Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Defense chief admits troops facing the "hardest" time there...

Ukraine has sent special forces to the embattled eastern city of Pokrovsk, the country's top military commander announced over the weekend, after the Kremlin has said that thousands of Ukrainian troops are surrounded in Pokrovsk.

The strategic city is considered to be "the gateway to Donetsk" - and its loss would be a huge blow to Ukraine's logistical abilities across the eastern front lines. Kiev has rejected Putin's claim to have the whole city surrounded and blockaded. "We are holding Pokrovsk," Ukraine's army chief Oleksandr Syrskii wrote on Facebook Saturday. "A comprehensive operation to destroy and dislodge enemy forces from Pokrovsk is ongoing."

Kiev's response involves the special forces units being sent to bolster potentially trapped Ukrainian forces - though this could soon prove too little, too-late. "Kyiv announced Saturday it had deployed special forces to the eastern city of Pokrovsk, where it is under pressure from an intense Russian assault involving thousands of troops," The Moscow Times wrote.

Recent days have seen Moscow and Kiev issue conflicting back-and-forth statements about the fighting in the city, with Russia's Ministry of Defense claiming that its troops had already defeated the Ukrainian special forces deployed there. It even later released videos purportedly showing two captured Ukrainian soldiers.

Gen. Syrskii has admitted that Ukrainian forces are facing their "hardest" time there currently. But he's still rejected Moscow's narrative of total battlefield encirclement of the city.

"The main burden lies on the shoulders of the units of the Armed Forces of Ukraine, particularly UAV [unmanned aerial vehicle] operators and assault units," Syrskii has said.

Russian officials over much of the past year of fighting there have consistently articulated that seizing Pokrovsk and the nearby city of Kostiantynivka would allow Moscow to advance north toward the last major Ukrainian strongholds in Donetsk - Kramatorsk and Sloviansk.

For the majority of the war Pokrovsk has acted as the logistical hub and rear operations base for Ukraine's eastern defensive lines. It sits astride both a key railroad juncture and the highway to Ukraine's fourth-largest metro, Dnipro.

The loss of the primary rail lines and highway routes in and out of Pokrovsk would cut resources to Ukrainian units across the Donbas and possibly force them to retreat before running out of supplies. This would mean an immediate and sweeping Russian advance all along the eastern lines.

The city's defensive positions are a final obstacle to Russia's access to most of the region. If Pokrovsk falls Russian forces will indeed be able to more easily flank entrenched troops in the north and south of the country.

Russia's military has said that Ukrainian forces have been suffering steady and immense losses seeking to defend Pokrovsk.

"At least 200 Russian infantry armed with automatic rifles, machine guns, and hand-held rockets were moving freely in the southern districts of city, at times ambushing Ukrainian defense forces still generally in control of central and northern districts, according to public statements by army officers to Ukrainian media," according to Kyiv Post reporting on the situation last week.

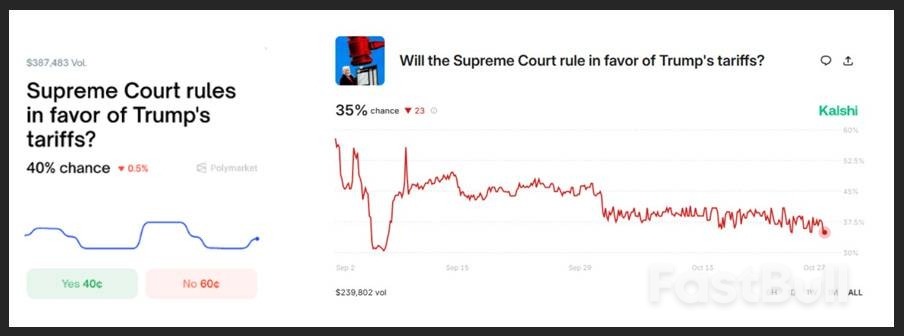

We will soon find out if tariffs are unconstitutional.

Nov 5th will be a key date for markets: the Supreme Court will start hearing arguments on Trump's IEEPA tariffs.

And while markets don't seem particularly focused on this event, I believe it's crucial to be prepared for it.

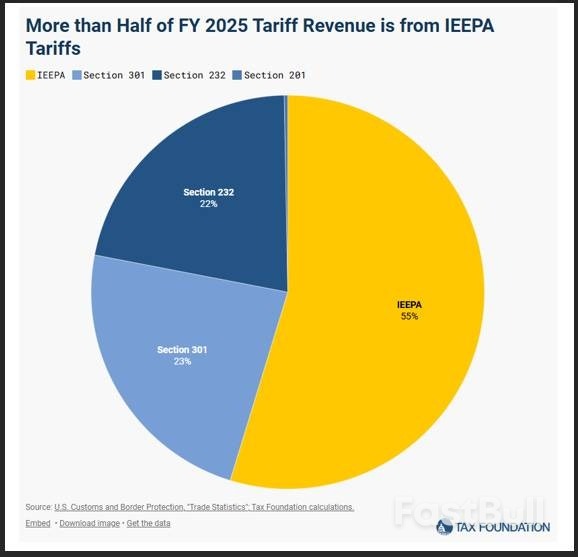

If the Supreme Court strikes down IEEPA tariffs as unconstitutional, around 55% of the US tariff income would be wiped out from the 2026 budget and US companies would be eligible for a refund for the 2025 tariffs paid under the IEEPA regime.

In numbers, we are talking about a $150-200bn annualized tariff income loss for the US.

Now, you all know that from a strict monetary perspective, the US tariffs act like a tax.

Data is uncontroversial there: tariffs are being paid by US consumers and corporates (mostly corporates), which is akin to an increase in corporate tax rate that reduces companies' margins.

If the Supreme Court undoes IEEPA tariffs, this would be the equivalent of a ~200bn fiscal stimulus:

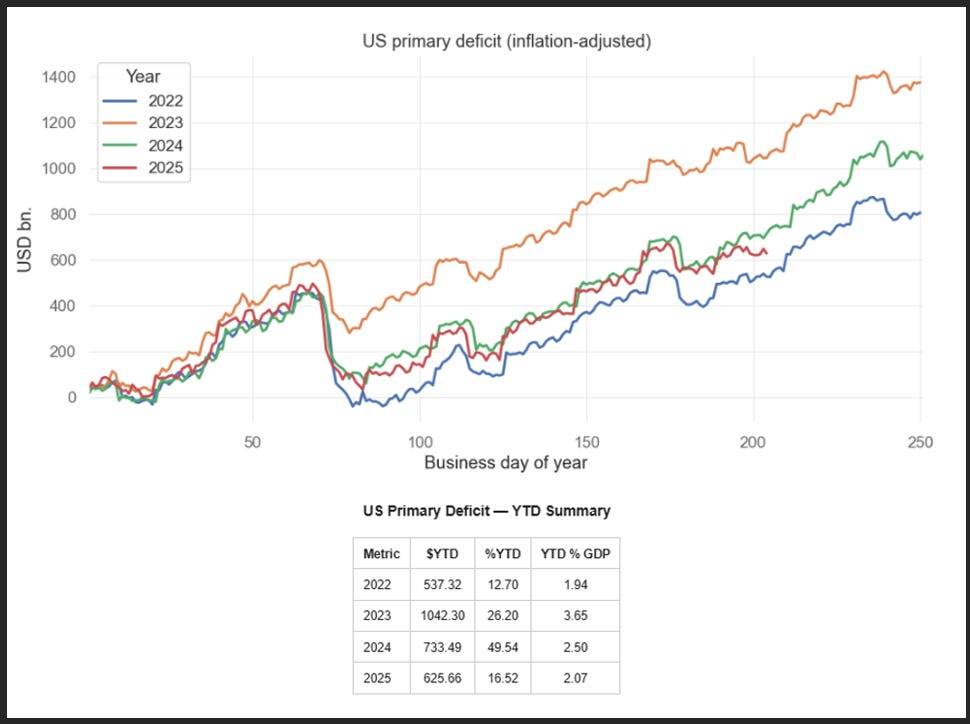

In 2025, the US government has injected $626 billion in the US economy – this is a much lower pace than 2023-2024. The slowdown in US primary deficit spending is mostly due to tariffs.

Revert the IEEPA tariffs, and the US will be going back to the glorious money-printing days of 2024 at least.

So, what are the odds that the Supreme Court will strike down Trump's IEEPA tariffs?

Prediction platforms suggest 60-65% odds, although volumes are quite small:

We can actually get an idea of the real market-implied odds by looking at another market: the newly set-up ''Tariff Refund Trade'' that certain banks are allowing hedge funds to invest in.

"Wall Street banks are arranging bets on President Donald Trump's tariffs being struck down by the Supreme Court — long-shot trades that could pay off handsomely for hedge funds betting against the legality of the administration's flagship policy.

Jefferies Financial Group Inc. and Oppenheimer & Co. are among firms brokering the deals, matching investors with companies that have paid tariffs to import goods into the US, according to people with knowledge of the matter and correspondence seen by Bloomberg News."

In the trades, the importing companies essentially sell to investors any future rights to claim refunds on their tariff bills, which could come if the nation's top court sides with an ongoing legal challenge to Trump's tariffs. The companies sell at a discount to their expected refunds, meaning investors would reap the upside in the event of a favorable ruling. The banks arranging the deals take a cut.

For example, a hedge fund might pay somewhere between 20 to 40 cents for each dollar of claims they could get back in refunds, giving them an upside of several times their bet, according to the correspondence and some of the people, who asked not to be identified discussing potential terms. Most of the trades range in size from $2 million to $20 million, with few over $100 million, one of the people said.''

It would seem that hedge funds are paying ~30% on average upfront for the trade, which implies roughly the same probability that tariffs are deemed unconstitutional.

But companies are cashing in months in advance the US government refund that would come if IEEPA tariffs are shut down, so we need to make an adjustment for that.

This cross-check says the real market-implied odds of tariffs deemed unconstitutional are closer to the 40-45% area, while prediction platform sit around 60-65%.

Call it 50-50: a coin toss.

Now, let's assume the Supreme Court strikes IEEPA tariffs down.

Can we say with 100% certainty that this will be akin to a ~200bn fiscal stimulus?

Not so fast.

Trump can also set tariffs under Section 232, 301 and 122.

Section 232 covers the sectorial tariffs under commerce authority, and Section 301 the ''fentanyl-like'' tariffs under USTR authority – both fall under the executive (President) powers, not the Congress.

Section 122 also falls under Presidential powers, and it would allow Trump to go for global 15% tariffs for 150 days before Congress would have to approve.

I am saying this because while the Supreme Court might strike down IEEPA tariffs, the Trump administration has seven Section 232 sectoral investigations ending by January 2026 and could come up with more Section 301 or blanket Section 122 tariffs to offset the Supreme Court decision.

Nevertheless, we are going into a coin-flip decision and markets might find reasons to celebrate a Supreme Court decision to strike down IEEPA tariffs – but Trump has weapons to counter such decisions.

Regardless of the Supreme Court decision, the global money printing machine will accelerate.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up