Котировки

Новости

Анализ

Пользователь

24/7

Экономический Календарь

Обучение

Данные

- Имена

- Последний

- Пред.

Сообщество аккаунт

Сигнальные аккаунты для участников

Все сигнальные аккаунты

Все конкурсы

Великобритания Торговый баланс (Окт)

Великобритания Торговый баланс (Окт)А:--

П: --

П: --

Великобритания Ежемесячное изменение индекса в сфере услуг

Великобритания Ежемесячное изменение индекса в сфере услугА:--

П: --

П: --

Великобритания Ежемесячный рост выпуска в строительстве (Сезонно скорректированный) (Окт)

Великобритания Ежемесячный рост выпуска в строительстве (Сезонно скорректированный) (Окт)А:--

П: --

П: --

Великобритания Годовой рост промышленного выпуска (Окт)

Великобритания Годовой рост промышленного выпуска (Окт)А:--

П: --

П: --

Великобритания Торговый баланс (Сезонно скорректированный) (Окт)

Великобритания Торговый баланс (Сезонно скорректированный) (Окт)А:--

П: --

П: --

Великобритания Торговый баланс с Евросоюзом (сезонно скорректированный) (Окт)

Великобритания Торговый баланс с Евросоюзом (сезонно скорректированный) (Окт)А:--

П: --

П: --

Великобритания Годовой прирост производства (Окт)

Великобритания Годовой прирост производства (Окт)А:--

П: --

П: --

Великобритания ВВП месяц к месяцу (Окт)

Великобритания ВВП месяц к месяцу (Окт)А:--

П: --

П: --

Великобритания ВВП год к году (сезонно скорректированный) (Окт)

Великобритания ВВП год к году (сезонно скорректированный) (Окт)А:--

П: --

П: --

Великобритания Ежемесячный рост промышленного выпуска (Окт)

Великобритания Ежемесячный рост промышленного выпуска (Окт)А:--

П: --

П: --

Великобритания Годовой рост выпуска в строительстве (Окт)

Великобритания Годовой рост выпуска в строительстве (Окт)А:--

П: --

П: --

Франция Окончательный ИПЦ месяц к месяцу (Нояб)

Франция Окончательный ИПЦ месяц к месяцу (Нояб)А:--

П: --

П: --

Китай, материк Годовой рост выданных кредитов (Нояб)

Китай, материк Годовой рост выданных кредитов (Нояб)А:--

П: --

П: --

Китай, материк Денежная масса M2 год к году (Нояб)

Китай, материк Денежная масса M2 год к году (Нояб)А:--

П: --

П: --

Китай, материк Денежная масса M0 год к году (Нояб)

Китай, материк Денежная масса M0 год к году (Нояб)А:--

П: --

П: --

Китай, материк Денежная масса M1 год к году (Нояб)

Китай, материк Денежная масса M1 год к году (Нояб)А:--

П: --

П: --

Индия ИПЦ год к году (Нояб)

Индия ИПЦ год к году (Нояб)А:--

П: --

П: --

Индия Рост депозитов (год к году)

Индия Рост депозитов (год к году)А:--

П: --

П: --

Бразилия Годовой рост в сфере услуг (Окт)

Бразилия Годовой рост в сфере услуг (Окт)А:--

П: --

П: --

Мексика Годовой рост промышленного выпуска (Окт)

Мексика Годовой рост промышленного выпуска (Окт)А:--

П: --

П: --

Россия Торговый баланс (Окт)

Россия Торговый баланс (Окт)А:--

П: --

П: --

Президент Федерального резервного банка Филадельфии Генри Полсон выступает с речью

Президент Федерального резервного банка Филадельфии Генри Полсон выступает с речью Канада Месячный рост строительных разрешений (Сезонно скорректированный) (Окт)

Канада Месячный рост строительных разрешений (Сезонно скорректированный) (Окт)А:--

П: --

П: --

Канада Годовой рост оптовых продаж (Окт)

Канада Годовой рост оптовых продаж (Окт)А:--

П: --

П: --

Канада Месячный рост оптовых запасов (Окт)

Канада Месячный рост оптовых запасов (Окт)А:--

П: --

П: --

Канада Годовой рост оптовых запасов (Окт)

Канада Годовой рост оптовых запасов (Окт)А:--

П: --

П: --

Канада Месячный рост оптовых продаж (Сезонно скорректированный) (Окт)

Канада Месячный рост оптовых продаж (Сезонно скорректированный) (Окт)А:--

П: --

П: --

Германия Текущий счет (Не сезонно скорректированный) (Окт)

Германия Текущий счет (Не сезонно скорректированный) (Окт)А:--

П: --

П: --

США Еженедельное общее бурение

США Еженедельное общее бурениеА:--

П: --

П: --

США Еженедельное общее бурение нефти

США Еженедельное общее бурение нефтиА:--

П: --

П: --

Япония Индекс диффузии крупных непроизводственных предприятий Танкан (4 квартал)

Япония Индекс диффузии крупных непроизводственных предприятий Танкан (4 квартал)--

П: --

П: --

Япония Индекс диффузии малых предприятий производственного сектора Танкан (4 квартал)

Япония Индекс диффузии малых предприятий производственного сектора Танкан (4 квартал)--

П: --

П: --

Япония Индекс прогноза крупных непроизводственных предприятий Танкан (4 квартал)

Япония Индекс прогноза крупных непроизводственных предприятий Танкан (4 квартал)--

П: --

П: --

Япония Индекс прогноза крупных предприятий по производству Танкан (4 квартал)

Япония Индекс прогноза крупных предприятий по производству Танкан (4 квартал)--

П: --

П: --

Япония Индекс малых предприятий производственного сектора по опросу Танкан (4 квартал)

Япония Индекс малых предприятий производственного сектора по опросу Танкан (4 квартал)--

П: --

П: --

Япония Индекс диффузии крупных предприятий по производству Танкан (4 квартал)

Япония Индекс диффузии крупных предприятий по производству Танкан (4 квартал)--

П: --

П: --

Япония Годовой рост капитальных затрат крупных предприятий по опросу Танкан (4 квартал)

Япония Годовой рост капитальных затрат крупных предприятий по опросу Танкан (4 квартал)--

П: --

П: --

Великобритания Индекс цен на жилье Rightmove (год к году) (Дек)

Великобритания Индекс цен на жилье Rightmove (год к году) (Дек)--

П: --

П: --

Китай, материк Годовой рост промышленного выпуска (с начала года) (Нояб)

Китай, материк Годовой рост промышленного выпуска (с начала года) (Нояб)--

П: --

П: --

Китай, материк Уровень безработицы в городской местности (Нояб)

Китай, материк Уровень безработицы в городской местности (Нояб)--

П: --

П: --

Саудовская Аравия ИПЦ год к году (Нояб)

Саудовская Аравия ИПЦ год к году (Нояб)--

П: --

П: --

Еврозона Годовой рост промышленного выпуска (Окт)

Еврозона Годовой рост промышленного выпуска (Окт)--

П: --

П: --

Еврозона Ежемесячный рост промышленного выпуска (Окт)

Еврозона Ежемесячный рост промышленного выпуска (Окт)--

П: --

П: --

Канада Продажи существующего жилья (месяц к месяцу) (Нояб)

Канада Продажи существующего жилья (месяц к месяцу) (Нояб)--

П: --

П: --

Еврозона Общие резервные активы (Нояб)

Еврозона Общие резервные активы (Нояб)--

П: --

П: --

Великобритания Ожидания уровня инфляции

Великобритания Ожидания уровня инфляции--

П: --

П: --

Канада Индекс национального экономического доверия

Канада Индекс национального экономического доверия--

П: --

П: --

Канада Новое начало строительства жилья (Нояб)

Канада Новое начало строительства жилья (Нояб)--

П: --

П: --

США Индекс занятости в производственном секторе Федерального резервного банка Нью-Йорка (Дек)

США Индекс занятости в производственном секторе Федерального резервного банка Нью-Йорка (Дек)--

П: --

П: --

США Индекс производства в производственном секторе Федерального резервного банка Нью-Йорка (Дек)

США Индекс производства в производственном секторе Федерального резервного банка Нью-Йорка (Дек)--

П: --

П: --

Канада Годовой рост основного индекса потребительских цен (Нояб)

Канада Годовой рост основного индекса потребительских цен (Нояб)--

П: --

П: --

Канада Месячный прирост невыполненных заказов в производстве (Окт)

Канада Месячный прирост невыполненных заказов в производстве (Окт)--

П: --

П: --

Канада Месячный прирост новых заказов в производстве (Окт)

Канада Месячный прирост новых заказов в производстве (Окт)--

П: --

П: --

Канада Ежемесячный рост основного индекса потребительских цен (Нояб)

Канада Ежемесячный рост основного индекса потребительских цен (Нояб)--

П: --

П: --

Канада Месячный прирост запасов в производстве (Окт)

Канада Месячный прирост запасов в производстве (Окт)--

П: --

П: --

Канада ИПЦ год к году (Нояб)

Канада ИПЦ год к году (Нояб)--

П: --

П: --

Канада ИПЦ месяц к месяцу (Нояб)

Канада ИПЦ месяц к месяцу (Нояб)--

П: --

П: --

Канада ИПЦ год к году (Скорректированный на сезонность) (Нояб)

Канада ИПЦ год к году (Скорректированный на сезонность) (Нояб)--

П: --

П: --

Канада Ежемесячный рост основного индекса потребительских цен (Сезонно скорректированный) (Нояб)

Канада Ежемесячный рост основного индекса потребительских цен (Сезонно скорректированный) (Нояб)--

П: --

П: --

Канада ИПЦ месяц к месяцу (Скорректированный на сезонность) (Нояб)

Канада ИПЦ месяц к месяцу (Скорректированный на сезонность) (Нояб)--

П: --

П: --

Нет соответствующих данных

Последние мнения

Последние мнения

Актуальные темы

Лучшие обозреватели

Последнее Обновление

Белая этикетка

API данных

Веб-плагины

План агентства

Посмотреть все

Нет данных

On-chain analytics firm CryptoQuant has revealed the five key Bitcoin on-chain alerts that could be to keep an eye on in the coming week.

Bitcoin Is Observing Developments On These Metrics

In a new thread on X, CryptoQuant has discussed about some Bitcoin on-chain alerts that could be to watch amid the consolidation phase in the cryptocurrency’s price.

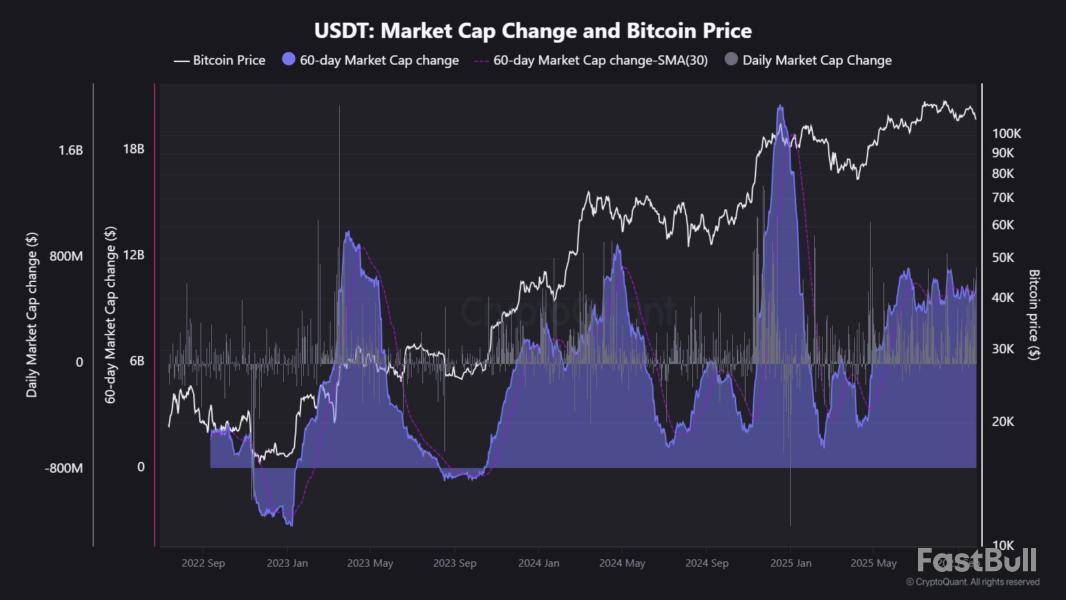

The first indicator shared by the analytics firm is the 60-day change in the market cap of USDT, the number one stablecoin.

As is visible in the above chart, the 60-day change in the USDT market cap has continued to sit at a notable positive level recently, implying the stablecoin has been witnessing growth.

Stablecoins are one of the main inlets of capital into the cryptocurrency sector, so growth in them can generally be a positive sign. Currently, the 60-day change in the USDT market cap has a value of $10 billion. “This is a clear sign of fresh liquidity entering the market,” notes CryptoQuant.

Another stablecoins-related indicator that can be relevant for Bitcoin is the Stablecoin Supply Ratio (SSR), which measures the ratio between the market cap of BTC and combined that of all stables.

A low value in the indicator can prove to be a bullish sign, as it implies investor purchasing power in the form of stablecoins is high compared to the Bitcoin market cap.

From the below chart, it’s apparent that the Relative Strength Index (RSI) of the BTC SSR stands at a value of 21 right now, which is considered to be inside the “buy” territory.

Another bullish sign that’s developing for Bitcoin is in the Accumulator Address Demand, an indicator that measures the demand that’s coming from addresses that have zero history of selling the cryptocurrency. These perennial HODLers now own 298,000 BTC, which is a new record.

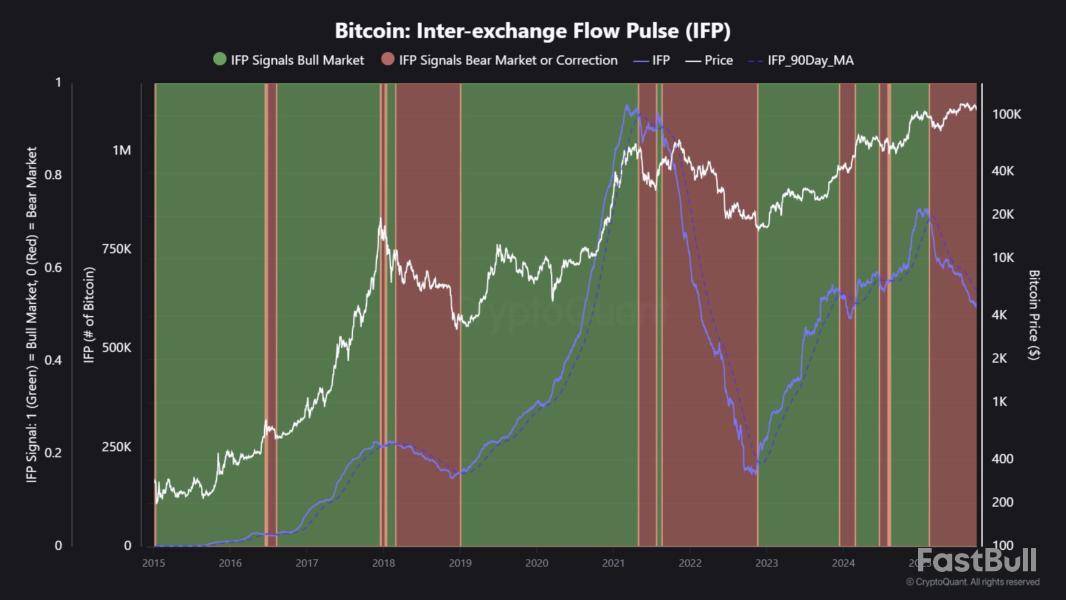

A metric that’s still inside the bearish zone, however, is the Inter-Exchange Flow Pulse (IFP). This metric keeps track of the BTC flows happening between spot and derivatives exchanges.

The indicator has been following a downtrend during the past few months, which is considered to be a bear market pattern. “Watch closely: a shift upward often marks the start of bullish momentum,” says the analytics firm.

The final metric shared by CryptoQuant is the Realized Price of the short-term holders (STHs), which measures the average cost basis of the Bitcoin investors who got in during the last 155 days.

During BTC’s recent plunge, the STHs briefly dipped into losses, but the asset has since recovered above their Realized Price of $109,775. Bullish trends have historically continued when the coin has traded above this level.

BTC Price

Bitcoin has climbed back to $114,200 following its recovery surge in the last couple of days.

An unknown whale is taking risks on the cryptocurrency market — but not with XRP. Instead, whales' attention is focused on Plasma, a layer-1 blockchain designed for stablecoin payments worldwide. After depositing 31.52 million USDC into Hyperliquid just 10 hours ago, the whale has since bought 29.27 million XPL, which is approximately $31.13 million.

XPL's market path

With strong liquidity and high trading volumes, XPL has recently risen on the charts, and this sudden accumulation is igniting speculation about it. CoinMarketCap reports that XPL is trading at $0.94, down 18% for the day, but it has a huge 24-hour volume of $2.49 billion or nearly 147% of its $1.69 billion market cap. XPL is establishing itself as a direct competitor on the payments market, in contrast to XRP, which has been having trouble with resistance levels and low volume. CoinMarketCap">

Plasma aims to create the foundation of a stablecoin-powered financial system by offering customizable gas tokens and zero-fee USDT transfers. Because of this positioning even in the face of price volatility, wealthy investors are placing significant bets on its long-term prospects. The whale's repeated behaviors imply that it is confident in accumulation at the present rate. Historically, insider confidence in impending developments or longer adoption cycles have frequently preceded such concentrated buying.

Whales are not enough?

But traders need to prepare for more volatility given the token's recent sharp swings, which include an all-time high of $1.68 just three days ago and today's retracement. This movement presents an indirect challenge to XRP. Although XPL's whale-driven surge indicates investor interest in alternative payment-layer solutions, Ripple is still firmly established in traditional financial corridors.

The long-standing dominance of XRP in cross-border settlements may be seriously challenged if Plasma manages to draw in this kind of funding. In summary, it is important to keep a close eye on the shift, where whales are investing in XPL rather than XRP. The sudden whale accumulation and stablecoin-first infrastructure of Plasma could signal the beginning of a larger struggle for relevance in blockchain-based payments.

Private crypto firm 21Shares recently listed two of its ETFs—the 21Shares Polkadot ETF (TDOT) and 21Shares Sui ETF (TSUI)—on the Depository Trust & Clearing Corporation (DTCC) on Tuesday. Both listings are part of the standard preparation process for launching new ETFs.

It’s important to note that this DTCC listing does not indicate regulatory approval. Instead, it reflects standard operational steps and growing confidence in the underlying assets. Both ETFs still require formal approval from the U.S. Securities and Exchange Commission (SEC) before they can start official trading.

The SEC’s decision deadlines are set for November 2025 for TDOT and December 2025 for TSUI. Recently, the SEC simplified the ETF approval process by removing the need for the 19b-4 filing, making it easier for crypto ETFs to move toward official listing.

Market Reaction to 19b-4 Rule Change

Starting tomorrow, October 2, the U.S. Securities and Exchange Commission (SEC) will begin issuing final decisions on crypto ETF approvals. Applications for Litecoin ETFs, including those from Canary, Grayscale, and CoinShares, will enter the final phase of the approval process.

Bloomberg analyst Eric Balchunas recently raised the odds of a crypto ETF approval to 100%, reflecting growing confidence in the SEC’s upcoming decisions.

Balchunas said, “Who’s ready for Cointober? Spot crypto ETF Deadlines start this week! Litecoin and Solana up first. Should be a wild month.”

As crypto ETF approvals approach, the SEC warned investors to watch out for scams. Crypto users should stay alert and avoid fraud.

DTCC Listing Buzz in Crypto ETFS

Over the past few weeks, DTCC listed multiple crypto ETFs, including Fidelity Solana ETF (FSOL), Canary HBAR ETF (HBR), and Canary XRP ETF (XRPC). However, neither of those ETFs has been approved by the SEC yet.

These listings are a groundwork that signals an upcoming SEC approval, but does not necessarily guarantee it. So, despite appearing on the DTCC platform, ETFs cannot trade without SEC approval.

As September 2025 closes in the green, cryptocurrency markets enter October with cautious optimism. Historically, October has been one of the strongest months for Bitcoin and Ethereum , while XRP faces potentially transformative ETF decisions that could reshape its future. With macroeconomic uncertainties, institutional inflows, and investor sentiment heating up, October may prove to be a pivotal month for the digital asset market.

Bitcoin Price Prediction October 2025

Bitcoin traders are closely watching October after BTC wrapped up September with gains, historically a strong signal for continued upside. An analysis of the past 15 Bitcoin Octobers reveals a 73% chance of a positive monthly close, with 11 of those 15 years ending in the green.

The last six consecutive Octobers have all closed positive, delivering an average return of +27% and a median return of +28.3%. Some Octobers have seen even greater strength, with rallies above 30% and one year surpassing 40%.

Negative Octobers have been rare, with the last occurring in 2018 when Bitcoin slipped 3.3% during the U.S. government shutdown. Historically, however, losing Octobers tend to deliver sharper drawdowns averaging around 30%. If such a pattern repeated today, Bitcoin could see a correction down to the $80,000 range.

Current indicators are also pointing to potential early weakness. The 4-day moving average cross suggests a corrective target near $105,000, while a bearish 5-day signal could extend that move lower toward $102,500. Even so, if Bitcoin follows its historical fourth-quarter performance, a renewed surge toward new all-time highs remains a strong possibility.

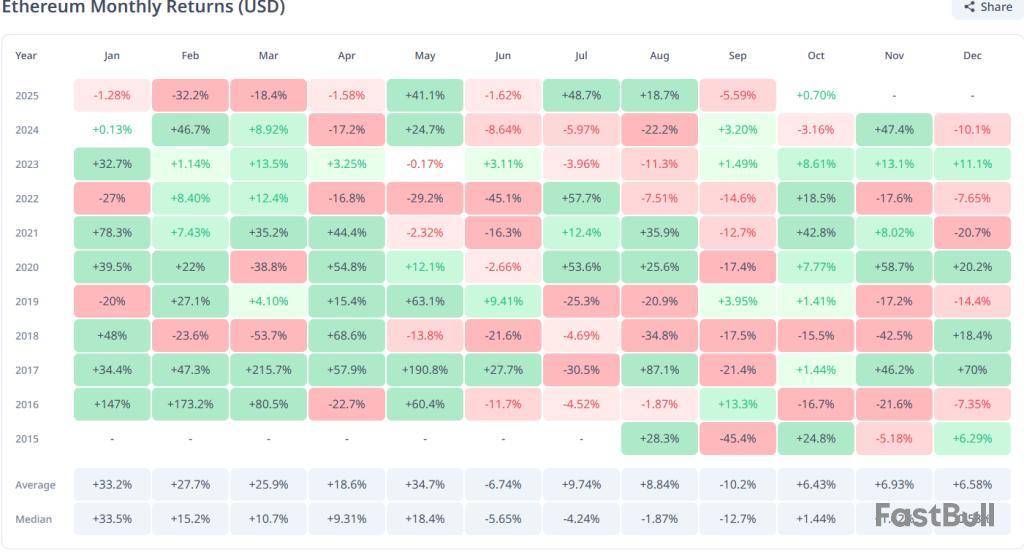

Ethereum Price Prediction October 2025

Ethereum enters October after a volatile September, having dipped below $4,000 to reach lows of $3,825 before bouncing and holding above the critical $3,900 support zone. Market participants are now focused on whether Ethereum can break through key resistance levels. The most immediate barrier sits around $4,260.

A strong breakout above this level could allow ETH to test $4,670, and if that range is surpassed with conviction, the $5,000 milestone becomes the next target. In a more cautious scenario, Ethereum may consolidate between $4,000 and $4,600 before deciding on its next direction.

From a technical perspective, Ethereum’s RSI is at its most oversold reading since April 2025, a rare condition that has historically preceded powerful rallies. The last time ETH was this oversold, it staged a 134% rally within just two months. This adds weight to the argument for a possible rebound in the weeks ahead.

Historical fourth-quarter data further supports this outlook, with Ethereum posting strong gains in past years: +104% in Q4 2020, +142% in Q4 2017, +36% in Q4 2023, and +28% in Q4 2024. On average, Ethereum has delivered nearly +24% in Q4, making this period historically a strong recovery phase. If ETH can reclaim and hold $4,000 on weekly closes, analysts believe a rally toward $7,000–$8,000 remains in play, potentially setting up a powerful bull run into early 2026.

XRP Price Prediction October 2025

XRP may be the biggest story of October 2025, with final SEC decisions due on eight XRP ETF applications from major asset managers such as Grayscale, WisdomTree, and Franklin Templeton between October 18 and 25. These firms oversee more than $8 trillion in assets under management, raising expectations that even modest institutional inflows could have an outsized impact on XRP.

Analysts estimate that $3–5 billion of inflows in the first year could be enough to double XRP’s market cap, pushing the token toward the $5 mark. Sustained inflows could potentially propel XRP price into double-digit territory for the first time in history, creating a transformative moment for the cryptocurrency.

Technically, XRP has been consolidating around the $3 level after pulling back from its $3.66 all-time high in July. The $3 price point has become a critical battleground for bulls and bears. Holding above it could trigger a breakout, first toward $3.65 and then potentially $4.50, which would open the door to new price discovery.

However, if XRP fails to hold momentum and volume weakens, the token risks sliding back to $2.75, a key support level that has held for months. Analysts also point out that XRP is displaying chart patterns similar to its 2017 bull run, suggesting that the asset may be preparing for a parabolic move.

The combination of potential ETF approvals, simplified SEC processes, and institutional interest could align to create one of the most important moments in XRP’s history.

Conclusion

Bitcoin starts October with a bullish historical track record, though risks like a U.S. government shutdown could cause short-term volatility. Ethereum looks oversold and ready for a potential Q4 rebound, with strong historical gains backing a recovery rally. XRP could be the biggest mover, as upcoming ETF decisions may trigger major institutional inflows.

Overall, Q4 2025 could set the stage for a transformative crypto rally heading into 2026.

Swiss-based digital asset bank Sygnum has launched the BTC Alpha Fund for investors to grow their Bitcoin without selling it. This new Fund promises 8%–10% yearly returns paid in Bitcoin, using smart arbitrage and DeFi strategies to turn idle holdings into bigger stacks.

Here’s how!

BTC Alpha Fund: New Way to Earn on Bitcoin

In a recent announcement, Sygnum noted that the BTC Alpha Fund is designed for professional and institutional investors who want security and growth. Unlike other products, investors don’t need to sell their Bitcoin, the fund aims to increase their holdings.

It uses arbitrage trading strategies to earn profits, which are converted into Bitcoin and added back to investors’ wallets. Meanwhile, the fund targets 8–10% returns per year, making it one of the few options to earn yield on BTC.

Currently, only 0.8% of Bitcoin’s supply is used in DeFi, less than $6.5 billion of the nearly $1 trillion market. This shows huge potential for growth in Bitcoin-based yield products.

How Will This Impact Bitcoin?

Markus Hammerli, who leads the BTC Alpha Fund, says the product is already seeing strong interest. Sygnum also notes that every $1 billion flowing into Bitcoin ETFs could push prices up 3–6% because of Bitcoin’s limited supply and the multiplier effect

While decentralized finance (DeFi) shows that Bitcoin can earn income, adoption is still small. By offering a regulated fund, Sygnum aims to meet this demand while giving investors a safer option compared to riskier DeFi projects.

Safety, Liquidity, and Flexibility

In addition, Sygnum has linked the fund to its broader banking services. Shares of the BTC Alpha Fund can be used as collateral for Lombard Loans, giving investors access to liquidity without selling their Bitcoin exposure.

This is a valuable tool for long-term holders who often struggle with cash flow while keeping their BTC untouched.

Tether, the issuer behind the leading stablecoin, USDT, has made headlines by acquiring $1 billion worth of Bitcoin—approximately 8,800 BTC—during the third quarter of this year.

While many investors have reacted positively to this significant investment, caution has emerged from industry experts like Jacob King, CEO of SwanDesk, who warns that this move may contribute to what he believes could be the “largest bubble in history.”

Bitcoin’s True Value Could Be Below $1,000

In a recent post on social media platform X (formerly Twitter), King raised serious concerns about the Bitcoin market, claiming that 80-90% of the total buy volume is artificially inflated.

He argues that Tether essentially creates money “out of thin air,” injecting it into Bitcoin and thereby exacerbating the speculative environment. Despite the growing trend of exchange-traded funds (ETFs) and institutional accumulation of Bitcoin as a treasury reserve, the cryptocurrency’s real value might be “far below $1,000.”

This narrative has been ongoing for years, provoking varied responses within the community. One investor countered King’s assertion by asking why major institutional players, including sovereign ETFs and Fortune 500 companies, continue to invest in Bitcoin if such a large portion of the trading volume is deemed fake.

His argument suggests that either these institutions are misinformed or that the real bubble lies within traditional fiat currencies rather than cryptocurrencies like Bitcoin.

King refuted this notion, alleging that the idea of significant institutional investment in Bitcoin is largely “a myth.” He contended that most inflows into ETFs are driven by retail investors, not large institutions.

Skepticism Vs. Optimism

Further amplifying his skepticism, King criticized Strategy (previously MicroStrategy), the largest publicly traded company holding over 600,000 BTC, describing it as a “leveraged Bitcoin casino.”

He alleged that the company’s co-founder, Michael Saylor, has a history of inflating numbers during the dot-com bubble, suggesting that the current situation is a repetition of “past mistakes.”

In contrast, other experts like Quinten Francois view Tether’s recent Bitcoin purchase through a more optimistic lens. Francois highlights the US government’s push for stablecoin adoption via the GENIUS Act, which mandates that stablecoin issuers be licensed, transparent, and fully backed by US Treasuries.

He argues that this regulatory framework could channel trillions in offshore Eurodollars into US bonds through stablecoins, effectively continuing quantitative easing but through these private entities rather than the Federal Reserve (Fed).

At the time of writing, BTC is trading within the lower channel of its consolidation range at $113,200, with no clear indication of where prices will move next. According to CoinGecko data, the leading cryptocurrency is currently 8% below its all-time high.

Featured image from DALL-E, chart from TradingView.com

Robert Kiyosaki, the bestselling author of "Rich Dad Poor Dad," launched a fresh attack on Warren Buffett after the billionaire investor made a rare case for gold and silver. Kiyosaki says Buffett’s change in attitude should be seen as a warning, and he has even hinted that a depression could be on the horizon.

For decades, Buffett mocked precious metals as "dead weight." In his view, unlike farmland or businesses that can generate profits, gold does not earn income or create anything useful.

Robert Kiyosaki@theRealKiyosakiOct 01, 2025I WANT TO VOMIT: getting nauseus, listening to Buffet tout the virtues of gold and silver…. after he ridiculed gold and silver for years. That means the stock and bond market are about to crash. Depression ahead?

Even though Buffet shit on gold and silver investors like me…

This is why Buffett’s recent praise of gold and silver is so surprising. Kiyosaki believes the shift is so dramatic that it signals serious problems brewing in stocks and bonds.

And even though he said Buffett’s words make him "want to vomit," they also make it clear that investors should not ignore the signs.

Instead of trusting the traditional system, Kiyosaki argues that it is time to hold defensive assets. For him, that means not only gold and silver but also Bitcoin and Ethereum, which he considers essential hedges for the future.

Bottom line

This clash reveals two very different approaches to interpreting the market. Despite his reputation, the "Oracle of Omaha" is moving toward assets he once dismissed. Kiyosaki, true to form, takes this as proof that the old rules no longer apply.

For everyday investors, the message is clear: when even Buffett starts praising gold, a big change may be on the horizon.

Белая этикетка

API данных

Веб-плагины

Создатель Плакатов

План агентства

Риск потерь при торговле такими финансовыми инструментами, как акции, валюта, сырьевые товары, фьючерсы, облигации, ETF и криптовалюты, может быть значительным. Вы можете полностью потерять средства, размещенные у брокера. Поэтому вам следует тщательно взвесить, подходит ли вам такая торговля с учетом ваших обстоятельств и финансовых ресурсов.

Ни одно решение об инвестировании не должно приниматься без проведения тщательной проверки самостоятельно или без консультации с вашими финансовыми консультантами. Наш веб-контент может не подойти вам, поскольку мы не знаем ваших финансовых условий и инвестиционных потребностей. Наша финансовая информация может иметь задержку или содержать неточности, поэтому вы должны нести полную ответственность за любые ваши торговые и инвестиционные решения. Компания не несет ответственности за потерю вашего капитала.

Без разрешения сайта запрещается копировать графику, тексты или торговые марки сайта. Права интеллектуальной собственности на содержание или данные, включенные в этот сайт, принадлежат его поставщикам и торговцам.

Не вошли в систему

Войдите в систему, чтобы получить доступ к дополнительным функциям

Участник FastBull

Пока нет

Покупка

Войти

Зарегистрироваться