Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

What Happened?

Shares of recreational products manufacturer American Outdoor Brands jumped 2.9% in the morning session after investors reacted to positive insider sentiment, which was fueled by a series of open-market stock purchases by company insiders. This confidence appeared to be a broad consensus, with reports indicating that nine different insiders bought shares. When company executives or directors purchase their own company's stock with their own money, it is often viewed by the market as a strong signal. This action suggested that those with the most knowledge of the company's operations believed the stock's value could rise in the future, providing a boost to investor optimism.

After the initial pop the shares cooled down to $7.23, up 2.3% from previous close.

Is now the time to buy American Outdoor Brands? Access our full analysis report here.

What Is The Market Telling Us

American Outdoor Brands’s shares are extremely volatile and have had 32 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 14 days ago when the stock gained 3.7% on the news that comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to markets amid concerns over high valuations, particularly in AI-related stocks.

American Outdoor Brands is down 51.9% since the beginning of the year, and at $7.23 per share, it is trading 59.3% below its 52-week high of $17.76 from February 2025. Investors who bought $1,000 worth of American Outdoor Brands’s shares 5 years ago would now be looking at an investment worth $523.15.

What Happened?

A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to markets amid concerns over high valuations, particularly in AI-related stocks.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Somnigroup (SGI)

Somnigroup’s shares are not very volatile and have only had 7 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

The previous big move we wrote about was 15 days ago when the stock gained 11.1% on the news that the company reported strong third-quarter financial results that beat expectations and raised its full-year guidance.

The bedding manufacturer announced that its revenue grew by 63.3% year-over-year to $2.12 billion, surpassing analyst forecasts of $2.06 billion. The company's adjusted earnings per share of $0.95 also topped Wall Street's expectations of $0.86. This strong performance was driven by significant growth in its direct-to-consumer sales, which offset a miss in its wholesale segment. Adding to the positive news, Somnigroup increased its full-year adjusted EPS guidance to a midpoint of $2.68. The comprehensive earnings beat and improved outlook fueled investor confidence in the company's direction.

Somnigroup is up 56.5% since the beginning of the year, and at $87.33 per share, it is trading close to its 52-week high of $93.50 from November 2025. Investors who bought $1,000 worth of Somnigroup’s shares 5 years ago would now be looking at an investment worth $3,405.

Check out the companies making headlines yesterday:

Shutterstock : Stock photography and footage provider Shutterstock fell by 9.4% on Monday after its proposed merger with Getty Images was referred for a more in-depth, Phase 2 review by the UK's Competition and Markets Authority (CMA). See our full article here.

Is now the time to buy Shutterstock? Access our full analysis report here.

Amazon : Cloud computing and online retail behemoth Amazon rose by 4.9% on Monday after the company announced a landmark $38 billion, multi-year cloud services agreement with OpenAI, the creator of ChatGPT. See our full article here.

Is now the time to buy Amazon? Access our full analysis report here.

Comcast : Telecommunications and media company Comcast fell by 3% on Monday after a series of analyst price target reductions and a recent ratings downgrade driven by concerns over its broadband business. See our full article here.

Is now the time to buy Comcast? Access our full analysis report here.

American Outdoor Brands : Recreational products manufacturer American Outdoor Brands fell by 1.5% on Monday after the stock hit a new 52-week low amid ongoing concerns about its financial performance. See our full article here.

Is now the time to buy American Outdoor Brands? Access our full analysis report here.

Arbor Realty Trust : Real estate investment trust Arbor Realty Trust fell by 3.3% on Monday after an analyst at Keefe, Bruyette & Woods lowered the price target for the stock, adding to investor concerns following the company's recent third-quarter results. See our full article here.

Is now the time to buy Arbor Realty Trust? Access our full analysis report here.

The past six months haven’t been great for American Outdoor Brands. It just made a new 52-week low of $6.67, and shareholders have lost 42.6% of their capital. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in American Outdoor Brands, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think American Outdoor Brands Will Underperform?

Despite the more favorable entry price, we're cautious about American Outdoor Brands. Here are three reasons you should be careful with AOUT and a stock we'd rather own.

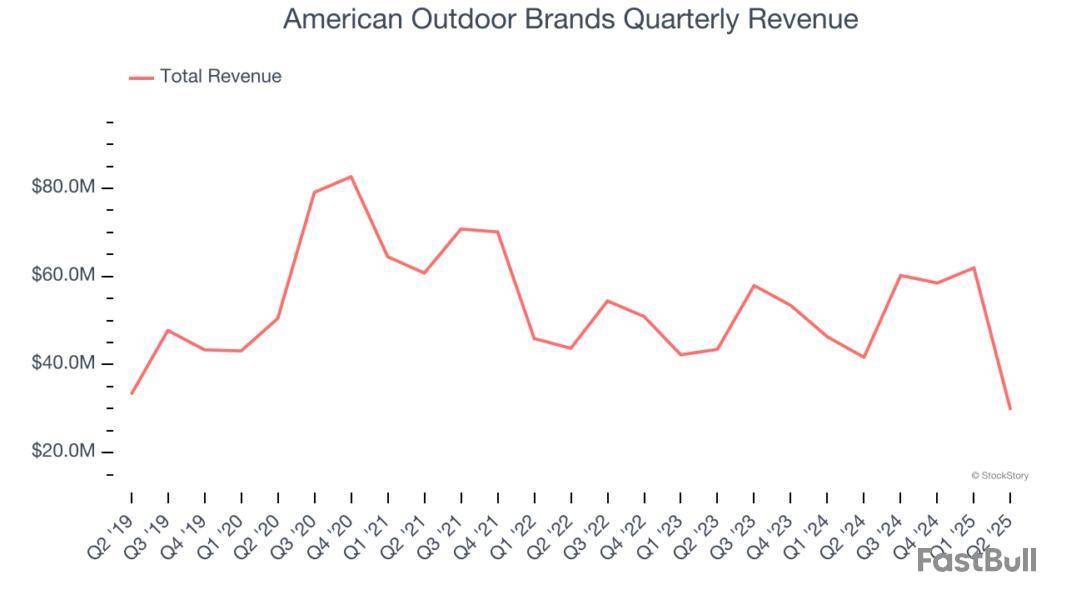

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, American Outdoor Brands’s sales grew at a weak 2.6% compounded annual growth rate over the last five years. This was below our standards.

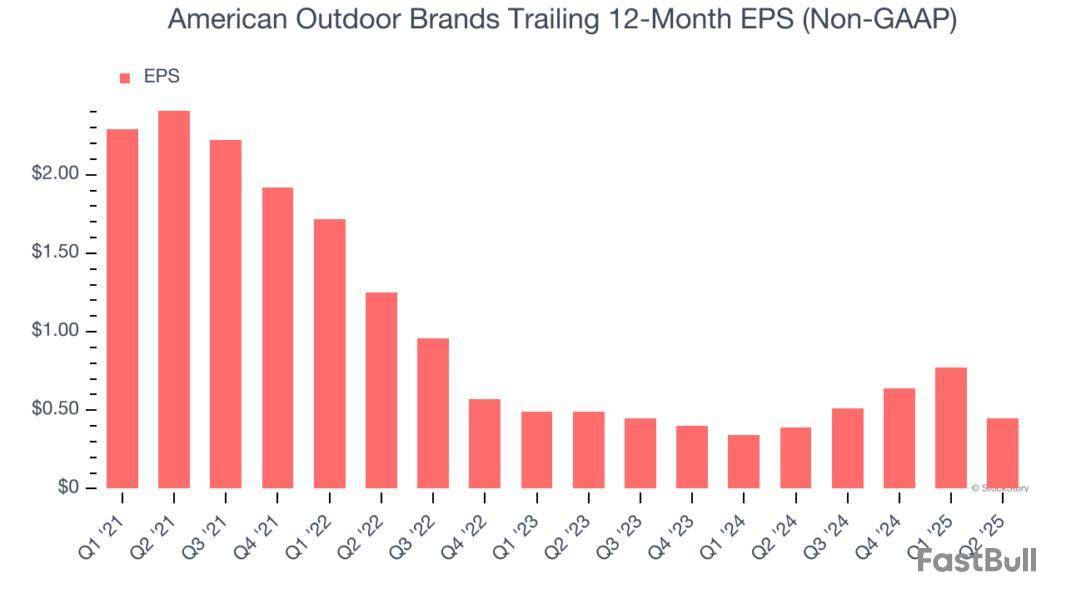

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

American Outdoor Brands’s full-year EPS dropped 225%, or 34.3% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, American Outdoor Brands’s low margin of safety could leave its stock price susceptible to large downswings.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, American Outdoor Brands’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We see the value of companies helping consumers, but in the case of American Outdoor Brands, we’re out. After the recent drawdown, the stock trades at 64.7× forward P/E (or $6.67 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward one of our all-time favorite software stocks.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

What Happened?

Shares of recreational products manufacturer American Outdoor Brands fell 1.5% in the morning session after the stock hit a new 52-week low amid ongoing concerns about its financial performance. The shares reached a low of $6.70, reflecting persistent challenges for the company. Financial metrics highlighted these struggles, including a negative return on equity of -2.71% and a significant decline in operating profit over the previous five years. The stock also showed weak momentum, with a relative price strength that was considered poor. This move happened during a mixed trading session where the majority of stocks in the broader market were also falling.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks. Is now the time to buy American Outdoor Brands? Access our full analysis report here.

What Is The Market Telling Us

American Outdoor Brands’s shares are extremely volatile and have had 34 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 24 days ago when the stock dropped 4.1% on the news that worries over worsening trade relations with China were triggered by critical comments from President Donald Trump.

The President's comments, stating on social media that China has 'become very hostile,' have injected significant volatility into the broader markets. This has particularly affected the leisure industry, which is highly sensitive to economic sentiment and discretionary spending. Leisure stocks, which include companies in travel, entertainment, and hospitality, rely on consumers feeling confident enough to spend on non-essential goods and services. Trump targeted China's tightening controls on rare earth metals, which are vital components in many technology products from electric vehicles to defense systems. The president's tone and the suggestion of canceling a meeting with President Xi caused a rapid sell-off in the market.

Earlier in the week, China announced new export controls on the critical minerals. Beijing's Commerce Ministry stated that foreign suppliers now need government approval to export products containing certain rare-earth materials. These materials are essential for producing high-tech goods, including computer chips, electric vehicles, and defense technology. Analysts viewed the move as a strategic assertion of China's dominance in the global rare earth supply chain, particularly amid ongoing trade tensions.The prospect of escalating tariffs raises concerns about economic headwinds, which could lead to a slowdown in consumer spending. If consumers tighten their budgets in response to economic uncertainty, discretionary purchases are often the first to be cut, directly impacting the revenues of companies in this sector.

American Outdoor Brands is down 54.6% since the beginning of the year, and at $6.83 per share, it is trading 61.6% below its 52-week high of $17.76 from February 2025. Investors who bought $1,000 worth of American Outdoor Brands’s shares 5 years ago would now be looking at an investment worth $433.33.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up