Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A rather famous old market adage is ‘there's nothing like price to change sentiment'. I might change that a bid, to ‘there's nothing like a TACO to change sentiment'.

WHERE WE STAND – A rather famous old market adage is ‘there's nothing like price to change sentiment'. I might change that a bid, to ‘there's nothing like a TACO to change sentiment'.Yes, that's right, after participants spent the back end of Thursday brushing up on funding markets and fretting (unnecessarily) about the state of US regional banks, a couple of positive trade-related snippets from ‘The Donald', and signs of easing money market stress stateside, were good to spark a bout of optimism as we moved into the weekend.

Fine, conditions were still incredibly choppy, and yes it wasn't as if the risk-on vibe that took hold was the most convincing of things that you're ever going to see, but at least participants appear to no longer be pointlessly worrying about insignificant financial institutions that nobody has ever heard of, and re-focusing on what remains a constructive setup for risk assets as we move towards year-end.I'll get to that in a second, but first just want to touch on the banking sector. Last week's jitters appeared to stem from a couple of relatively small banks writing off bad loans – one of these was Zions Bancorp, who took a $50mln write-down on a fraudulent loan, but have a $90bln (with a ‘B'!) balance sheet, which at best makes that seem ‘small beer'.

In many ways, those jitters last week were a bit of a ‘perfect storm', with idiosyncratic loan write-downs coinciding with sizeable funding pressures stemming from the California tax filing deadline, as well as Treasury auction settlements, thus creating notable tightness in funding markets. Said tightness subsided on Friday, with no institutions tapping the Fed's SRF, while in any case the Fed are alert to the lack of ‘wriggle room' that they now have, with RRP usage basically zero, and Chair Powell having already flagged that balance sheet run-off will probably wrap up sooner rather than later. December is the base case on that front, though risks skew towards it happening sooner.

Anyway, markets already appeared on surer footing as those fears subsided, before we got a ‘TACO' for lunch to help steady things up even more. That, of course, came by virtue of comments from President Trump, who continued to dial down the rhetoric in terms of US-China trade tensions, confirming that he will be meeting President Xi in a fortnight, that high tariffs on Chinese goods are ‘not sustainable', and again noting that things will be ‘fine' with China in due course. Treasury Sec Bessent confirming he'll meet his Chinese counterpart this week provided a bit of a helping hand as well.

Given the above, equities on Wall St ended the week in the green, with this rally resulting in the major benchmarks notching a weekly gain, despite what was quite the rollercoaster ride over the last five days. Though conditions have clearly been turbulent, I remain an equity bull, with earnings growth solid, underlying economic growth resilient, the monetary backdrop becoming looser, the present round of trade tensions likely to soon be de-escalated, corporate buybacks being on the verge of resuming, as well as the typical FOMO/FOMU buying into year-end. All that feels like a very powerful force that I'd not want to fight.

Speaking of powerful forces, relentless selling pressure was felt across the precious metals complex as the week wrapped up, with spot gold falling back towards $4,200/oz, and spot silver notching its biggest one-day drop in half a year. It must be said that there wasn't anything especially obvious to drive these moves, besides perhaps a combination of fading haven demand coupled with an unwind of relatively fresh momentum-based longs, in a market that had undoubtedly come a very long way, in a very short space of time.

I'm not going to sit here and call a ‘top' in the complex, not least considering that the bull case which has underpinned a 60% YTD gain in gold, and near-80% YTD gain in silver, continues to hold water, amid the risk of inflation expectations un-anchoring, continued runaway DM fiscal spending and, most importantly, incredibly high levels of physical demand. That said, if Friday's moves were to prove the start of a pullback in this uptrend, you'd initially be looking for support at $4,000/oz in gold, and $50/oz in silver, where I'd be keen to buy into any dips – one to keep on the radar for the week ahead.

Speaking of buying dips, I was reassured by the way in which the dollar not only snapped a 3-day losing run as the week wrapped up, but how the DXY held above both the 50- and 100-day moving averages as well. Although conditions in the G10 FX space have become akin to watching paint dry in recent weeks, the Fed's ‘run it hot' approach skews risks towards us returning to the RHS of the ‘dollar smile' as risks to the US economic outlook increasingly tilt to the upside.

That same approach, though, should tilt risks to Treasuries, especially at the long-end, to the downside as well, however that's not a call I'd have especially much conviction in for the time being, not least until we can be confident that sentiment is on much steadier footing.

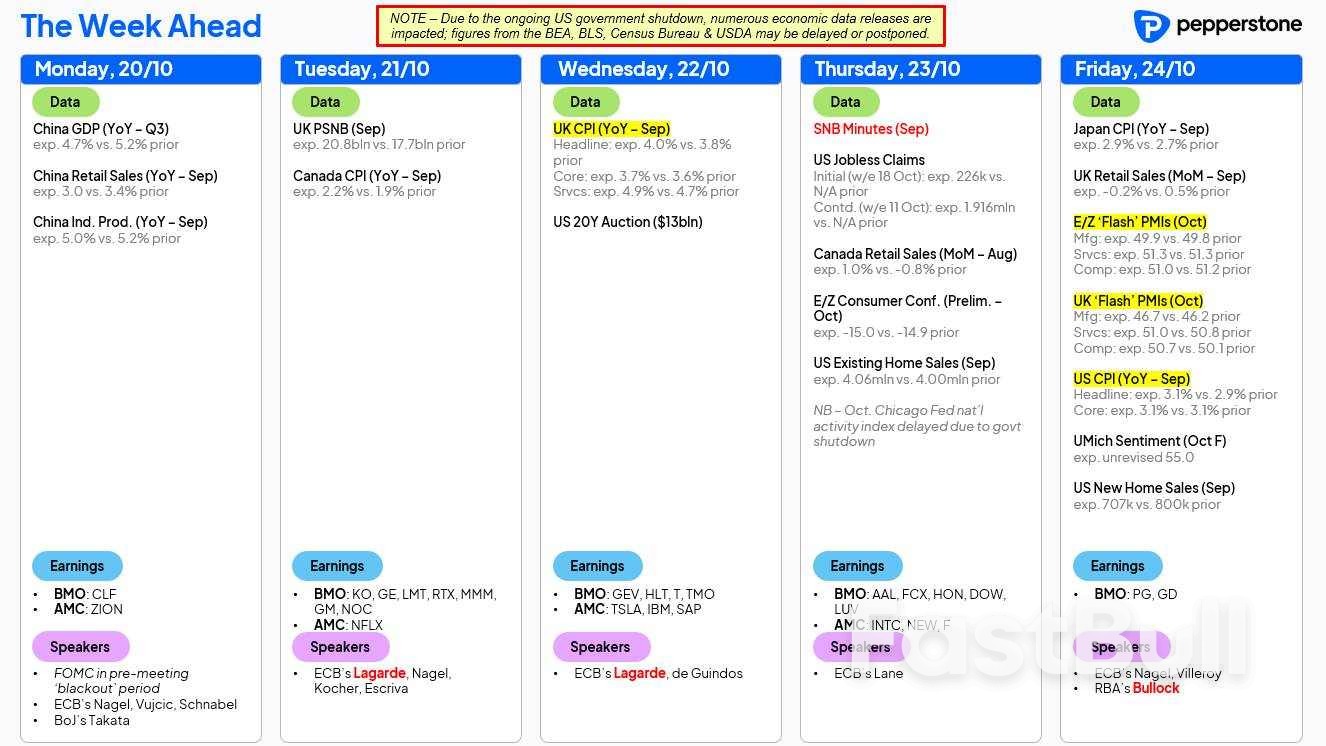

LOOK AHEAD – As the US government shutdown rolls on, the economic calendar remains something of a mess, with market participants continuing, by and large, to operate in a data vacuum.

That said, we will at least get the September US CPI figures this week, with that print on Friday highlighting the data docket. Both headline and core CPI are seen having risen by 3.1% YoY last month, as tariff-induced price pressures continue to make themselves known, though it's very tough indeed to imagine the data materially altering the Fed policy outlook, with 25bp cuts this month, and in December, effectively locked in amid mounting downside labour market risks.For those curious, the CPI data is being released due to it being required in calculating the annual Social Security cost of living adjustment, no other BLS-calculated figures will be released until the shutdown comes to an end.

Elsewhere, we also get inflation figures from here in the UK this week, with headline CPI seen having risen to 4.0% YoY in September, and services CPI pushing 5.0% YoY once more. The BoE expect that this will be the peak in price pressures this cycle, though are unlikely to take any more steps to remove policy restriction until they are sure of that fact, meaning my base case is now that the ‘Old Lady' stands pat until delivering a 25bp cut next February. Meanwhile, ‘flash' PMIs from pretty much every major economy, as well as Canadian inflation, and US consumer sentiment are also due.

From a policy perspective, the FOMC are now (mercifully!!) in the pre-meeting ‘blackout' period, though plenty of ECB speakers will fill that particular void. We also receive the first ever set of minutes from an SNB decision this week, where comments on the valuation of the CHF are likely to be of particular interest.Earnings season also steps up a gear this week, with 90 S&P 500 set to report this week, including notable releases from the likes of Netflix (NFLX), Tesla (TSLA), and Intel (INTC).Finally, focus will of course also remain on incoming trade and tariff news flow, especially with Treasury Secretary Bessent meeting his Chinese opposite number in Malaysia at some point this week.

As always, the full week ahead calendar is below.

Renewables specialist FairWind is set to boost its Asia-Pacific (APAC) presence and accelerate global growth by reaching agreement to acquire Cosmic Group, a leading Australian wind installation and maintenance provider.This strategic acquisition reinforces the company's existing presence in Australia and expands its footprint into New Zealand and Japan. The transaction is expected to close in Q4 subject customary regulatory approval, and will see the Brisbane-based business and its team of 100 technicians become part of FairWind.

Together with Cosmic, FairWind will be able to leverage local expertise while aligning the team with its global systems, standards, and strategic direction. The business will become the regional hub for FairWind's APAC operations with one of its founders, Matt Crossan, appointed as Regional Director. Cosmic, will continue to operate under the Cosmic name - ensuring continuity for its existing projects and clients.Stewart Mitchell CEO FairWind said: "This collaboration with Cosmic is a significant step in our growth strategy. There are great synergies between the two organisations, with shared values and unwavering commitment to safety. By joining forces with a team known for delivering to the highest standards, we're extending our geographic reach while strengthening our capability to support customers wherever they operate.

"Together, our deep technical expertise and track record in onshore and offshore wind create a powerful platform in our mission to help advance the global energy transition. We look forward to working closely together and unlocking new opportunities across the region's renewables landscape."Matt Crossan commented: "With the installed turbine base set to continue to increase and the next generation of wind turbines being introduced to the region by our customers, there is significant potential for growth across Asia Pacific.

"We are proud of what we have built at Cosmic to become one of the leading wind services providers, by joining FairWind we have a partner who enhances our existing capability and we are excited for the next phase of the business."FairWind has a workforce of more than 2,000 people in more than 40 countries across Europe, North America, South America, Asia, and Oceania. The business provides complete lifecycle solutions for the installation and maintenance of onshore and offshore wind turbines around the world.

China imported no soybeans from the U.S. in September, the first time since November 2018 that shipments fell to zero, while South American shipments surged from a year earlier, as buyers shunned American cargoes during the ongoing trade dispute between the world's two largest economies.Imports last month from the U.S. fell to zero from 1.7 million metric tons a year earlier, data from China's General Administration of Customs showed on Monday.Shipments fell because of the high tariffs China has imposed on U.S. imports and as previously harvested U.S. supplies, known as old-crop beans, have already been traded. China is the world's biggest soybean importer.

"This is mainly due to tariffs. In a typical year, some old-crop beans would still enter the market," said Wan Chengzhi, an analyst at Capital Jingdu Futures.Brazil arrivals last month jumped 29.9% year-on-year to 10.96 million tons, accounting for 85.2% of China's total imports of the oilseed, customs data showed, while shipments from Argentina rose 91.5% to 1.17 million tons, or 9% of the total.China's soybean imports reached 12.87 million metric tons in September, the second-highest level on record.

China has not purchased any U.S. soybean cargoes from this autumn's harvest. The window for U.S. soybean purchases is rapidly closing as buyers secure shipments through November, largely from Brazil and Argentina, helped by Argentina's brief tax holiday.Without a breakthrough in trade talks, U.S. farmers could face billions in losses as Chinese crushers continue sourcing from South America. Beijing, however, may also face a potential supply crunch early next year before Brazil's new crops hit the market."A soybean supply gap may emerge in China between February and April next year if there's no trade deal in place. Brazil has already shipped a huge volume, and no one knows how much old-crop stock remains," said Johnny Xiang, founder of Beijing-based AgRadar Consulting.

Trade negotiations between Beijing and Washington appear to be regaining momentum after weeks of fresh tariff threats and export controls. U.S. President Donald Trump said on Sunday he believed a soybean deal would be reached.For the January-September period, China imported 63.7 million tons from Brazil, up 2.4% year-on-year, and 2.9 million tons from Argentina, up 31.8% year-on-year.Even as Chinese buyers are shunning this year's U.S. harvest, purchases earlier in 2025 mean that year-to-date imports of American beans have totalled 16.8 million tons, up 15.5%, data showed.

Masan Group is in talks with Costco Wholesale Corp. to sell its branded noodles, fish sauce and coffee in the retailer’s US stores as the Vietnamese conglomerate accelerates its global expansion.“Our leading products such as fish sauce, chili sauce, and noodles have already entered Costco’s hypermarket system in South Korea, and will soon be available in Costco in the US,” said Le Thi Nga, deputy chief executive officer of Masan Consumer, the group’s unit.

Some of its products are now being offered in a limited number of Costco stores on a trial basis, according to Masan Consumer.Representatives for Costco didn’t immediately respond to requests for comment.The Ho Chi Minh City-based company is also in discussions with Walmart Inc. to put some of its branded products on the retail giant’s shelves, Nga said.Representatives for Walmart didn’t immediately respond to requests for comment outside regular business hours.

Masan Consumer produces a range of food and beverages, including sauces, noodles, cereals, instant coffee and beer. It aims for 15% of its revenue to come from abroad “in the next few years,” up from about 5% now, Nga said.In particular, it seeks to ramp up global sales of its Chin-su seasoning products, Omachi noodles and Vinacafe instant coffee.The company says it sells goods in regions including North America, Europe, New Zealand, the UK, South Korea, Japan, and China.

Masan Consumer is making a major push to form more US partnerships, said Nga, who oversees the unit’s research and development.“Masan is pursuing a strategy to bring Vietnamese cuisine and products to the world, and we are taking our first firm steps in that direction,” she said.Masan Group is planning an initial public offering of the unit, which could raise as much as $1.5 billion.

The conglomerate reported second-quarter net income of 1.03 trillion dong ($39.1 million), up from 503 billion dong in the same year-ago period. Revenue was at 18.32 trillion dong.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up