Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

By Kate Abnett and Simon Jessop SAO PAULO (Reuters) -The world has failed to meet its main climate change target of limiting the rise in global temperatures to 1.5 degrees Celsius, and will likely br...

The world has failed to meet its main climate change target of limiting the rise in global temperatures to 1.5 degrees Celsius, and will likely breach this threshold in the next decade, the United Nations' Environment Programme said on Tuesday.

The annual Emissions Gap report said because of countries' slow action to reduce planet-heating greenhouse gas emissions, it was now clear that the world would exceed the core target of the 2015 Paris Agreement - at least temporarily.

"This will be difficult to reverse – requiring faster and bigger additional reductions in greenhouse gas emissions to minimize overshoot," UNEP said.

Lead report author Anne Olhoff said deep emissions cuts now could delay when the overshoot happens, "but we can no longer totally avoid it".

The 2015 Paris Agreement commits countries to limit the global average temperature rise to 2°C above pre-industrial levels, and to aim for 1.5°C.

Yet governments' latest pledges to cut emissions in future, if met, would see the world face 2.3-2.5°C of warming, UNEP said.

That's around 0.3°C less warming than the U.N.'s projection a year ago - indicating that new emissions-cutting plans announced this year by countries including top CO2 emitter China have failed to substantially close the gap.

China pledged in September to cut emissions by 7-10% from their peak by 2035. Analysts note the country tends to set modest targets and exceed them.

The findings add pressure to the U.N.'s COP30 climate summit this month, where countries will debate how to kick-start and finance faster action to rein in global warming.

The Paris Agreement temperature goals were based on scientific assessments of how each increment of global warming fuels worse heatwaves, droughts and wildfires. For example, 2°C of warming would more than double the share of the population exposed to extreme heat, compared with 1.5°C . Warming of 1.5°C would destroy at least 70% of coral reefs, versus 99% at 2°C.

Current policies - the ones countries already have in place - would lead to even more warming, of around 2.8°C, UNEP said.

The world has made some progress. A decade ago, when the Paris Agreement was signed, the planet was on course for around a 4°C temperature rise.

But heat-trapping CO2 emissions continue to rise, as countries burn coal, oil and gas to power their economies.

Global greenhouse gas emissions increased by 2.3% in 2024, to 57.7 gigatonnes of CO2 equivalent, UNEP said.

A Washington Parish grand jury in Louisiana has indicted Democratic Bogalusa, Louisiana Mayor Tyrin Z. Truong on charges of malfeasance in office, public intimidation, and theft, according to the Bogalusa Daily News.

The indictment is part of what officials describe as an ongoing multi-agency investigation involving federal, state, and local authorities. Prosecutors allege Truong intentionally carried out his official duties unlawfully and knowingly allowed other city employees to ignore theirs. His arraignment is scheduled for November 10, 2025.

According to prosecutors, the case centers on claims that Truong misused Bogalusa taxpayer funds to pay a personal legal debt from a 2023 Louisiana public records lawsuit in which a judge ruled that Truong personally owed attorney fees and penalties after refusing to release public documents.

When the Bogalusa City Council denied his request to use public money, prosecutors say Truong threatened retaliation, vowing to overwhelm council members with records requests. Investigators allege he then pressured a city insurance vendor to issue a check labeled as a "reimbursement," had it deposited into a city account, and ordered another check for the same amount to be written to himself.

The Daily News writes that the indictment details additional alleged misconduct, including accepting unauthorized salary and leave payments, forcing a city contractor to pay another contractor who did no work, purchasing illegal narcotics from known drug dealers and failing to report the activity, attempting to solicit a bribe from a local business — a move that allegedly cost the city a major development project — and ordering city workers to perform plumbing repairs at his mother's home using city materials.

Prosecutors also accuse Truong of using city funds to solicit a prostitute at an Airbnb in Atlanta.

The charges follow Truong's January 2025 arrest by the Louisiana State Police during a drug-trafficking investigation. At the time, State Police said Truong "organized entertainment with a prostitute" during a mayors' conference in Atlanta and paid for the Airbnb using public funds, while also being accused of purchasing drugs in Louisiana. Investigators allege a Bogalusa-based drug ring was selling opioids, high-grade marijuana, THC products, and MDMA, with profits used to purchase firearms later connected to local crimes.

Sims emphasized that the probe continues and involves cooperation from multiple agencies. He said, "This case reflects the ongoing commitment to ensuring accountability and integrity in public office." Truong remains presumed innocent until proven guilty in a court of law.

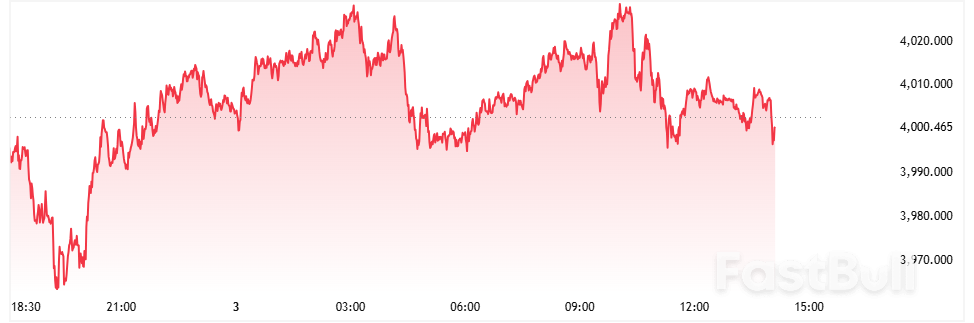

CEOs of Wall Street heavyweights Morgan Stanley and Goldman Sachs on Tuesday cautioned that equity markets could be heading toward a drawdown, underscoring growing concerns over sky-high valuations.

Fears of a market bubble come as the benchmark S&P 500 continues its meteoric climb, repeatedly hitting record highs and evoking memories of the dot-com boom.

"We should welcome the possibility that there would be drawdowns, 10% to 15%, that are not driven by some sort of macro cliff effect," Morgan Stanley CEO Ted Pick said at the Global Financial Leaders' Investment Summit in Hong Kong.

Markets have so far largely brushed aside concerns about inflation, elevated interest rates, policy uncertainty from shifting trade dynamics and the ongoing federal government shutdown, now in its fifth week.

"When you have these cycles, things can run for a period of time. But there are things that will change sentiment and will create drawdowns, or change the perspective on the growth trajectory, and none of us are smart enough to see them until they actually occur," Goldman CEO David Solomon said at the summit.

Futures tracking Wall Street's main indexes slipped early on Tuesday, while the VIX, Wall Street's "fear gauge," hovered near a two-week high.

At 07:08 a.m., Dow E-minis fell 356 points, or 0.75%, S&P 500 E-minis shed 75 points, or 1.09%, and Nasdaq 100 E-minis lost 360.25 points, or 1.37%.

"Technology multiples are full," Solomon said, but added that the same does not hold true for the broader market.

His remarks echo the mood among seasoned Wall Street executives, who have front-row seats to market trends. Positioning a pullback as healthy also underscores the degree of exuberance in markets.

Last month, banking giant JPMorgan Chase's CEO Jamie Dimon had warned of a heightened risk of a significant correction in the U.S. stock market within the next six months to two years.

"I am far more worried about that than others," Dimon said, according to the BBC, adding there were a "lot of things out there" creating an atmosphere of uncertainty, pointing to risk factors, including geopolitical tensions, fiscal spending and global remilitarization.

Earlier this week, the co-chief investment officers of hedge fund Bridgewater Associates had said that investors are overlooking mounting risks.

The surge in enthusiasm for generative AI has drawn comparisons to the dot-com bubble, as investors pour billions into technology firms amid soaring valuations and expectations of transformative growth.

In September, Citigroup said it expects AI-related infrastructure spending by tech giants to surpass $2.8 trillion through 2029, higher than the $2.3 trillion it estimated earlier.

The frenzy is evident across corporate dealmaking. On Monday, OpenAI inked a seven-year, $38 billion agreement to purchase cloud services from Amazon.com.

The dot-com bubble of the late 1990s was fueled by speculative investment in internet-based companies, leading to a surge in tech stock valuations that eventually collapsed in 2000, wiping out trillions in market value.

Still, some analysts say the current AI boom differs from the dot-com era, as the leading companies driving it are supported by solid earnings and tangible business performance.

Last month, Nvidia made history as the first company to reach $5 trillion in market value.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up