Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

"...lift the hood and the picture is not so healthy."

Amid the month-long vacuum of macro data, thanks to the shutdown, 'soft' survey data has become almost the only leg left standing to judge the economy by (absent the housing data).

Following better-than-expected prints across Europe, and beats in Brazil and Canada, this morning's S&P Global US Manufacturing PMI rose more than expected to 52.5 (52.2 exp), up from 52.0 - tracking hard data higher.

That signaled a third successive month that the S&P Global PMI has posted above the critical 50.0 no-change mark and indicative of a solid improvement in operating conditions that was in line with the survey's trend pace.

The PMI was supported in October by concurrent and accelerated gains in both output and new orders.

Production was increased at a solid pace, whilst the gain in new orders was the best recorded in 20 months. Growth in new work has been registered consistently throughout the year to date, albeit to varying degrees, and panelists noted in October an uplift in market demand and success in securing new contracts. However, October's growth was increasingly reliant on the domestic market as new export orders faltered.

BUT...

...as usual in the baffle 'em with bullshit world, ISM's US Manufacturing PMI missed expectations, falling from 49.1 to 48.7 (worse than the 49.5 exp) - the 8th straight month of contraction (below 50)

"US manufacturers reported a solid start to the fourth quarter with production rising at an increased rate in response to an encouragingly robust jump in new orders," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"However, lift the hood and the picture is not so healthy."

"Most worrying is the unprecedented rise in unsold stock reported in October, widely linked to weaker than anticipated sales to customers, especially in export markets, which could trigger a downshifting of production in the coming months unless demand revives.

Indeed, ISM shows prices falling fast and new orders and employment improving MoM (though both below 50 - contracting).

The index of prices paid for raw materials fell 3.9 points to 58, the lowest since the start of the year. Since a recent peak in April, during the height of the tariffs rollout, the price gauge has dropped nearly 12 points...

Companies have also become less optimistic about the year ahead, with sentiment back down close to the gloomy levels seen around the April tariff announcements.

"US trade policy uncertainties are again a big factor in dampening business spirits, with tariff policies being increasingly blamed both on rising export losses and import supply chain disruptions.

These export and import worries are being exacerbated by more domestically focused political concerns, including the federal shutdown, which are manifesting themselves most prominently in consumer-focused industries."

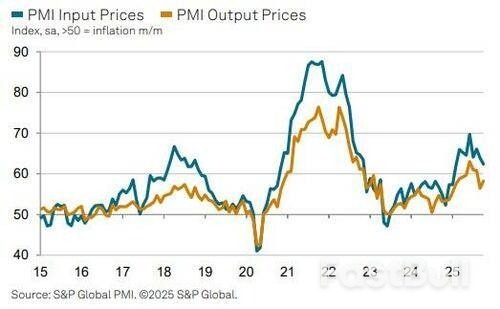

Tariffs remained a key source of higher input costs during October with S&P Global's latest data showing another round of historically elevated inflation – albeit the lowest since February.

Selling prices were raised markedly in response, and to a quicker degree than September's recent low.

Finally, Williamson notes that business confidence among producers of consumer goods is now down to its lowest for two years "as firms growing increasingly worried about household spending in the US and falling sales to consumers in export markets."

President Donald Trump is set to host Syria's self-appointed interim leader later this month for talks in Washington, marking the first ever visit by a Syrian head of state to the US capitol. Abu Mohammad al-Jolani, who once fought alongside foreign fighters while killing American soldiers in Iraq, will enjoy his red carpet reception in Washington on November 10.

This will also mark the first time a former ISIS member will be hosted in the Oval Office, an absurdity which would have been hard to believe a mere decade ago. But the US-Saudi-Israel axis reached its regime change goal in Damascus, which overthrew the secular Arab nationalist leader Bashar al-Assad, which resulted in the Islamist Hayat Tahrir al-Sham (HTS) taking over.

The HTS leader Abu Mohammad al-Jolani, who was even earlier this year still on the US terrorism list, quickly reverted to his birth name of Ahmed al-Sharaa. The US had promptly removed the $10 million bounty on his head just before President Trump met with him in Riyadh last May.

"President Ahmed al-Sharaa will be at the White House at the start of November," Syria's foreign minister said in speech in Bahrain. "Of course, this is a historic visit. It is the first visit by a Syrian president to the White House in more than 80 years."

"There will be many issues on the table, starting with the lifting of sanctions and opening of a new chapter between the United States and Syria. We want to establish a very strong partnership between the two countries."

One area of proposed cooperation is in fighting terrorism, ironically enough, and the US and Syria under Jolani are expected to sign an agreement joining a US-led international coalition against ISIS during the visit, which is somewhat laughable given ISIS patches have recently been seen among HTS ranks.

Despite attempts to distance his group from extremist organizations, the United States still designated his new group a terror organization and targeted members of HTS who once fought for Al Qaeda, proving his rebranding attempts a failure.

And NBC too underscored Jolani's ISIS pedigree soon after he ousted Assad in December 2024:

Born in Syria in 1982, he joined other foreign fighters in Iraq after the 2003 U.S.-led invasion, and was detained by the American military, according to The Associated Press.

When Syria's vicious civil war erupted in 2011, Abu Bakr al-Baghdadi, leader of the Islamic State of Iraq (ISI), sent Jolani to Syria to establish the Al-Nusra Front, a branch of Al Qaeda.

Their conflict escalated two years later. Jolani rejected Baghdadi's calls to dissolve the Nusra Front and merge it with ISI to form ISIS. Instead, he pledged allegiance to Al Qaeda, which later disassociated itself from ISIS. The Nusra Front then became Al Qaeda's Syria affiliate and later battled ISIS for supremacy in the battle against Assad.

His aforementioned ruling Islamist faction HTS has since taking control in Damascus been conducting sectarian attacks on ethno-religious minorities in Syria. Thousands of Alawites, Druze, and Christians have been killed and/or driven from their homes.

All the while, Sharraa has sought to claim before international cameras that he'll ensure equality for non-Muslims as well as women, but the actions of his HTS gangs are the opposite.

Federal Reserve Governor Stephen Miran said on Monday it is wrong to put too much emphasis on the strength of equity and corporate credit markets in assessing monetary policy that he feels remains too restrictive and is heightening the risk of a downturn.

"Financial markets are driven by a lot of things, not just monetary policy," Miran said on the Bloomberg Surveillance television program, in explaining why he dissented last week against a quarter-percentage-point rate cut in favor of a half-percentage-point reduction.Rising equity prices, narrow corporate credit spreads, and other factors don't "necessarily tell you anything about the stance of monetary policy" at a moment when interest-sensitive sectors like housing are less buoyant and some parts of the private credit market appear under stress.

Miran's remarks highlight the competing views that Fed officials have begun to offer about the state of the economy and the risks facing it since last week's divided decision to reduce the U.S. central bank's benchmark policy rate by a quarter of a percentage point to the 3.75%-4.00% range.

The 10-2 policy vote marked only the third time since 1990 that voting Fed members have objected in favor of both tighter and looser monetary policy, and Fed Chair Jerome Powell's remarks at his post-meeting press conference indicated an even deeper divide as he noted the "strongly differing views about how to proceed" at the central bank's December 9-10 meeting.

It was an unusual reference to action at an upcoming meeting, with Powell emphasizing that another rate cut "is not a foregone conclusion - far from it."

Kansas City Fed President Jeffrey Schmid, who dissented in favor of no rate cut last week, laid out on Friday the case for keeping more of a focus on inflation that remains above the central bank's 2% target, including the fact that "financial markets appear to be easy across many metrics. Equity markets are near record highs, corporate bond spreads are very narrow, and high-yield bond issuance is high. None of this suggests that financial conditions are particularly tight or that the stance of policy is restrictive."

Asked specifically about the arguments cited by Schmid, a career banker, Miran said it overlooked stress that may be developing elsewhere in the financial system and the sluggishness in the housing market.

In addition, repeating arguments he has laid out since joining the Fed while on leave as a top economic adviser to President Donald Trump, Miran said the economy has been buffeted by population changes and other shocks since last year that have lowered underlying interest rates and mean "that policy has passively tightened" despite the Fed's rate cuts. He said he continues to think the Fed should cut in half-percentage-point increments until hitting a "neutral" level he estimates is "quite a ways below" where it is now.

Other U.S. central bank officials are due to continue the debate later on Monday, including in an appearance at the Brookings Institution by Fed Governor Lisa Cook, her first since Trump attempted to fire her earlier this year in an action so far blocked by federal judges but awaiting an appeal to the U.S. Supreme Court.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up