Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)A:--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Federal Reserve Chair Jerome Powell signaled the US central bank is on track to deliver another quarter-point interest-rate cut later this month, even as a government shutdown significantly reduces its read on the economy.

Federal Reserve Chair Jerome Powell signaled the US central bank is on track to deliver another quarter-point interest-rate cut later this month, even as a government shutdown significantly reduces its read on the economy.

Powell, in a speech Tuesday at the National Association for Business Economics annual meeting, said that the economic outlook appeared unchanged since policymakers met in September, when they lowered interest rates and projected two more this year.

“A rate cut in October is done,” said Julia Coronado, founder of the research firm MacroPolicy Perspectives and a former Fed economist. “Nothing has changed the perspective that there’s still downside risks to the labor market.”

Powell pointed several times to the low pace of hiring and noted that it may weaken further.

“You’re at a place where further declines in job openings might very well show up in unemployment,” Powell said during a question-and-answer session following his prepared remarks. “You’ve had this amazing time where you came straight down, but I just think you’re going to reach a point where unemployment starts to go up.”

Expectations for a rate cut in October were little changed after Powell’s remarks. Investors see a nearly 100% chance of a reduction, according to federal funds futures contracts.

The Fed’s September cut was their first since December, and followed a sharp summer slowdown in hiring. Still, the unemployment rate has so far remained relatively low, ticking up to 4.3% in August. The Labor Department delayed the release of the September payrolls report due to the ongoing government shutdown, but has recalled staff to prepare September consumer price index data for release later this month.

“Right now, the risks to the employment side of the mandate are rising,” Yelena Shulyatyeva, senior US economist at the Conference Board, said on the sidelines of the NABE conference. “That’s what is going to drive the decision in the near term.”

The Fed is scheduled to meet again Oct. 28-29. Last month, the median projection from its 19 policymakers pointed to two more rate cuts this year. But nine officials saw one or fewer cuts as appropriate.

That division among policymakers is also making Powell more cautious about the path for rates next year, said Diane Swonk, chief economist at KPMG.

“Those are the cues of, ‘We don’t really know where we’re going longer term,’” she said.

The absence of a full suite of official economic data has ramped up concern that the Fed won’t get a clear read on how the economy is evolving, increasing the potential for policy mistakes.

It’s a particularly difficult time for the Fed to go without data. Its mandates of price stability and maximum employment are pulling officials in opposite directions, with the labor market cooling while inflation remains above the central bank’s 2% target.

Powell said he and his colleagues are looking to alternative, private-sector data sources but emphasized the importance of government data, which he called the “gold standard.”

“We don’t expect that we’d be able to replace the data we’re not getting,” Powell said. “We’ll start to miss that data, and particularly the October data. If this goes on for a while they won’t be collecting it, and it could become more challenging.”

Powell also signaled the central bank may stop shrinking its balance sheet in the coming months, an important shift necessary to preserve liquidity in overnight funding markets.

The U.S. and China on Tuesday began charging additional port fees on ocean shipping firms that move everything from holiday toys to crude oil, making the high seas a key front in the trade war between the world's two largest economies.A return to an all-out trade war appeared imminent last week, after China announced a major expansion of its rare earths export controls and President Donald Trump threatened to raise tariffs on Chinese goods to triple digits.

But after the weekend, both sides sought to reassure traders and investors, highlighting cooperation between their negotiating teams and the possibility they could find a way forward.China said it had started to collect the special charges on U.S.-owned, operated, built or flagged vessels but clarified that Chinese-built ships would be exempted from the levies.In details published by state broadcaster CCTV, China spelled out specific provisions on exemptions, which also include empty ships entering Chinese shipyards for repair.

Similar to the U.S. plan, the new China-imposed fees would be collected at the first port of entry on a single voyage or for the first five voyages within a year."This tit-for-tat symmetry locks both economies into a spiral of maritime taxation that risks distorting global freight flows," Athens-based Xclusiv Shipbrokers said in a research note.Early this year, the Trump administration announced plans to levy the fees on China-linked ships to loosen the country's grip on the global maritime industry and bolster U.S. shipbuilding.

An investigation during the former Biden administration concluded that China uses unfair policies and practices to dominate the global maritime, logistics and shipbuilding sectors, clearing the way for those penalties.China hit back last week, saying it would impose its own port fees on U.S.-linked vessels from the same day the U.S. fees took effect."We are in the hectic stage of the disruption where everyone is quietly trying to improvise workarounds, with varying degrees of success," said independent dry bulk shipping analyst Ed Finley-Richardson. He said he has heard reports of U.S. shipowners with non-Chinese vessels trying to sell their cargoes to other countries while en route so the vessels can divert. Reuters was not immediately able to confirm.

Analysts expect China-owned container carrier COSCO to be most affected by the U.S. fees, shouldering nearly half of that segment's expected $3.2 billion cost from those fees in 2026.Major container lines, including Maersk, Hapag-Lloyd and CMA CGM, slashed their exposure by switching China-linked ships out of their U.S. shipping lanes. Trade officials there reduced fees from initially proposed levels and exempted a broad swath of vessels after heavy pushback from the agriculture, energy and U.S. shipping industries.

USTR did not immediately respond to a request for comment.

China's commerce ministry on Tuesday said, "If the U.S. chooses confrontation, China will see it through to the end; if it chooses dialogue, China's door remains open."In a related move, Beijing also imposed sanctions on Tuesday against five U.S.-linked subsidiaries of South Korean shipbuilder Hanwha Ocean which it said had "assisted and supported" a U.S. probe into Chinese trade practices.Hanwha, one of the world's largest shipbuilders, owns Philly Shipyard in the U.S. and has won contracts to repair and overhaul U.S. Navy ships. Its entities also will build a U.S.-flagged LNG carrier.

Hanwha said it is aware of the announcement and is closely monitoring the potential business impact, and that it will continue to provide services to its customers, "including through our investments in the U.S. maritime industry and via Hanwha Philly Shipyard."

Hanwha Ocean's shares sank nearly 6%.

China also launched an investigation into how the U.S. probe affected its shipping and shipbuilding industries.

A Shanghai-based trade consultant said the new fees may not cause significant upheaval."What are we going to do? Stop shipping? Trade is already pretty disrupted with the U.S., but companies are finding a way," said the consultant, who requested anonymity because he was not authorised to speak with the media.The U.S. announced last Friday a carve-out for long-term charterers of China-operated vessels carrying U.S. ethane and LPG, deferring the port fees for them through December 10.

Meanwhile, ship-tracking company Vortexa identified 45 LPG-carrying VLGCs - 11% of the total fleet - that would be subject to China's port fee.

Clarksons Research said in a report that China's new port fees could affect oil tankers accounting for 15% of global capacity. Jefferies analyst Omar Nokta estimated that 13% of crude tankers and 11% of container ships in the global fleet would be affected.

In a reprisal against China curbing exports of critical minerals, Trump on Friday threatened to slap additional 100% tariffs on goods from China and put new export controls on "any and all critical software" by November 1.Administration officials hours later warned that countries voting in favor of a plan by the U.N. International Maritime Organization to reduce planet-warming greenhouse gas emissions from ocean shipping this week could face sanctions, port bans, or punitive vessel charges. China has publicly supported the IMO plan.

"The weaponisation of both trade and environmental policy signals that shipping has moved from being a neutral conduit of global commerce to a direct instrument of statecraft," Xclusiv said.Shares in Shanghai-listed COSCO rose more than 2% in early trading on Tuesday. The company said its board had approved a plan to buy back up to 1.5 billion yuan ($210.3 million) worth of its shares within the next three months to maintain corporate value and safeguard shareholder interests.

Oil steadied after falling to five-month low, as investors weighed an expected supply glut against the fallout of escalating US-China trade tensions.

West Texas Intermediate traded near $59 a barrel after sliding to the lowest since May on Tuesday, while Brent closed near $62. The International Energy Agency on Tuesday increased its forecast for an unprecedented oversupply of oil for 2026. Worldwide crude supplies will exceed demand by almost 4 million barrels a day next year, a record overhang in annual terms, the agency said.

Meanwhile, investors are bracing for the latest tit-for-tat retaliation between the world’s two biggest economies, as Beijing sanctioned the US units of a South Korean shipping giant. US Trade Representative Jamieson Greer predicted that heightened tensions with China over export controls would ease, following the latest talks between their representatives.

Oil posted losses in August and September, and WTI has shed about 18% year-to-date. The decline has been driven by growing concerns that global supply will run ahead of demand, with many Wall Street banks forecasting futures will revisit the $50s-a-barrel range.

The heads of Japan’s main opposition parties are expected to discuss Wednesday whether they can close policy gaps and pick a candidate of their own for the nation’s premiership.The leaders — Yuichiro Tamaki of the Democratic Party for the People, Yoshihiko Noda of the Constitutional Democratic Party, and Fumitake Fujita of the Japan Innovation Party (Ishin) — plan to hold their first three-way meeting since the collapse of the ruling coalition last week. The three parties have enough combined seats in the powerful lower house of parliament to outnumber the ruling Liberal Democratic Party to block its new leader Sanae Takaichi from becoming the prime minister.

Lawmakers are also expected to confirm that an extraordinary parliament session will take place on Oct. 21 so that they can vote to pick the prime minister. A candidate doesn’t need an outright majority to become prime minister. If no one receives more than 50% support, the top two candidates compete in a runoff. The lower house’s decision overrules the upper house in the event the two chambers choose a different candidate.

Tamaki’s DPP has fewer seats in the lower house than CDP or Ishin, but its rising popularity demonstrated in the past two national elections makes Tamaki the leading candidate to challenge Takaichi. During a meeting between senior officials of the three parties held on Tuesday, Tamaki’s DPP sought a change in the CDP’s stance on security issues as well as nuclear energy.The political instability is also feeding into worries over the economic outlook, already heightened by US-China trade tensions. The yen was broadly stable Wednesday morning, trading around 151.70 to the dollar, while the Topix index rose 1% in early trading.

There is a precedent for multiple opposition parties unifying behind a single candidate to become premier despite the LDP having the biggest bloc in parliament. That happened in 1993, though the resulting government proved unstable, leading to the eventual return of the LDP to power.

As the opposition parties eye cooperation, Takaichi continues to lay the groundwork for the possibility of becoming prime minister. She is considering tapping main LDP rival and Agriculture Minister Shinjiro Koizumi as defense minister, and Chief Cabinet Secretary Yoshimasa Hayashi as internal affairs minister, according to the Yomiuri newspaper.For investors, either Takaichi or Tamaki would likely mean more government spending and pressure on the Bank of Japan to slow its path toward raising interest rates. While the instability might cause short-term falls in equities, the policy direction might then lift stocks, while feeding into a weaker yen and higher super-long yields with moves potentially larger in the case of a Tamaki-led administration.

South Korea rolled out a new round of measures aimed at reining in a red-hot housing market, stepping up efforts to curb speculative buying as policymakers weigh interest-rate cuts to bolster a slowing economy.The government’s latest steps include tighter loan limits in Greater Seoul, newly designated overheated districts, a faster roll-out of higher risk weights on banks’ home loans and cutting loan-to-value ratios on mortgage properties. The package comes as home prices continue to climb despite earlier interventions that included tighter mortgage caps in Seoul and restrictions on purchases by foreign buyers.

The recent instability in housing markets is spreading on global rate-cut expectations and persistent supply-demand imbalances that are driving concerns over excess capital inflows into real estate, Minister of Land, Infrastructure and Transport Kim Yun-duk said in a briefing Wednesday.“In response, we’re going to take preemptive measures to curb instability in the housing market early and to ensure that capital is directed toward more productive sectors of the economy,” he added.

The persistent gains are making it more risky for the Bank of Korea to lower borrowing costs to stimulate growth, as easier policy could fuel financial imbalances. The central bank held rates steady in April, about a month after the government released a fresh round of measures to cool the housing market, before conducting its most recent rate cut on May 29.

Since starting its easing cycle in October last year, the BOK has cut rates four times, but paused at its last two meetings to weigh the risks from rising household debt and rising property prices in Greater Seoul. The bank next sets policy on Oct. 23.President Lee Jae Myung, who took office in June after campaigning on improving housing affordability, has struggled to curb property prices that have kept many first-time buyers out of the market.Apartment prices in Seoul rose 0.27% in the week ended Sept. 29, accelerating from a 0.19% gain the previous week, according to the latest data from the Korea Real Estate Board released in early October. The rise marked the steepest weekly advance since early July, and it extended the market’s rally to a 35th consecutive week.

As part of the latest move, Korea will set different mortgage limits for home purchases in Seoul and other regulated areas, based on property prices, according to a joint release from financial authorities. The current 600 million won ($418,442) cap on loans will remain for homes valued at up to 1.5 billion won. But for properties priced between 1.5 billion won and 2.5 billion won, the cap will be reduced to 400 million won, while homes worth more than 2.5 billion won will be limited to loans of up to 200 million won.The government will also designate all 25 districts of Seoul as regulated and speculative areas, including regions on the outskirts of Seoul, such as parts of Gyeonggi Province. The new designations will take effect from Thursday.

Newly designated “regulated zones” will immediately face stricter mortgage limits. In these areas, home buyers can only borrow up to 40% of a property’s value, down from the previous 70%. The aim is to curb borrowing and tighten access to home loans, the statement added. Even tenants with rental loans or individuals with personal loans will face restrictions on purchasing homes in these districts, the statement said.Other measures include a rule that makes banks treat home loans as riskier, meaning they must hold more capital when issuing them. The change — raising the minimum risk level for mortgages from 15% to 20% — will take effect in January 2026, three months earlier than previously planned, the government statement showed.

Rising financial stability risks have prompted more economists to forecast that the BOK will hold rates at next week’s meeting. The decision comes as the government has said it expects to post its slowest annual growth since the pandemic slump of 2020. Adding to the strain, new tariffs imposed by Donald Trump are weighing on South Korea’s export-dependent recovery.Exports slipped in September, reinforcing signs of a broader slowdown. The central bank noted that while household debt growth has moderated, housing price expectations in Seoul remain stubbornly high.

The crypto market is in "fear" mode, with the Fear and Greed Index ranging from 34 to 40. This sentiment affects BTC, ETH, and AVAX, seen in liquidity shifts and ETF flows.

Market uncertainty is prompting caution among investors, with previous periods of fear often signaling future opportunities for strategic accumulations. The Fear and Greed Index serves as a critical sentiment indicator.

The current crypto market atmosphere is influenced by fear, with the index ranging from 34 to 40 recently. This has led to cautious behavior among investors, reflected in liquidity trends and risk-off sentiment. Bitcoin, Ethereum, and Avalanche are notably affected as they experience a decrease in trading volumes and price support.

Prominent figures such as Arthur Hayes from BitMEX underscore the potential for long-term gains during such market conditions. Vitalik Buterin from Ethereum has reiterated the continued focus on scalability and security upgrades, whereas Binance’s official updates emphasize monitoring sentiment pivots before making portfolio changes.

Potential financial outcomes include fluctuating Total Value Locked (TVL) in DeFi protocols and increasingly cautious ETF flows. Stablecoin inflows have risen as investors seek stability, indicating a defensive stance amid prevailing concerns. Historical precedents suggest a possibility of post-fear market rebounds supported by institutional accumulation.

The recent crypto market crash on October 10 marks the largest liquidation event in the history of digital asset trading, with over $19 billion forcibly liquidated in a matter of minutes. This unprecedented event triggered a cascade of liquidations, causing a dramatic $65 billion decline in open interest and highlighting vulnerabilities in crypto infrastructure and market stability. As the industry grapples with the fallout, experts point to technical flaws and possible coordinated attack vectors as key contributing factors to this historic downturn.

The crash on October 10 shattered previous records for liquidation volume, with more than $19 billion wiped out in a matter of minutes, according to market data. The liquidation wave resulted in a $65 billion drop in open interest across derivatives markets, exceeding past liquidity crises such as the COVID-19 crash and the collapse of FTX.

Market analysts have identified vulnerabilities in Binance’s pricing oracles as a potential catalyst. These oracles, which determine the value of certain pegged tokens like USDE, bnSOL, and wBETH, relied on internal data — not external oracles — increasing risk during market stress. These internal valuations are central to Binance’s “Unified Accounts” feature, making users susceptible to liquidation during irregular trading conditions.

While evidence of a coordinated attack remains inconclusive, the data indicates suspicious behavior. Notably, USDE experienced substantial liquidations, accounting for about $346 million, with other tokens like wBETH and bnSOL also heavily affected. The mass withdrawal of liquidity on stablecoin pairs adds a layer of suspicion, hinting at possible manipulation or strategic market moves.

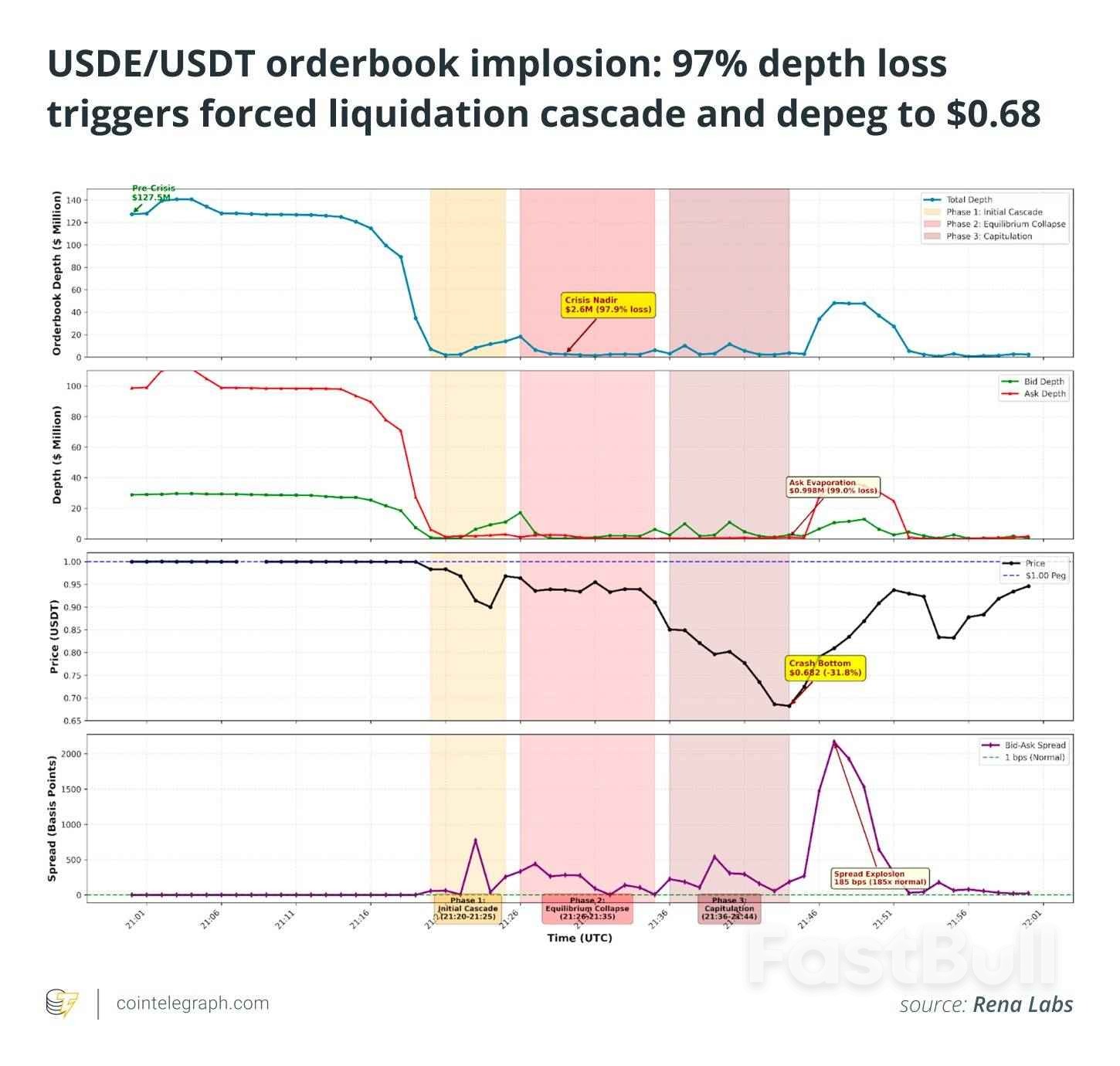

Using detailed analytics from Rena Labs, a leading AI-driven market analysis firm, researchers detected one of the most severe and complex dislocations ever observed in stablecoin trading. Despite the USDE peg being intact, liquidity evaporated rapidly. Total liquidity on Binance declined from an average of $89 million to just $2 million in under 20 minutes, with bid-ask spreads widening to 22%, and nearly complete market depth disappearing.

During the crisis, trading activity surged exponentially — nearly 16 times higher than normal — with almost 3,000 trades per minute, predominantly sell orders. This panic-driven trading, combined with stop-loss triggers and forced liquidations, accelerated the liquidity collapse.

Rena’s anomaly detection system identified unusual activity hours before the liquidity crisis. At around 21:00 UTC, it recorded 28 anomalies, including spikes in volume, price deviations, and suspicious trade patterns such as spoofing — where traders manipulate markets by placing deceptive orders to influence prices.

Order book analysis revealed three large-volume order “volleys” just before the collapse, hinting at targeted manipulation when Bitcoin was already declining but before USDE liquidity vanished. These events underscore the fragility of crypto markets, where leverage and leverage-fueled liquidations can wipe out seemingly stable trades and expose systemic weaknesses, especially where market makers like Wintermute are absent.

This incident emphasizes the importance of robust risk management and reliable oracles in blockchain-based finance. As the crypto industry faces increasing scrutiny over its infrastructure, the October 10 crash serves as a stark reminder of the ongoing vulnerabilities within digital asset markets.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up