للشركات الكبيرة (الربع 4)

اليابان مؤشر تانكان للنفقات الرأسمالية للشركات الكبيرة (الربع 4)ا:--

ا: --

ا: --

المملكة المتحدة مؤشر أسعار المنازل Rightmove السنوي (ديسمبر)

المملكة المتحدة مؤشر أسعار المنازل Rightmove السنوي (ديسمبر)ا:--

ا: --

ا: --

البر الرئيسى الصينى الإنتاج الصناعي السنوي (YTD) (نوفمبر)

البر الرئيسى الصينى الإنتاج الصناعي السنوي (YTD) (نوفمبر)ا:--

ا: --

ا: --

البر الرئيسى الصينى معدل البطالة في المناطق الحضرية (نوفمبر)

البر الرئيسى الصينى معدل البطالة في المناطق الحضرية (نوفمبر)ا:--

ا: --

ا: --

المملكة العربية السعودية مؤشر أسعار المستهلك

المملكة العربية السعودية مؤشر أسعار المستهلكا:--

ا: --

ا: --

منطقة اليورو الإنتاج الصناعي السنوي (أکتوبر)

منطقة اليورو الإنتاج الصناعي السنوي (أکتوبر)ا:--

ا: --

ا: --

منطقة اليورو المخرجات الصناعية شهريا (أکتوبر)

منطقة اليورو المخرجات الصناعية شهريا (أکتوبر)ا:--

ا: --

ا: --

كندا مبيعات المنازل الكائنة الشهري (نوفمبر)

كندا مبيعات المنازل الكائنة الشهري (نوفمبر)ا:--

ا: --

ا: --

كندا مؤشر الثقة الاقتصادية الوطني

كندا مؤشر الثقة الاقتصادية الوطنيا:--

ا: --

ا: --

كندا عدد المساكن الجديدة قيد الانشاء (نوفمبر)

كندا عدد المساكن الجديدة قيد الانشاء (نوفمبر)ا:--

ا: --

أمريكا مؤشر بنك الاحتياطي الفيدرالي في نيويورك للتوظيف في القطاع الصناعي (ديسمبر)

أمريكا مؤشر بنك الاحتياطي الفيدرالي في نيويورك للتوظيف في القطاع الصناعي (ديسمبر)ا:--

ا: --

ا: --

أمريكا مؤشر بنك الاحتياطي الفيدرالي في نيويورك لقطاع التصنيع (ديسمبر)

أمريكا مؤشر بنك الاحتياطي الفيدرالي في نيويورك لقطاع التصنيع (ديسمبر)ا:--

ا: --

ا: --

كندا مؤشر أسعار المستهلك CPI الأساسي السنوي (نوفمبر)

كندا مؤشر أسعار المستهلك CPI الأساسي السنوي (نوفمبر)ا:--

ا: --

ا: --

كندا الطلبات المعلقة في قطاع التصنيع شهريا (أکتوبر)

كندا الطلبات المعلقة في قطاع التصنيع شهريا (أکتوبر)ا:--

ا: --

ا: --

أمريكا مؤشر بنك الاحتياطي الفيدرالي في نيويورك للاستحواذ على سعر التصنيع (ديسمبر)

أمريكا مؤشر بنك الاحتياطي الفيدرالي في نيويورك للاستحواذ على سعر التصنيع (ديسمبر)ا:--

ا: --

ا: --

أمريكا مؤشر بنك الاحتياطي الفيدرالي في نيويورك لطلبات التصنيع الجديدة (ديسمبر)

أمريكا مؤشر بنك الاحتياطي الفيدرالي في نيويورك لطلبات التصنيع الجديدة (ديسمبر)ا:--

ا: --

ا: --

كندا الطلبات الجديدة في قطاع التصنيع شهريا (أکتوبر)

كندا الطلبات الجديدة في قطاع التصنيع شهريا (أکتوبر)ا:--

ا: --

ا: --

كندا مؤشر أسعار المستهلك CPI الأساسي الشهري (نوفمبر)

كندا مؤشر أسعار المستهلك CPI الأساسي الشهري (نوفمبر)ا:--

ا: --

ا: --

كندا مؤشر أسعار المستهلك CPI المقتطع السنوي (معدل موسميا) (نوفمبر)

كندا مؤشر أسعار المستهلك CPI المقتطع السنوي (معدل موسميا) (نوفمبر)ا:--

ا: --

ا: --

كندا مخزون قطاع التصنيع شهريا (أکتوبر)

كندا مخزون قطاع التصنيع شهريا (أکتوبر)ا:--

ا: --

ا: --

كندا مؤشر أسعار المستهلك

كندا مؤشر أسعار المستهلكا:--

ا: --

ا: --

كندا مؤشر أسعار المستهلك

كندا مؤشر أسعار المستهلكا:--

ا: --

ا: --

كندا مؤشر أسعار المستهلك CPI السنوي

كندا مؤشر أسعار المستهلك CPI السنويا:--

ا: --

ا: --

كندا مؤشر أسعار المستهلك CPI الأساسي الشهري (معدل موسميا) (نوفمبر)

كندا مؤشر أسعار المستهلك CPI الأساسي الشهري (معدل موسميا) (نوفمبر)ا:--

ا: --

ا: --

كندا مؤشر أسعار المستهلك CPI الشهري

كندا مؤشر أسعار المستهلك CPI الشهريا:--

ا: --

ا: --

ألقى محافظ مجلس الاحتياطي الفيدرالي ميلان خطابًا

ألقى محافظ مجلس الاحتياطي الفيدرالي ميلان خطابًا أمريكا مؤشر سوق الإسكان NAHB (ديسمبر)

أمريكا مؤشر سوق الإسكان NAHB (ديسمبر)ا:--

ا: --

ا: --

أستراليا المركب التمهيدي لمؤشر مديري المشتريات PMI (ديسمبر)

أستراليا المركب التمهيدي لمؤشر مديري المشتريات PMI (ديسمبر)--

ا: --

ا: --

أستراليا مؤشر مديري المشتريات PMI في قطاع الخدمات التمهيدي (ديسمبر)

أستراليا مؤشر مديري المشتريات PMI في قطاع الخدمات التمهيدي (ديسمبر)--

ا: --

ا: --

أستراليا مؤشر مديري المشتريات PMI في قطاع التصنيع الأولي (ديسمبر)

أستراليا مؤشر مديري المشتريات PMI في قطاع التصنيع الأولي (ديسمبر)--

ا: --

ا: --

اليابان مؤشر مديري المشتريات PMI في قطاع التصنيع أولي (معدل موسميا) (ديسمبر)

اليابان مؤشر مديري المشتريات PMI في قطاع التصنيع أولي (معدل موسميا) (ديسمبر)--

ا: --

ا: --

المملكة المتحدة معدل التغيير فيي التوظيف في لمدة 3 أشهر منظمة العمل الدولية ILO (أکتوبر)

المملكة المتحدة معدل التغيير فيي التوظيف في لمدة 3 أشهر منظمة العمل الدولية ILO (أکتوبر)--

ا: --

ا: --

المملكة المتحدة عدد المطالبين بإعانات البطالة (نوفمبر)

المملكة المتحدة عدد المطالبين بإعانات البطالة (نوفمبر)--

ا: --

ا: --

المملكة المتحدة معدل البطالة (نوفمبر)

المملكة المتحدة معدل البطالة (نوفمبر)--

ا: --

ا: --

المملكة المتحدة معدل البطالة لثلاثة أشهر وفقًا لمكتب العمل الدولي (أکتوبر)

المملكة المتحدة معدل البطالة لثلاثة أشهر وفقًا لمكتب العمل الدولي (أکتوبر)--

ا: --

ا: --

المملكة المتحدة راتب 3 أشهر (أسبوعيًا، بما في ذلك التوزيع) السنوي (أکتوبر)

المملكة المتحدة راتب 3 أشهر (أسبوعيًا، بما في ذلك التوزيع) السنوي (أکتوبر)--

ا: --

ا: --

المملكة المتحدة راتب 3 أشهر (أسبوعيًا، باستثناء التوزيع) سنويا (أکتوبر)

المملكة المتحدة راتب 3 أشهر (أسبوعيًا، باستثناء التوزيع) سنويا (أکتوبر)--

ا: --

ا: --

فرنسا مؤشر مديري المشتريات PMI في قطاع الخدمات التمهيدي (ديسمبر)

فرنسا مؤشر مديري المشتريات PMI في قطاع الخدمات التمهيدي (ديسمبر)--

ا: --

ا: --

فرنسا المركب الأولي لمؤشر مديري المشتريات (معدل موسميا) (ديسمبر)

فرنسا المركب الأولي لمؤشر مديري المشتريات (معدل موسميا) (ديسمبر)--

ا: --

ا: --

فرنسا مؤشر مديري المشتريات PMI في قطاع التصنيع الأولي (ديسمبر)

فرنسا مؤشر مديري المشتريات PMI في قطاع التصنيع الأولي (ديسمبر)--

ا: --

ا: --

ألمانيا مؤشر مديري المشتريات PMI في قطع الخدمات الأولي (معدل موسميا) (ديسمبر)

ألمانيا مؤشر مديري المشتريات PMI في قطع الخدمات الأولي (معدل موسميا) (ديسمبر)--

ا: --

ا: --

ألمانيا مؤشر مديري المشتريات PMI في قطاع التصنيع أولي (معدل موسميا) (ديسمبر)

ألمانيا مؤشر مديري المشتريات PMI في قطاع التصنيع أولي (معدل موسميا) (ديسمبر)--

ا: --

ا: --

ألمانيا المركب الأولي لمؤشر مديري المشتريات (معدل موسميا) (ديسمبر)

ألمانيا المركب الأولي لمؤشر مديري المشتريات (معدل موسميا) (ديسمبر)--

ا: --

ا: --

منطقة اليورو المركب الأولي لمؤشر مديري المشتريات (معدل موسميا) (ديسمبر)

منطقة اليورو المركب الأولي لمؤشر مديري المشتريات (معدل موسميا) (ديسمبر)--

ا: --

ا: --

منطقة اليورو مؤشر مديري المشتريات PMI في قطع الخدمات الأولي (معدل موسميا) (ديسمبر)

منطقة اليورو مؤشر مديري المشتريات PMI في قطع الخدمات الأولي (معدل موسميا) (ديسمبر)--

ا: --

ا: --

منطقة اليورو مؤشر مديري المشتريات PMI في قطاع التصنيع أولي (معدل موسميا) (ديسمبر)

منطقة اليورو مؤشر مديري المشتريات PMI في قطاع التصنيع أولي (معدل موسميا) (ديسمبر)--

ا: --

ا: --

المملكة المتحدة مؤشر مديري المشتريات PMI في قطاع الخدمات التمهيدي (ديسمبر)

المملكة المتحدة مؤشر مديري المشتريات PMI في قطاع الخدمات التمهيدي (ديسمبر)--

ا: --

ا: --

المملكة المتحدة مؤشر مديري المشتريات PMI في قطاع التصنيع الأولي (ديسمبر)

المملكة المتحدة مؤشر مديري المشتريات PMI في قطاع التصنيع الأولي (ديسمبر)--

ا: --

ا: --

المملكة المتحدة المركب التمهيدي لمؤشر مديري المشتريات PMI (ديسمبر)

المملكة المتحدة المركب التمهيدي لمؤشر مديري المشتريات PMI (ديسمبر)--

ا: --

ا: --

منطقة اليورو مؤشر المعنويات الاقتصادية ZEW (ديسمبر)

منطقة اليورو مؤشر المعنويات الاقتصادية ZEW (ديسمبر)--

ا: --

ا: --

ألمانيا مؤشر الوضع الاقتصادي ZEW (ديسمبر)

ألمانيا مؤشر الوضع الاقتصادي ZEW (ديسمبر)--

ا: --

ا: --

ألمانيا مؤشر المعنويات الاقتصادية ZEW (ديسمبر)

ألمانيا مؤشر المعنويات الاقتصادية ZEW (ديسمبر)--

ا: --

ا: --

منطقة اليورو الميزان التجاري (غير معدل موسميا) (أکتوبر)

منطقة اليورو الميزان التجاري (غير معدل موسميا) (أکتوبر)--

ا: --

ا: --

منطقة اليورو مؤشر الوضع الاقتصادي ZEW (ديسمبر)

منطقة اليورو مؤشر الوضع الاقتصادي ZEW (ديسمبر)--

ا: --

ا: --

منطقة اليورو الميزان التجاري (معدل موسميا) (أکتوبر)

منطقة اليورو الميزان التجاري (معدل موسميا) (أکتوبر)--

ا: --

ا: --

منطقة اليورو إجمالي الأصول الاحتياطية (نوفمبر)

منطقة اليورو إجمالي الأصول الاحتياطية (نوفمبر)--

ا: --

ا: --

المملكة المتحدة معدل التضخم المتوقع

المملكة المتحدة معدل التضخم المتوقع--

ا: --

ا: --

لا توجد البينات المعلقة

أحدث المشاهدات

أحدث المشاهدات

الموضوعات الشائعة

المؤلفون الشائعون

أحدث

البطاقة البيضاء

API البيانات

المكونات الإضافية للويب

برنامج التابعة لها

عرض جميع نتائج البحث

لا توجد بيانات

Sygnum’s Head of Investment Research, Katalin Tischhauser, has forecasted a potential price trajectory for bitcoin in a scenario in which each $1 billion of inflows from a potential U.S. strategic bitcoin reserve could spark a multiplier effect — significantly expanding the digital asset’s market capitalization.

Speaking with The Block, Tischhauser explained that every additional billion dollars of inflow could add as much as $20 billion to bitcoin’s market cap — a phenomenon she attributes not only to the direct capital inflow but also to a significant upward price shock. “Each $1 billion of strategic reserve purchases could drive a 20x multiplier effect on bitcoin’s market cap,” Tischhauser said. The extra $19 billion in the multiplier projection, she noted, would come from the resultant demand shock and a squeeze on the already limited liquid supply of bitcoin.

Limited liquidity could fuel exponential growth

According to Tischhauser, the impact is compounded by the inherently small liquid supply of bitcoin. “The potential demand shock will be so significant because the liquid supply of bitcoin is really very small,” she explained. Her comments suggest that as new money enters the market, the finite supply forces a rapid escalation in price. This upward pressure is expected to intensify as early inflows are absorbed, leaving even less bitcoin available for subsequent demand.

Tischhauser illustrated the dynamic by breaking down the effect: the first and second billion dollars in inflows would largely “burn through” available demand, while the third and fourth would encounter a more constrained supply environment, leading to accelerated price increases.

“This is what I call demand shocks—when the amount of money coming into the market exceeds the supply available for sale, the price is shocked to the upside,” she said.

Potentially multiple sources of net demand

The research head highlighted that the net increase in demand could arise from a variety of sources. State and local governments seeking reserve assets, allocations from large institutional investors, and, potentially, corporate treasuries are all expected to contribute to the cumulative net demand that fuels this multiplier effect in a "market stampede."

Tischhauser also pointed to the growth in stablecoin market cap as a proxy signal, noting that as stablecoins swell, it typically indicates that more funds are being funneled into the crypto market.

She further underscored that the observed multipliers during the inflows in 2024 have laid the groundwork for this projection. “The 20x multiplier is based on what we saw during the surges in inflows in 2024. But we could have bigger surges this year if central banks really get involved,” Tischhauser added.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Data recently published by the director of Coinbase reveals the total amount of Bitcoin owned by mysterious Bitcoin founder Satoshi Nakamoto. That amount translated in fiat exceeds the wealth of Microsoft founder Bill Gates.

Besides, the top U.S. cryptocurrency exchange, Kraken, may possess information about Nakamoto’s true identity, according to Coinbase's top executive.

Satoshi Nakamoto's wealth bigger than Bill Gates’s

An X thread published by Coinbase director Conor Grogan has revealed a stunning picture of the mysterious Bitcoin founder Satoshi Nakamoto and his Bitcoin holdings. According to the on-chain data published by Grogan, Nakamoto may now own a whopping 1.096 million Bitcoins.

That staggering amount of BTC is worth around $108 billion at the current exchange rate – this exceeds Microsoft founder Bill Gates’s net worth of $106.4 billion on paper.

Wu Blockchain@WuBlockchainFeb 06, 2025Coinbase director Conor Grogan said that Satoshi Nakamoto may own 1.096 million bitcoins (worth about $108 billion), with a paper wealth exceeding Bill Gates. There are 24 recorded transfer transactions from these addresses, and the most common target address is related to the…

Kraken ex-CEO may know who Satoshi Nakamoto was: Grogan

Grogan mentioned that he stumbled across Satoshi wallet data on the Arkham website — the Patoshi Mining Pattern set of addresses. He clarified, “We can't definitively link these to Satoshi, but there is good evidence.”

According to this data, the last on-chain activity conducted by Satoshi Nakamoto may have been in 2014 – four years after he opted to disappear from public view.

Conor Grogan said that some of those transactions were targeted at Canadian centralized crypto exchange CaVirtEx. U.S.-based Kraken exchange acquired that platform in 2016. Therefore, Grogan, says, the former CEO of Kraken, Jesse Powell could be aware of who Satoshi was in reality if they had kept the KYC information on that blockchain address: “As such. There is a chance that @jespow has information on the true identity behind Satoshi if they maintain any KYC information on this wallet.”

He advised Powell to delete that information: “My advice to him would be to delete the data.”

Len Sassaman unlikely Satoshi candidate

Now, here comes the most interesting thing: the Coinbase director admitted that if the above-revealed data is accurate, it is less likely now, in his view, that Len Sassaman was the true Bitcoin creator: “This is the first set of evidence I've seen in years that has decreased my confidence that Satoshi was Len.”

Conor@jconorgroganFeb 05, 2025This is the first set of evidence I've seen in years that has decreased my confidence that Satoshi was Len

The official account of Kraken responded playfully: “We are all Satoshi,” as if confirming that this data will never be revealed publicly.

Burwick Law and Wolf Popper LLP, two law firms currently suing pump.fun, have issued a cease and desist letter to the Solana memecoin launchpad to remove tokens that impersonate the two companies.

In a Wednesday statement, Burwick said that the two companies demand the immediate removal of memecoins that infringe upon their intellectual property, including company names and logos.

The U.S.-based law firm claimed that Pump.fun launched such tokens "in conjunction with" third-party efforts to “intimidate” clients of the two firms and undermine their legal action against the platform. “Burwick Law confirmed that [Pump.fun] has the technical capability to remove these tokens and has chosen not to act, despite the clear financial and legal risks posed to the public,” the statement said.

Hundreds of memecoins that apparently mimic or mock Burwick and Wolf Popper remain trading on the Solana launchpad.

The law firm also demanded the removal of the Dogshit2 token, which was allegedly pushed by promoters in a “high-risk pump-and-dump” scheme.

It was reported earlier this week that some members of the crypto community suspected that Burwick and Wolf Popper were behind the Dogshit2 token, as some claimed that a blockchain address shown in the firms’ legal documents matched the address associated with the Dogshit2 memecoin. “Our firms have no affiliation, endorsement, or ownership interest in the Dogshit2 token or any related assets,” Burwick wrote. “Simply put, our firms have not launched any memecoins onchain.”

Amid Wednesday's cease-and-desist order, Dogshit2 saw over 1,000% surge in trade volume over the past day, according to data from CoinGecko. It has a market capitalization of over $8.7 billion, up 242% in the past 24 hours.

On Jan. 30, Burwick and Wolf Popper filed a proposed class-action lawsuit against Pump.fun — representing memecoin investor Diego Aguilar who claims to have suffered losses on the platform. The lawsuit claims the platform marketed tokens similar to Ponzi schemes as significantly profitable, deliberately targeting less-affluent and younger investors.

The Block has reached out to Burwick Law and Pump.fun for comment.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The Canadian Investment Regulatory Organization (CIRO) ruled that cryptocurrency funds will not be eligible for reduced margin rates, citing concerns over volatility, liquidity risks and regulatory uncertainty.

On Feb. 5, CIRO released a new List of Securities Eligible for Reduced Margin (LSERM). This quarterly list identifies which securities are eligible for reduced margin rates. Financial institutions eligible for reduced margin rates benefit from improved capital efficiency and lower trading costs.

In the announcement, CIRO said that cryptocurrency funds are not eligible for reduced margins “until further notice.” As a result, investors trading cryptocurrency funds will need to maintain higher collateral, making it more expensive to leverage crypto positions compared with stocks or exchange-traded funds (ETFs).

Funds subject to higher margin requirements are more likely to undergo forced liquidations during market downturns, as reduced margin rates provide some breathing room before liquidations occur.

Requirements for securities to be eligible for reduced margin

According to CIRO, highly liquid securities with substantial market capitalization and lower volatility are more likely to be eligible for reduced margin.

In its general inclusion requirements, CIRO said that to be eligible, securities must have price volatility measures, including a calculated price volatility margin interval of 25% or less. This measure assesses the security’s price fluctuations over a specified period to determine its volatility.

In addition, The security should have a market value of at least 2 CA$ per share. This requirement ensures the security maintains a minimum price level, often associated with reduced volatility.

Apart from price volatility, securities must meet liquidity measure requirements to qualify for reduced margin. This includes a public float value exceeding 100 million CA$ and an average daily trading volume of at least 25,000 daily shares during each month in the preceding quarter. Higher-priced securities need at least 1 million CA$ daily traded value each month.

Lastly, securities must be listed on a Canadian exchange and eligible for margin for six months. For those listed under six months, the security must have a market value greater than 5 CA$ per share, a dollar value of public float greater than 500 million CA$, and be in an industry sector known for low price volatility.

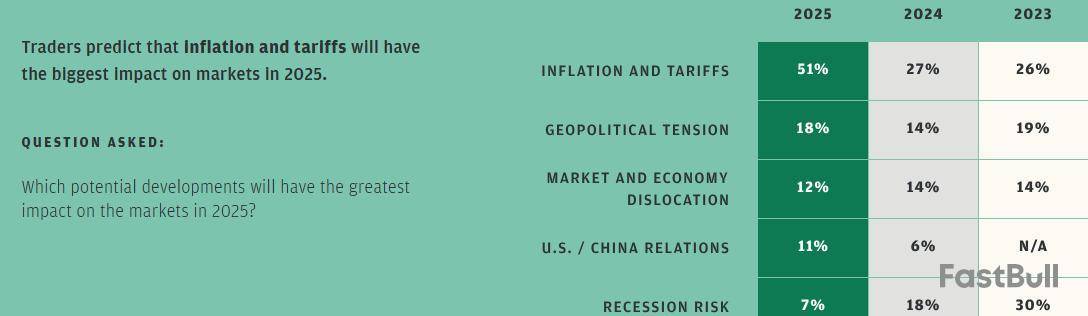

Global traders, including those in crypto, should brace for volatility as tariffs and inflation take center stage in shaping market trends, according to a new survey by JPMorgan Chase.

The survey’s findings indicated a significant rise in concern compared to the previous year when only 27% of respondents cited inflation as a major issue.

Tariffs To Stir Market Uncertainty, JP Morgan Survey Says

Over the past week, US President Donald Trump introduced a 25% tariff on imports from Mexico and Canada and a 10% tariff on goods from China, only to delay some of these measures shortly afterward.

“…We further agreed to immediately pause the anticipated tariffs for one month…,” Trump revealed in a post.

Before the pause, however, the tariffs had triggered significant market fluctuations, with stocks, currencies, and commodities all responding to policy announcements.

Against this backdrop, an annual survey featuring institutional trading clients from JPMorgan Chase revealed that 51% of traders believe inflation and tariffs will be the most influential factors in global markets for 2025.

The survey cites the back-and-forth nature of these policies, saying that it has led to sharp market movements. This engagement alludes to China’s move to announce a 10% tariff on US crude oil and agricultural machinery in response to US tariffs on all Chinese imports.

On the inflation front, traders view Trump’s tariff policies as inherently inflationary, pushing prices higher across multiple sectors. Additionally, fewer traders are worried about a potential recession. Only 7% of those surveyed cited it as a major concern compared to 18% in 2024.

The report also highlights changing market structures. It emphasizes that electronic trading is expected to expand across all asset classes, including emerging markets like crypto.

Volatility Remains a Core Concern

JPMorgan’s survey also identified market volatility among the challenges to watch in 2025. Specifically, 41% of respondents named it their primary concern, up from 28% in 2024. Unlike in previous years when volatility was expected around key scheduled events, traders are now experiencing sudden market swings driven by unpredictable political and economic news.

“What distinguishes this year is the somewhat unexpected timing of volatility. Unlike in the past, when volatility was tied to scheduled events like elections or nonfarm payroll data, we’re seeing more sudden fluctuations in response to news headlines around the administration’s plans, leading to knee-jerk reactions in the marketplace,” Reuters reported, citing Eddie Wen, global head of digital markets at JPMorgan.

Meanwhile, the broader financial markets are not the only ones reacting to Trump’s tariff policies. Bitcoin and the crypto sector have also felt the impact of these economic shifts. When Trump delayed tariffs on Canada and Mexico, the Coinbase Bitcoin premium index surged to a new 2025 high.

Likewise, the news triggered a rebound in Bitcoin prices. Traders interpreted the delay as a sign of potential economic stability. Additionally, when the US paused tariffs on Mexico, XRP saw a significant recovery. This highlights the direct influence of trade policies on the digital asset market.

However, China’s retaliation to Trump’s tariffs introduced fresh instability, further exacerbating market fluctuations.

“[Ethereum would fall] Back to 2200-2400 if China trade war is real,” crypto analyst Andrew Kang wrote.

Elsewhere, Glassnode highlighted the unusual nature of the current Bitcoin cycle. As BeInCrypto reported, the blockchain analytics firm noted how macroeconomic factors—including tariffs—play an outsized role. Unlike previous cycles that primarily followed internal crypto industry trends, the 2025 cycle could realize significant influence from global economic policies.

Solana is not out of the woods, but some signs show that the SOL price rebound might finally be here. While the digital currency has dropped by 1.58% over the past 24 hours, its growth trend shows optimism. With increasing volatility, the volume boosts on Binance, liquidation figures and sustained open interest prove that SOL might have bottomed out.

Solana rebound signals

In the past 24 hours, Solana jumped from a low of $195.39 to its current price level. Along the way, it breached a major resistance level at $199.16. Despite volatility, SOL has stayed above this level as investors evaluate their next moves.

On the Binance exchange, SOL volume has jumped by 17.69% in 24 hours to $656,537,696. This is a significant signal, considering the user base and liquidity that Binance commands. If traders’ buying activities on Binance are high, it might take time before it trickles down, translating to a price boom.

Futures traders' exposure to Solana is also minimal, as showcased by its liquidation data on CoinGlass. Overnight, only $8.67 million worth of SOL was liquidated, outpaced by BTC, ETH and XRP, respectively.

In addition, SOL open interest is marginally high, with more than 27 million SOLs committed by traders. This shows confidence in its prospects of printing higher price trends soon.

What's next for SOL?

Amid the growing volatility, Solana's price must combat the current fluctuations and stabilize its core metrics before charting a new growth milestone. Of the top Ethereum killers, Solana has the most promising fundamentals, which can translate to price growth.

The hype generally returns to Solana, with its associated tokens like BONK and dogwifhat still in the spotlight in the meme coin scene. In the near term, analysts are convinced Solana that may breach its previous all-time high (ATH) to $300.

By Elsa Ohlen

As the dust is settling for markets after a week of wild market swings, the fallout for cryptos is mixed.

Bitcoin was trading up 1.3% early Thursday to $98,700, now fully recovered from Monday's selloff — during which it plummeted to a seven-day low of $91,687, according to CoinDesk data.

However, XRP — the popular altcoin that has in the past few months soared to compete with Tether for the title of third largest cryptocurrency by market value — is down 3.5% over the past 24 hours. It last traded at $2.43, according to CoinDesk.

XRP, like Ether, Solana, and Dogecoin hasn't recovered all the way from Monday's big drop, prompted by President Donald Trump saying he would impose tariffs on Mexico, Canada and China.

Traditionally, Bitcoin and other smaller cryptos are been seen as riskier types of assets that tend to fall with market uncertainty, while safe haven assets such as gold rise.

While this still appears to be true for altcoins, Bitcoin is increasingly moving in tandem with the broader market — not yet viewed "digital gold" but also not a typical risky asset anymore.

Write to Elsa Ohlen at elsa.ohlen@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

البطاقة البيضاء

API البيانات

المكونات الإضافية للويب

صانع ملصقات مجاني قابل للتخصيص

برنامج التابعة لها

يمكن أن تكون مخاطر الخسارة كبيرة عند تداول الأصول المالية مثل الأسهم أو العملات الأجنبية أو السلع أو العقود الآجلة أو السندات أو صناديق الاستثمار المتداولة أو العملات المشفرة. قد تتعرض لخسارة كامل الأموال التي تودعها لدى شركة الوساطة. لذلك، يجب أن تفكر مليًا فيما إذا كانت هذه التجارة مناسبة لك في ضوء ظروفك ومواردك المالية.

لا ينبغي الاقدام على الاستثمار دون إجراء التدقيق و الأبحاث اللاّزمة أو التشاور مع مستشاريك الماليين. قد لا يناسبك محتوى موقعنا ، لأننا لا نعرف حالتك المالية واحتياجاتك الاستثمارية. من المحتمل أن معلوماتنا المالية قد يكون لها زمن انتقال أو تحتوي على معلومات غير دقيقة، لذلك يجب أن تكون مسؤولاً بالكامل عن أي من معاملاتك وقراراتك الاستثمارية. لن تكون الشركة مسؤولة عن خسارة أي من أموالك.

بدون الحصول على إذن من موقع الويب، لا يُسمح لك بنسخ رسومات الموقع أو النصوص أو العلامات التجارية. حقوق الملكية الفكرية في المحتوى أو البيانات المدرجة في هذا الموقع مملوكة لمزوديها و بورصات التداول.

لم تسجّل الدخول

سجل الدخول لعرض المزيد من الميزات

عضوية FastBull

ليس بعد

شراء

تسجيل الدخول

الاشتراك