Котировки

Новости

Анализ

Пользователь

24/7

Экономический Календарь

Обучение

Данные

- Имена

- Последний

- Пред.

Сообщество аккаунт

Сигнальные аккаунты для участников

Все сигнальные аккаунты

Все конкурсы

Франция Торговый баланс (Сезонно скорректированный) (Окт)

Франция Торговый баланс (Сезонно скорректированный) (Окт)А:--

П: --

Еврозона Годовой рост занятости (Сезонно скорректированный) (3 квартал)

Еврозона Годовой рост занятости (Сезонно скорректированный) (3 квартал)А:--

П: --

Канада Частичная занятость (Сезонно скорректированный) (Нояб)

Канада Частичная занятость (Сезонно скорректированный) (Нояб)А:--

П: --

П: --

Канада Уровень безработицы (Сезонно скорректированный) (Нояб)

Канада Уровень безработицы (Сезонно скорректированный) (Нояб)А:--

П: --

П: --

Канада Полная занятость (Сезонно скорректированная) (Нояб)

Канада Полная занятость (Сезонно скорректированная) (Нояб)А:--

П: --

П: --

Канада Уровень участия в занятости (Сезонно скорректированный) (Нояб)

Канада Уровень участия в занятости (Сезонно скорректированный) (Нояб)А:--

П: --

П: --

Канада Занятость (Сезонно скорректированный) (Нояб)

Канада Занятость (Сезонно скорректированный) (Нояб)А:--

П: --

П: --

США Индекс потребительских цен PCE (месяц к месяцу) (Сент)

США Индекс потребительских цен PCE (месяц к месяцу) (Сент)А:--

П: --

П: --

США Ежемесячный доход физических лиц (Сент)

США Ежемесячный доход физических лиц (Сент)А:--

П: --

П: --

США Ежемесячный рост базового индекса цен на личное потребление (Сент)

США Ежемесячный рост базового индекса цен на личное потребление (Сент)А:--

П: --

П: --

США Индекс потребительских цен PCE (год к году, сезонно скорректированный) (Сент)

США Индекс потребительских цен PCE (год к году, сезонно скорректированный) (Сент)А:--

П: --

П: --

США Годовой рост базового индекса цен на личное потребление (Сент)

США Годовой рост базового индекса цен на личное потребление (Сент)А:--

П: --

П: --

США Ежемесячные расходы физических лиц (сезонно скорректированные) (Сент)

США Ежемесячные расходы физических лиц (сезонно скорректированные) (Сент)А:--

П: --

США Ожидания инфляции на 5-10 лет (Дек)

США Ожидания инфляции на 5-10 лет (Дек)А:--

П: --

П: --

США Месячный рост реальных расходов потребления (Сент)

США Месячный рост реальных расходов потребления (Сент)А:--

П: --

США Еженедельное общее бурение

США Еженедельное общее бурениеА:--

П: --

П: --

США Еженедельное общее бурение нефти

США Еженедельное общее бурение нефтиА:--

П: --

П: --

США Кредиты потребителей (Сезонно скорректированные) (Окт)

США Кредиты потребителей (Сезонно скорректированные) (Окт)А:--

П: --

Китай, материк Валютные резервы (Нояб)

Китай, материк Валютные резервы (Нояб)А:--

П: --

П: --

Япония Торговый баланс (Окт)

Япония Торговый баланс (Окт)А:--

П: --

П: --

Япония Пересмотренная квартальная темпоральная валовая продукция (3 квартал)

Япония Пересмотренная квартальная темпоральная валовая продукция (3 квартал)А:--

П: --

П: --

Китай, материк Годовой рост импорта (Китайский юань) (Нояб)

Китай, материк Годовой рост импорта (Китайский юань) (Нояб)А:--

П: --

П: --

Китай, материк Экспорт (Нояб)

Китай, материк Экспорт (Нояб)А:--

П: --

П: --

Китай, материк Импорт (Китайский юань) (Нояб)

Китай, материк Импорт (Китайский юань) (Нояб)А:--

П: --

П: --

Китай, материк Торговый баланс (Китайский юань) (Нояб)

Китай, материк Торговый баланс (Китайский юань) (Нояб)А:--

П: --

П: --

Китай, материк Экспорт (год к году, в долларах США) (Нояб)

Китай, материк Экспорт (год к году, в долларах США) (Нояб)А:--

П: --

П: --

Китай, материк Годовой рост импорта (Доллар США) (Нояб)

Китай, материк Годовой рост импорта (Доллар США) (Нояб)А:--

П: --

П: --

Германия Ежемесячный рост промышленного выпуска (сезонно скорректированный) (Окт)

Германия Ежемесячный рост промышленного выпуска (сезонно скорректированный) (Окт)А:--

П: --

Еврозона Индекс доверия инвесторов Sentix (Дек)

Еврозона Индекс доверия инвесторов Sentix (Дек)А:--

П: --

П: --

Канада Индекс национального экономического доверия

Канада Индекс национального экономического доверияА:--

П: --

П: --

Великобритания Розничные продажи BRC Like-For-Like YoY (Нояб)

Великобритания Розничные продажи BRC Like-For-Like YoY (Нояб)--

П: --

П: --

Великобритания Общие розничные продажи BRC YoY (Нояб)

Великобритания Общие розничные продажи BRC YoY (Нояб)--

П: --

П: --

Австралия Овернайт (заемный) ключевой процент

Австралия Овернайт (заемный) ключевой процент--

П: --

П: --

Заявление о ставках РБА

Заявление о ставках РБА Пресс-конференция РБА

Пресс-конференция РБА Германия Экспорт г/м (SA) (Окт)

Германия Экспорт г/м (SA) (Окт)--

П: --

П: --

США Индекс оптимизма малого бизнеса NFIB (сезонно скорректированный) (Нояб)

США Индекс оптимизма малого бизнеса NFIB (сезонно скорректированный) (Нояб)--

П: --

П: --

Мексика Инфляция за 12 месяцев (ИПЦ) (Нояб)

Мексика Инфляция за 12 месяцев (ИПЦ) (Нояб)--

П: --

П: --

Мексика Годовой рост основного индекса потребительских цен (Нояб)

Мексика Годовой рост основного индекса потребительских цен (Нояб)--

П: --

П: --

Мексика Индекс цен производителей (год к году) (Нояб)

Мексика Индекс цен производителей (год к году) (Нояб)--

П: --

П: --

США Еженедельные розничные продажи по данным Redbook YoY (год к году)

США Еженедельные розничные продажи по данным Redbook YoY (год к году)--

П: --

П: --

США Вакансии JOLTS (сезонно скорректированные) (Окт)

США Вакансии JOLTS (сезонно скорректированные) (Окт)--

П: --

П: --

Китай, материк Денежная масса M1 год к году (Нояб)

Китай, материк Денежная масса M1 год к году (Нояб)--

П: --

П: --

Китай, материк Денежная масса M0 год к году (Нояб)

Китай, материк Денежная масса M0 год к году (Нояб)--

П: --

П: --

Китай, материк Денежная масса M2 год к году (Нояб)

Китай, материк Денежная масса M2 год к году (Нояб)--

П: --

П: --

США Краткосрочный прогноз добычи сырой нефти на текущий год EIA (Дек)

США Краткосрочный прогноз добычи сырой нефти на текущий год EIA (Дек)--

П: --

П: --

США Прогноз добычи природного газа на следующий год EIA (Дек)

США Прогноз добычи природного газа на следующий год EIA (Дек)--

П: --

П: --

США Краткосрочный прогноз добычи сырой нефти на следующий год EIA (Дек)

США Краткосрочный прогноз добычи сырой нефти на следующий год EIA (Дек)--

П: --

П: --

Ежемесячный краткосрочный обзор энергетики EIA

Ежемесячный краткосрочный обзор энергетики EIA США Еженедельные запасы бензина API

США Еженедельные запасы бензина API--

П: --

П: --

США Еженедельные запасы сырой нефти API в Кушинге

США Еженедельные запасы сырой нефти API в Кушинге--

П: --

П: --

США Еженедельные запасы сырой нефти API

США Еженедельные запасы сырой нефти API--

П: --

П: --

США Еженедельные запасы нефтепродуктов API

США Еженедельные запасы нефтепродуктов API--

П: --

П: --

Южная Корея Уровень безработицы (Сезонно скорректированный) (Нояб)

Южная Корея Уровень безработицы (Сезонно скорректированный) (Нояб)--

П: --

П: --

Япония Индекс Рейтерс Танкан по предпринимателям-непроизводителям (Дек)

Япония Индекс Рейтерс Танкан по предпринимателям-непроизводителям (Дек)--

П: --

П: --

Япония Индекс Рейтерс Танкан по производителям (Дек)

Япония Индекс Рейтерс Танкан по производителям (Дек)--

П: --

П: --

Япония Ежемесячный рост цен на товары внутренних предприятий (Нояб)

Япония Ежемесячный рост цен на товары внутренних предприятий (Нояб)--

П: --

П: --

Япония Годовой рост цен на товары внутренних предприятий (Нояб)

Япония Годовой рост цен на товары внутренних предприятий (Нояб)--

П: --

П: --

Китай, материк Индекс цен производителей (год к году) (Нояб)

Китай, материк Индекс цен производителей (год к году) (Нояб)--

П: --

П: --

Китай, материк ИПЦ месяц к месяцу (Нояб)

Китай, материк ИПЦ месяц к месяцу (Нояб)--

П: --

П: --

Италия Годовой рост промышленного выпуска (сезонно скорректированный) (Окт)

Италия Годовой рост промышленного выпуска (сезонно скорректированный) (Окт)--

П: --

П: --

Нет соответствующих данных

Последние мнения

Последние мнения

Актуальные темы

Лучшие обозреватели

Последнее Обновление

Белая этикетка

API данных

Веб-плагины

План агентства

Посмотреть все

Нет данных

Hong Kong’s stablecoin regulatory framework limits their use for derivative trading on blockchain networks, according to Sebastian Paredes, CEO of DBS Hong Kong.

According to a Friday report by local news outlet The Standard, Paredes said that Hong Kong regulations on stablecoin Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements will significantly restrict their use for onchain derivatives trading. He said the bank will monitor developments but focus instead on building broader stablecoin capabilities in Hong Kong.

The comments follow the rollout of Hong Kong’s new stablecoin rules on Aug. 1. The rules immediately criminalized the promotion of unlicensed stablecoins and established a public registry of authorized issuers.

Others have also criticized Hong Kong’s stablecoin rules as overly harsh. When the framework was first introduced, stablecoin companies operating in Hong Kong posted double-digit losses, attributed to stricter rules than expected.

DBS is not new to crypto

The local DBS branch is a major bank in Hong Kong and holds nearly 492 billion Hong Kong dollars ($63.2 billion) as of last year, according to regulatory filings. DBS is also the largest bank in Southeast Asia by assets, totaling $842 billion Singapore dollars ($620 billion).

The bank has long been involved with blockchain technology and the crypto industry. Earlier this month, DBS, Franklin Templeton and Ripple joined forces to launch tokenized trading and lending services for institutional investors, leveraging the XRP Ledger.

In late August, DBS also decided to expand its digital asset offerings with the launch of tokenized structured notes on the Ethereum blockchain. The bank is also no stranger to stablecoins, being responsible for managing the US dollar reserve of the Global Dollar (USDG).

In late 2024, DBS also introduced a new suite of blockchain-powered services for its institutional clients and announced the offering of over-the-counter crypto options. The bank also launched a solution last year that uses blockchain technology to streamline the disbursement of government grants.

Hong Kong’s stablecoin hiccups

Hong Kong was buzzing with stablecoin activity both before and after the local regulators adopted a new framework. When the rules, strict as they were, came into force, the Hong Kong Securities and Futures Commission (SFC) official warned that the introduction of the new local stablecoin regulatory framework had increased the risk of fraud.

The statement was largely motivated by the speculative frenzy around companies that announced their interest in obtaining a stablecoin license. Reports that HSBC and ICBC considered applying for stablecoin licenses were followed by suggestions that the firms backed away under pressure from Chinese authorities.

In early August, Chinese authorities instructed local firms to cease publishing research or holding seminars related to stablecoins.

This was followed by a since-removed report from major local financial news outlet Caixin that mainland Chinese firms operating in Hong Kong may be forced to withdraw from cryptocurrency-related activities.

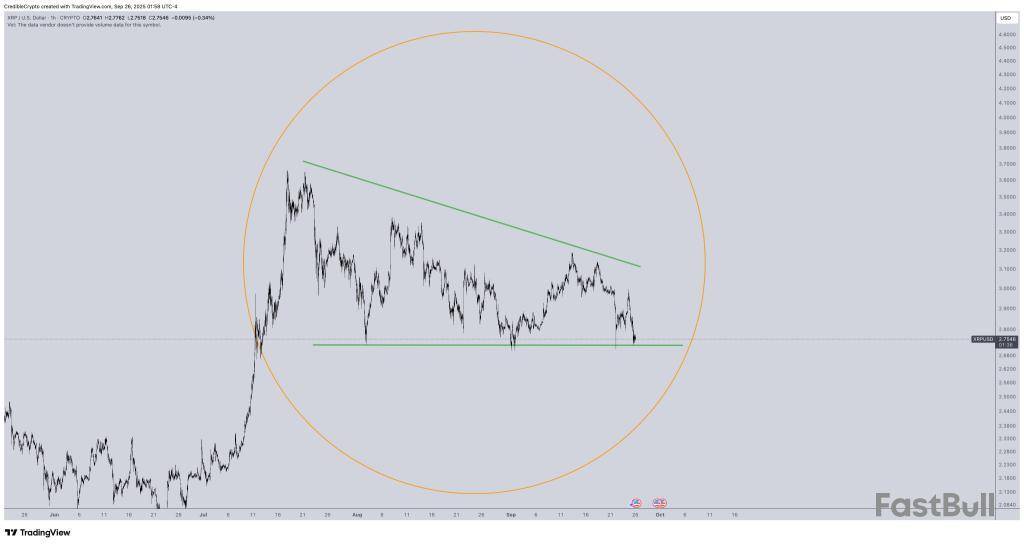

XRP price has dropped more than 5%, slipping below $2.75 and hitting its lowest level in a month. This sudden fall has made many traders fear a bigger crash, with some even warning of a full “capitulation.” But according to popular analyst CrediBULL Crypto, the panic may be unnecessary.

He believes that while the short-term chart looks weak, the larger trend still points towards a bullish surge.

Ripple XRP Price Crash Ahead

According to CrediBULL Crypto, the chart causing panic is being misunderstood when looked at alone. Zooming out to a higher timeframe (HTF), the current price is part of a larger bullish pattern, shown in an orange circle on the chart. This shows that despite short-term ups and downs, XRP’s overall trend remains positive.

The analyst noted that XRP could dip below $2.65, its triple-low level, if Bitcoin falls under $105,000. This could push XRP toward the $2–$2.40 zone, a drop of about 10-15% from current prices.

CrediBULL Crypto stressed that this isn’t true capitulation. Short-term pullbacks like this are normal during market corrections and don’t change the long-term bullish outlook for XRP.

When Will XRP Price Bounce Back?

Analyzing the chart further, CrediBULL shows that the bigger market structure remains intact. On higher timeframes, XRP is still following a bullish setup. He highlighted that XRP is likely to be one of the first coins to bounce back when the overall market recovers.

The HTF demand levels show strong support, making this dip a potential buying opportunity rather than a sign of weakness. Historically, coins that stabilize early during a pullback often rebound strongly, outperforming others when new market highs are reached.

What Next for XRP?

As of now, XRP is holding just above $2.75. The key question is whether buyers can protect the $2.60–$2.74 zone.

If this support holds, XRP could bounce back toward $2.95 and even $3.08. But if the token slips under this range, the next big test will be at $2.60. A break below that could push XRP down to $2.40, making it a deeper correction.

Key takeaways:

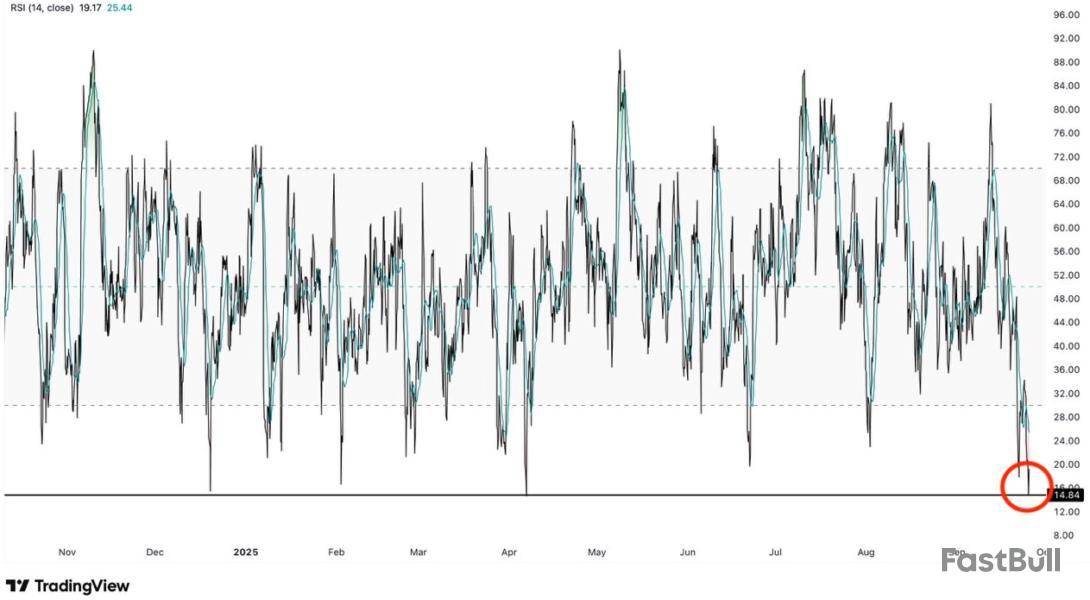

Ether’s “rare oversold” RSI, historically tied to major ETH price rallies, suggests a potential price reversal in the short-term.

ETH traders say price must stay above the $3,800-$3,900 range to avoid more losses.

Ether traders expect a short-term bounce as a key ETH price metric sinks to its lowest levels in several months.

Data from Cointelegraph Markets Pro and TradingView reveal extremely “oversold” conditions on the relative strength index (RSI).

ETH price dip sends RSI back to April

Ether's 20% drop below $4,000 from $4,800 over the last two weeks has significantly impacted low-timeframe RSI.

On the four-hour chart, the RSI fell from local highs of 82 on Sept. 13 to six-month lows of 14.5 on Thursday.

Such a sharp decline is rare, taking from “overbought” to “oversold” in less than two weeks. The last time that the index measured so low was on April 7, when traded at $1,400.

RSI measures trend strength and contains three key levels for observers: the 30 “oversold” boundary, the 50 midpoint and the 70 “overbought” threshold.

When the price crosses these levels, depending on the direction, traders can make inferences about the future of a given uptrend or downtrend. During bull markets, ETH regularly spends extended periods in “overbought” territory.

“ETH RSI flashes extreme lows,” said crypto markets commentator Coin Bureau in an X post on Friday, adding that it is a “rare” signal from Ether’s price action.

With the latest drawdown, traders quickly suggested that the ETH price was due for a relief bounce due to seller exhaustion.

“The RSI is in the zone that triggers bullish reversal as it did in June,” analyst Mickybull Crypto said in an X post while outlining “signs that the local bottom is likely” in for ETH.

Zooming out, fellow analyst Max Crypto said Ether’s “daily RSI is now the most oversold since June 2025,” adding:

Max Crypto@MaxCryptoxxSep 25, 2025$ETH DAILY RSI IS NOW THE MOST OVERSOLD SINCE JUNE 2025.

LAST TIME ETH WAS THIS MUCH OVERSOLD, IT RALLIED 134% IN JUST 2 MONTHS. pic.twitter.com/UcKnSG4yF0

As Cointelegraph reported, heavy accumulation by whales at lower levels supports the case of a possible short-term ETH price reversal.

Key ETH price levels to watch at $4,000

While traders believe bearish targets are still in play, there are several key price levels to watch above and below the spot price.

The “last two times $ETH was this oversold on the 8H RSI, marked the bottom,” pseudonymous analyst Crypto Devil pointed out in a Friday X post.

For Crypto Devil, the altcoin needs to hold above $3,900 to secure a “rally back to test the declining EMAs” around $4,100.

A deeper correction could see a retest of the $3,600 support or into the lower zone around $3,000-$3,300.

Fellow analyst Jelle said that ETH price needed to hold above the megaphone’s breakout level of $3,800 to avoid an “uncomfortable” pullback lower.

As Cointelegraph reported, a collapse below $3,800 could accelerate a deeper correction toward the lower target of a symmetrical triangle at $3,400.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

By Elsa Ohlen

Bitcoin and other cryptocurrencies extended their losses Friday, at the end of a week that has seen the biggest deleveraging of the year. It comes ahead of inflation data, expected to be key for the path of interest rates.

Bitcoin was down 2.3% over the past 24 hours to $109.190, bringing seven-day losses to 5.6%, according to CoinDesk data.

The world's second largest crypto by market value, Ether, and Ripple's XRP both fell 3.2% each.

Solana has seen the most pronounced losses lately as the crypto sector is experiencing a slump. The token was down 4.7% to $192.90 early Friday, extending losses over the past seven days to 19%.

The moves come ahead of the August personal consumption expenditure price index data (PCE), scheduled for 8:30 a.m. Friday. The Federal Reserve lowered interest rates by 25 basis points last week, however, officials say they'd like to see more progress on inflation before committing to more cuts this year, Barron's has reported.

If PCE data comes in hotter-than-expected, it might push the central bank to pause cuts for now, which would likely have a negative effect on riskier assets like cryptos.

While the inflation numbers could deepen the crypto slump, they could also end up helping tokens regain some losses, particularly if inflation is cooler than expected, increasing rate-cut odds. Higher interest rates tend to dampen traders' appetite for risk-assets, and vice versa.

The deleveraging event that started earlier this week came as digital-asset investors unwound bullish bets made after the Fed's latest interest rate cut.

Write to Elsa Ohlen at elsa.ohlen@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

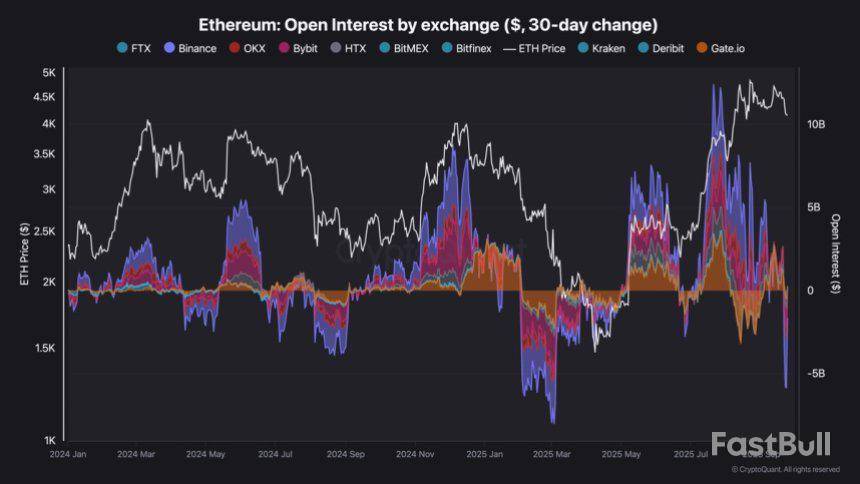

Ethereum has fallen below the $4,000 level for the first time since early August, marking a significant shift in market sentiment. After weeks of strong performance, ETH has now lost nearly 20% of its value since September 13, leaving many traders concerned about the next move. The broader market correction has fueled uncertainty, but some analysts argue this is a necessary reset that could prepare the ground for renewed growth.

Top analyst Darkfost highlights that Ethereum’s Open Interest is experiencing one of its biggest resets. He notes that after an extended period of bullish momentum, excess leverage has been punished, leading to a sharp contraction in positions. This decline is especially visible on Binance, where much of the recent ETH trading activity has taken place.

While the drop in price and sentiment appears negative, analysts see potential positives in this reset. Lower Open Interest often reduces the risk of cascading liquidations and allows the market to stabilize. For Ethereum, this moment may serve as a critical test of its ability to hold strong levels of support and set the stage for its next move once bullish momentum returns.

Ethereum’s Open Interest Reset Marks a Turning Point

Darkfost explains that the recent shift in Ethereum’s Open Interest is not only significant but also one of the sharpest resets observed since the start of 2024. Historically, such resets follow periods where excessive leverage pushes Open Interest to unsustainable levels, as was the case for ETH in recent weeks. The cryptocurrency had been attracting a large share of market attention, fueled by ETF enthusiasm and strong accumulation patterns, which left it vulnerable to sharp liquidations.

Once liquidations accumulate and Open Interest falls, the immediate selling pressure often begins to ease. This tends to create conditions where the market can stabilize and, in some cases, prepare for recovery. The dynamic can be seen as a “cleansing” effect, flushing out overextended traders and restoring balance to the market structure.

In detail, Binance recorded the steepest monthly average decline, with more than $3 billion in Open Interest wiped out on September 23rd, followed by another $1 billion yesterday. Bybit also faced a reduction of $1.2 billion, while OKX dropped around $580 million. These figures underscore the scale of the reset across major derivatives platforms.

This contraction reflects a broader market reset, unwinding an environment that had become dangerously over-leveraged. For Ethereum, it may mark the beginning of a healthier phase, where reduced speculative pressure allows organic demand and fundamentals to play a stronger role in shaping the next trend.

Price Action Insights: Testing Critical Levels

Ethereum (ETH) is trading near $3,939, marking a sharp decline of over 5% in the latest session and extending its correction since the early September peak above $4,700. This drop has brought ETH below the key $4,000 psychological level for the first time since August, signaling rising selling pressure.

The chart shows ETH breaking down after forming a double top pattern around the $4,700–$4,800 range, a classic bearish signal that suggested exhaustion of upward momentum. The rejection from this zone has now pushed ETH closer to its 50-day moving average (blue), which previously acted as strong support during the rally. A decisive close below this line could open the door to a deeper retrace toward the 200-day moving average (red), now positioned near $3,100–$3,200.

Despite the current weakness, ETH remains in a broader uptrend when viewed from the July low near $2,200. That rebound established a strong bullish structure, and as long as ETH holds above the $3,500–$3,600 region, the long-term outlook remains constructive. For now, bulls must reclaim $4,200 to regain momentum, while failure to hold current levels may accelerate selling pressure and test deeper supports in the coming sessions.

Featured image from Dall-E, chart from TradingView

On September 25, 2025, nine European banks formed a consortium to develop a euro-backed stablecoin, set to launch in the second half of 2026. The consortium has created a new Netherlands-based company to issue the token. The central European banks forming the consortium include UniCredit (Italy), ING (Netherlands), DekaBank (Germany), Banca Sella (Italy), KBC Group (Belgium), Danske Bank (Denmark), SEB (Sweden), CaixaBank (Spain), and Raiffeisen Bank International (Austria).

The goal is to challenge dollar dominance in stablecoins. The current stablecoin market is almost entirely dominated by the US dollar via $USDT ($173B market cap) and $USDC ($74B). Thus, most global crypto and digital payments rely on USD rather than EUR.

Another possible reason could be Europe’s intention to attain strategic autonomy. Europe stepping in with its own stablecoin is seen as an effort to create an alternative to $USDT and $USDC, while also regaining control over digital payments and settlements.

As Europe takes a bold step towards launching its own stablecoin, investors’ interest in crypto projects and utility-driven tokens with real momentum is rising.

One standout is Best Wallet Token ($BEST), a token backing a mobile-first crypto wallet. It’s currently in presale, having raised over $16.1M to date.

Europe’s Big Push for Regulated Euro Stablecoins and Digital Sovereignty

With the EU’s MiCA regulation offering a clear framework for stablecoin issuance, Europe has a safer backdrop to launch euro-backed stablecoins. This context already makes for an optimistic outlook.

In light of the news, several European leaders and officials also voiced their positive opinions on a Euro stablecoin:

The EU’s bold new move is welcomed by retail and institutional investors worldwide considering the potential growth of the stablecoin market, with analysts estimating stablecoins potentially handling $100T–$200T in annual payments by 2030. The growth of stablecoins may not only benefit banks but also boost demand for secure stablecoin wallets and related utility tokens, such as Best Wallet Token ($BEST), which is already undergoing a booming presale.

Its wallet app already powers onramping, secure storage, transfers, and swaps for stablecoins and other tokens across top blockchains.

Best Wallet Token ($BEST) – Utility Crypto with a Secure, Multi-Chain Wallet and DeFi Features

Best Wallet Token ($BEST) is the native token of Best Wallet, a top-notch multi-chain asset storage offering seamless access to crypto onramping, DeFi platforms, and integrated decentralized swaps.

Within this ecosystem, $BEST provides exclusive holder benefits, including:

Learn more about Best Wallet Token with our guide.

Then, we have Best Wallet, which is on a mission to capture 40% of the crypto wallet market by the end of 2026. As with any scaling crypto storage ecosystem, Best Wallet has built its own token to keep users engaged, fund growth, and build community ownership.

The Best Wallet ecosystem itself stands out as a highly promising platform thanks to its comprehensive roadmap.

It includes upcoming features such as the staking aggregator we mentioned, plus a crypto debit card, integrated market analytics, and derivatives trading. By the end of stage 4, this app will be an all-in-one crypto solution for retail traders.

Backed by this vision, the $BEST token provides investors with direct exposure to the ecosystem’s growth.

For early investors, it offers the added advantage of securing tokens at a lower price, positioning them to benefit most as the Best Wallet expands into multi-chain finance.

$BEST Token Presale Is Booming, Attracting Whale Buyers

$BEST’s presale has gained strong momentum, already raising $16.1M. Whales are now circling in, staking their bags with $BEST worth $70.2K and $50.9K, a clear reflection of the project’s strong upside potential.

With the token currently priced at $0.025695 and our $BEST price prediction forecasting 98% growth in 2026, this could make a good long-term play for investors who seek to diversify.

If our expert $BEST predictions come to fruition, a $500 investment in $BEST today could grow to around $685 by the end of 2025 (at $0.035215) and nearly $994 by 2026 (at $0.05106175) in price appreciation.

New adopters can also lock in dynamic staking rewards (currently 82% APY). But rewards will naturally taper as more participants join, making the earliest investors the biggest winners.

With staking at 82% APY and considering the most bullish forecasts, your $500 investment today could swell to roughly ~$1,808 after one year ($814.76 of that coming from staking rewards alone). This is assuming the APY and prediction hold.

With the subsequent presale price rise set for tomorrow, now is the chance to secure $BEST at lower-tier prices.

Visit the $BEST token presale now.

This is not financial advice. Always do your own research before investing in crypto, as the market is highly volatile.

Authored by Aaron Walker, NewsBTC — https://www.newsbtc.com/news/9-european-banks-stablecoin-consortium-fight-dollar-dominance/

American Bitcoin (ABTC), the mining firm tied to Eric Trump and backed by Hut 8, is drawing headlines again – this time for all the wrong reasons.

CNBC’s Jim Cramer has put the stock under the spotlight, warning retail investors not to expect smooth sailing. What’s the reason for worry now? Let’s dive in.

Cramer Calls ABTC Pure Speculation

On his Mad Money Lightning Round, Cramer was blunt.

“It’s a spec. It’s your one spec, as I say, in how to make money… But that could lose everything. Just so long as you know that, that’s fine,” he told viewers.

Mad Money On CNBC@MadMoneyOnCNBCSep 26, 2025.@jimcramer rings the lightning round bell, which means he’s giving his answers to callers’ stock questions at rapid speed. On Thursday, he told one caller that American Bitcoin was speculative.https://t.co/AinxFMpYIr

The comments came as ABTC shares slipped 4.29% on Thursday, closing at $6.69, in line with a broader pullback across crypto markets.

From Nasdaq Debut to Trump’s Mining Vision

American Bitcoin only began trading on Nasdaq in early September after its merger with Gryphon Digital Mining. The company is majority-owned by Hut 8, one of the largest corporate holders of Bitcoin, and is branding itself as the backbone of America’s Bitcoin mining infrastructure.

The political link is hard to miss.

Eric Trump has been championing a strategy of mining Bitcoin below market cost and holding it in reserves, pitching ABTC as an alternative way to gain exposure to Bitcoin’s growth. This vision ties directly into Donald Trump’s broader push to make the U.S. a leader in crypto mining, which is a stark shift from when he once dismissed Bitcoin as a scam.

Green Mining in a Tough Market

Bitcoin mining has always been unforgiving. Energy bills alone can swallow 70–80% of costs, and difficulty levels keep rising every two weeks. Halving events only squeeze margins further.

ABTC’s merger with Gryphon could soften the blow. Gryphon is known for renewable energy strategies, using solar, wind, and hydro to cut costs. If successful, that could give American Bitcoin an edge in a sector where competition from Texas to Kazakhstan is fierce.

Sky-High Valuation, Mixed Returns

Despite its short trading history, the stock already carries a heavy premium. ABTC trades at a P/E ratio of 39.8x, higher than the U.S. software industry average of 35.4x and far above peers at 11x.

But the fundamentals aren’t keeping pace. Earnings growth has recently turned negative, and profit margins have slipped compared to last year. The stock’s performance has also been choppy, erasing earlier gains and leaving investors questioning whether the optimism is justified.

The Bigger Picture

Cramer’s warning may sound harsh, but it highlights the crossroads ABTC finds itself at. On one side, there’s the Trump-backed ambition to build America’s Bitcoin backbone with green mining and long-term reserves. On the other, there’s the brutal reality of mining economics, volatile markets, and a stock price that demands a lot from the future.

For now, American Bitcoin remains a high-risk, high-reward bet and one the market will be watching closely.

Белая этикетка

API данных

Веб-плагины

Создатель Плакатов

План агентства

Риск потерь при торговле такими финансовыми инструментами, как акции, валюта, сырьевые товары, фьючерсы, облигации, ETF и криптовалюты, может быть значительным. Вы можете полностью потерять средства, размещенные у брокера. Поэтому вам следует тщательно взвесить, подходит ли вам такая торговля с учетом ваших обстоятельств и финансовых ресурсов.

Ни одно решение об инвестировании не должно приниматься без проведения тщательной проверки самостоятельно или без консультации с вашими финансовыми консультантами. Наш веб-контент может не подойти вам, поскольку мы не знаем ваших финансовых условий и инвестиционных потребностей. Наша финансовая информация может иметь задержку или содержать неточности, поэтому вы должны нести полную ответственность за любые ваши торговые и инвестиционные решения. Компания не несет ответственности за потерю вашего капитала.

Без разрешения сайта запрещается копировать графику, тексты или торговые марки сайта. Права интеллектуальной собственности на содержание или данные, включенные в этот сайт, принадлежат его поставщикам и торговцам.

Не вошли в систему

Войдите в систему, чтобы получить доступ к дополнительным функциям

Участник FastBull

Пока нет

Покупка

Войти

Зарегистрироваться