Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)A:--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The European Central Bank must be alert to upside inflation risks and resist the temptation to fine-tune policy, according to Governing Council member Peter Kazimir.

The European Central Bank must be alert to upside inflation risks and resist the temptation to fine-tune policy, according to Governing Council member Peter Kazimir.

The Slovak official pointed to supply-chain uncertainty, energy costs, and surprisingly strong underlying price pressures and earnings gauges in arguing that officials "must recognize the presence of lingering upside risks."

"The mosaic of data contains elements that should serve as a reminder of why letting one's guard down wouldn't be advisable at this stage," Kazimir said in an op-ed on the Slovak central bank's website. Still, he reiterated the ECB's mantra that policy is in a "good position to face the challenges of the current turbulent environment."

The ECB held interest rates at 2% last week after the economy largely performed in line with expectations. President Christine Lagarde said inflation is close to the 2% target — even as risks warrant close monitoring.

They relate primarily to the trade outlook for the 20-nation euro zone. While a deal with the US has alleviated some uncertainty, firms remain vulnerable — and the latest tussle between Washington and Beijing has highlighted how quickly things can change.

It's against that backdrop that Kazimir cautions against too much activism — even as near-term projections show price pressures falling short of the ECB's goal.

"We should not try to over-engineer our policy and fine-tune inflation dynamics to perfection with small moves," he said. "In trying to be overly precise, the central bank could itself become a source of volatility rather than the pillar of stability our economy needs."

In advocating a steady-hands approach, Kazimir joins officials including Latvia's Martins Kazaks, who warned last week against "jumpy" responses to data as they arrive. "The steadiness of our policy decisions is an advantage," he said.

Kazimir argued that the ECB will "remain vigilant" to both upside and downside inflation risks, and is prepared to respond if needed.

"'Data-dependent' means keeping all options open," he said. "It means our next move — when it comes — could, in principle, be in either direction, depending on the signals we receive."

Peru broke off diplomatic relations with Mexico on Monday in the latest chapter of a years-long dispute stemming from Mexican support for left-wing politicians accused of plotting a 2022 coup in the South American nation.

The announcement was made by the top diplomat to Peru's new conservative President Jose Jerí, who accused Mexican officials of meddling in its affairs by offering asylum protections to former Prime Minister Betssy Chávez. She served under ousted leftist ex-President Pedro Castillo.

"The Peruvian government has decided to break diplomatic relations with Mexico," Foreign Minister Hugo de Zela told reporters. He described the decision by Mexican officials to allow Chávez to stay in Mexico's diplomatic compound in Lima as an "unfriendly act" and castigated Mexico's current and former presidents for intervening in Peru's internal affairs.

Mexico's foreign ministry didn't immediately respond to a request for comment.

Previously held in pre-trial detention, Chávez faces criminal charges over her role in Castillo's alleged coup attempt. At the time, Castillo sought to dissolve Congress in an apparent bid to stop a vote to remove him from power. Lawmakers ousted him anyway.

Chávez missed her most recent court appearances, fueling speculation she had fled to an embassy.

Mexico's former President Andrés Manuel López Obrador loudly opposed the ouster of his fellow leftist Castillo, casting it as a coup by right-wing lawmakers in Peru. López Obrador granted Castillo and his family asylum, although Castillo was arrested before he could get to Mexico's embassy.

Castillo's conservative successor responded by expelling Mexico's ambassador in protest. In 2023, Peru escalated by recalling its ambassador in Mexico City. Peru's latest move to fully break off relations marks a fresh escalation.

Much like her predecessor, Mexico's current President Claudia Sheinbaum has staunchly backed Castillo, arguing he did not attempt a coup but was instead the victim of one.

Beyond the diplomatic moves and counter-moves, political asylum is an increasingly sore subject in Peru. In recent years, Castillo's wife Lilia Paredes was granted asylum and safe passage to Mexico despite Peru's protests. Similarly, the wife of ex-President Ollanta Humala, former First Lady Nadine Heredia, was granted asylum in Brazil after she was sentenced to prison for laundering campaign funds from a Brazilian construction company.

In both cases, Peru's prior administration recognized the rights of other countries to grant asylum to its nationals and allowed them to leave the country.

On Monday, De Zela did not say whether Jerí's government would recognize asylum for Chávez.

Rachel Reeves will lay the groundwork for a tax-raising budget that could break Labour's election promise on income tax, in a major speech in which she will be "candid" about the tough choices ahead.

The chancellor will give the speech as the markets open on Tuesday, when she will promise to make fair choices at this month's budget but decline to repeat her manifesto pledge of no rise in income tax, VAT or national insurance.

Keir Starmer told MPs on Monday night it would be a "Labour budget built on Labour values" and promised it would protect the NHS, reduce debt and ease the cost of living.

The prime minister gave MPs a hint at how the government would frame its potential manifesto breach – saying it was "becoming clearer that the long-term impact of Tory austerity, their botched Brexit deal and the pandemic on Britain's productivity is worse than even we feared".

Starmer told the grim-faced crowd of MPs, many sceptical of the potential manifesto breach, that there would be "tough but fair decisions" – saying the choice of the Conservatives and Reform would be "to return us to austerity".

MPs in the meeting repeatedly grilled Starmer on whether the budget would lift the two child benefit cap, in what one described as "coordinated" pressure on the prime minister.

While nobody raised concerns over a manifesto breach explicitly, at least one MP spoke about the necessity that the public "know what we stand for". However, the absence of any direct confrontation over the manifesto may give Starmer and Reeves some confidence that they are not facing a major backlash from within the parliamentary Labour party.

Senior strategists are understood to be heavily invested in pitch-rolling the major changes before the budget, believing the key success of last year's statement was that markets were not surprised by the changes to investment rules or the national insurance rise for employers, which although controversial were well trailed.

Though the fiscal landscape ahead of the budget is hard, the economic picture is said by some insiders to be less gloomy than predicted.

While they accept the Office for Budget Responsibility's productivity downgrade has created a headache, they point out that a fall in debt financing costs and more people coming into the jobs market may help limit the damage. Interest rate cuts and stronger-than-expected retail sales could also help.

"It's a tough backdrop but we're going to be honest with people about the choices," one ally of the chancellor said. "And there are some reasons for economic optimism."

But the budget will still mean hard decisions, as Reeves seeks to potentially double her fiscal headroom, as well as find billions to scrap or ease the two-child benefits limit and protect capital spending in the NHS.

There will be a focus on easing the cost of living in the budget, with Reeves understood to be considering cutting VAT on domestic energy bills and some green levies.

The chancellor has been urged by an influential thinktank to raise income tax by 2p but to cut national insurance by the same amount, raising £6bn mostly from the added burden on those who do not pay NI – such as pensioners and landlords.

The move may allow the chancellor to argue that her budget will protect the incomes of working people – those paid with a monthly payslip.

The Resolution Foundation said that higher-than-expected pay could offset almost all the fiscal damage from the productivity downgrade and also reduce borrowing – predicting the gap would be £4bn, far smaller than expected.

Its former chief executive Torsten Bell, now a government minister, is a key figure who sits on the budget board of senior ministers and advisers in No 10 and No 11.

The thinktank also suggests further tax rises, including extending the freeze on income tax threshold, raising dividend tax and closing capital gains tax loopholes to raise a total of £26bn.

Reeves is also said to be considering an increased tax on higher earners – and has spoken about how those with the broadest shoulders should bear the burden. Reports have suggested that could target people with incomes over £46,000.

However, sources have told the Guardian that they believe the chancellor is convinced that raising the higher income tax threshold alone would not raise nearly enough.

At a speech in Downing Street, Reeves will promise to address the speculation about her budget, though she is not expected to make any specific policy announcements.

At last week's prime minister's questions, Starmer did not repeat his manifesto promises on tax, saying only that he would "lay out our plans" during the budget.

In a clear signal that Reeves intends to give herself more headroom and end the cycle of budget black holes, she will promise to "make the choices necessary to deliver strong foundations for our economy – for this year, and years to come.

"It will be a budget led by this government's values, of fairness and opportunity and focused squarely on the priorities of the British people – protecting our NHS, reducing our national debt and improving the cost of living."

The chancellor will say that there has been "a lot of speculation about the choices I will make … these are important choices that will shape our economy for years to come.

"But it is important that people understand the circumstances we are facing, the principles guiding my choices – and why I believe they will be the right choices for the country."

Inside No 10, senior figures believe the biggest risk at the budget is the reaction of Labour MPs to a manifesto breach, given how MPs forced U-turns on winter fuel payments and welfare cuts.

"If we are going down this road we need to be absolutely clear where it leads us; we must have a plan that means ordinary people feel better off as a result, that we can deliver tangibly better public services or ease the cost of living," one minister said.

Another government source said: "I fear that the communication around this will be that we need to take this action for economic stability or because of the economic situation. That will completely kill us. We need to show people we are delivering direct benefit to them as a result of their taxes going up."

Another minister said: "Already we are hearing too much about bond markets and paying the debt down. We should care about those things quietly, and speak more loudly about what this money is paying for that our voters care about."

One minister, a close ally of Starmer, said the prime minister had been clear with his team that he believed they were already in effect in a general election campaign, and they had to start making far more tangible offers and progress to the public on cost of living, tackling illegal migration and improving public services.

In an appearance on the Bloomberg Surveillance television program, Fed Governor Stephen Miran restated the case for deep interest rate cuts that he has laid out since joining the central bank's Board of Governors in September, and expanded his rationale to argue that buoyant stock and corporate credit markets are no reason to think monetary policy is too loose.

"Financial markets are driven by a lot of things, not just monetary policy," said Miran, who is on leave from his job as a top economic adviser in the White House, in explaining why he dissented last week against the Fed's decision to cut rates by a quarter of a percentage point. Miran favored a half-percentage-point reduction.

Rising equity prices, narrow corporate credit spreads, and other factors don't "necessarily tell you anything about the stance of monetary policy" at a moment when interest-sensitive sectors like housing are less buoyant and some parts of the private credit market appear under stress, Miran said, adding that he still feels Fed policy remains too restrictive and is heightening the risk of a downturn.

Chicago Fed President Austan Goolsbee, in contrast, told Yahoo Finance he was leery of further rate cuts while inflation remains significantly above the central bank's 2% target and is expected to accelerate through the rest of 2025.

Goolsbee, who is a voting member of the Fed's policy committee this year, supported the recent rate cut, but said "I'm not decided going into the December meeting ... I am nervous about the inflation side of the ledger, where you've seen inflation above the target for four and a half years, and it's trending the wrong way."

San Francisco Fed chief Mary Daly, whose turn to vote isn't until 2027 but who takes part in the policy discussion and debate as all 19 U.S. central bankers do, also said she supported last week's cut as "insurance" against labor-market weakening.

As for the December meeting, Daly said she has an "open mind" and feels the Fed could cut again "if we feel that more is needed because we're getting more signs" that there is a "precipice of concern" about the labor market. "I don't see that right now," she said, noting that inflation remains too high and the Fed must make a decision that "balances those risks."

Kansas City Fed President Jeffrey Schmid, who dissented in favor of no rate cut last week, laid out on Friday the case for keeping more of a focus on inflation, including the fact that "financial markets appear to be easy across many metrics. Equity markets are near record highs, corporate bond spreads are very narrow, and high-yield bond issuance is elevated. None of this suggests that financial conditions are particularly tight or that the stance of policy is restrictive."

Asked specifically about the arguments cited by Schmid, a career banker, Miran said they overlooked stress that may be developing elsewhere in the financial system and the sluggishness in the housing market.

Miran also noted that the economy has been buffeted by population changes and other shocks since last year that have lowered underlying interest rates and mean "that policy has passively tightened" despite the Fed's rate cuts. He said he continues to think the central bank should cut in half-percentage-point increments until hitting a "neutral" level he estimates is "quite a ways below" where it is now.

Miran's preference for steep rate cuts remains an outlier, though others at the central bank, including Fed Governor Christopher Waller, have similarly indicated they feel short-term borrowing costs are restraining the economy, which allows room for further rate cuts.

The view, however, remains contested.

"I think we're barely restrictive if at all," Cleveland Fed President Beth Hammack said on Friday.

A travel association has urged the U.S. Congress in a letter on Monday to reopen the federal government ahead of the Thanksgiving travel rush, as the shutdown stretches into its 34th day.

The prolonged shutdown has led to a spike in airline delays, affecting airports and 3.2 million passengers due to a high number of absences in air traffic controllers, with many of them taking up second jobs to cope.

The shutdown is estimated to cost the U.S. economy between $7 billion and $14 billion, according to the nonpartisan Congressional Budget Office.

"Air travel's number one priority is safety and while safety will be maintained, travelers will pay a heavy and completely unnecessary price in terms of delays, cancellations and lost confidence in the air travel experience," said U.S. Travel Association President and CEO Geoff Freeman.

In a letter that was signed by 500 organizations, including Hilton and MGM Resorts, Freeman urged the Congress that the fastest way to restore confidence and restart travel was to reopen the government by passing a clean continuing resolution.

"The damage from this shutdown is growing by the hour with 60% of Americans reconsidering their travel plans".

The shutdown has forced 13,000 air traffic controllers and 50,000 Transportation Security Administration officers to work without pay and snarled tens of thousands of flights.

Federal Reserve Governor Lisa Cook said the ongoing risks for both inflation and the labor market create a teachable moment for how the Fed must proceed carefully when it comes to future interest rate cuts.

Cook — who previously taught at Michigan State University as a professor of economics and international relations — noted that it's a moment that she might tap into one day if she ever returns to the classroom.

And she cleverly noted that going back to teaching isn't something she wants to do too soon.

Cook, of course, has been in the hot seat since President Donald Trump moved in the middle of the night to fire her from the Federal Reserve in late August. Cook sued Trump, challenging his authority to fire a Fed governor. Attorney Abbe David Lowell, who is representing Cook, has said Trump's action was "illegal."

On Oct. 1, the U.S. Supreme Court rejected Trump's efforts to immediately remove Cook based on the Trump administration's ongoing allegations that she misrepresented information about occupancy on two mortgages she obtained in 2021, including one for an Ann Arbor home.

The Supreme Court will hear oral arguments on the case in January, a case that could set a major economic precedent when it comes to the central bank's ability to act independently from the president.

If Trump can fire Cook, what other power does a president have over other seated Fed governors? No other president has ever fired a Fed governor in the Fed's nearly 112-year history.

On Monday, Nov. 3, Cook made her first public remarks since the Trump firestorm when she gave a presentation on the economic outlook and took some limited questions at an afternoon event held by The Brookings Institution in Washington, D.C.

Cook declined to speak specifically on the topic that made her one of the most recognizable names among Fed governors. She did, though, make a few not-so-subtle remarks during a question-and-answer period.

"With respect to Fed independence," she said at one point, "I'm not going to say much but I support it."

She also expressed gratitude for the many people, including some she said were in the audience Monday, who offered her words of support.

And she gave an indication that her life has changed, saying that she's no longer able to easily go out into the community and talk directly with business owners and consumers about what they're experiencing in the economy.

In the past, Cook said, she might have slipped into a diner in Virginia to listen to conversations and understand what's going on but noted that she cannot do that anymore.

"What I want is the mortar between the bricks," Cook said.

Cook said she studies the economic data before casting her vote about whether interest rates should be reduced or raised. She tries to gather some information on her own beforehand on what people seem to be experiencing in their prospective corners of the economy.

The Federal Reserve banks across the country, she said, fill in many of those gaps by offering much research through conversations with businesses, nonprofits and others.

Eight times a year, each Federal Reserve Bank publishes a Beige Book after conducting interviews with regional business leaders and others to gather on-the-ground, real-time economic insight.

Cook voted in favor of the quarter-point rate cut announced Oct. 29, moving the target range for the federal funds rate to 3.75% to 4%.

Two Fed governors voted against the latest rate cut: Stephen Miran, who preferred a more aggressive move and wanted to lower the target range for the federal funds by a half percentage point, and Jeffrey Schmid, who preferred no change at the October meeting.

The October rate cut was the second step by the Fed in 2025 to reduce short term interest rates. On Sept.17, the Fed cut short-term rates by a quarter point to a target range of at 4% to 4.25%. The Fed board's decision wasn't unanimous in September, either.

The next Federal Reserve meeting is Dec. 9 and Dec. 10. More questions are being raised about what the Fed might do next.

"Every meeting, including December's, is a live meeting," Cook said.

Keeping rates too high can contribute to higher levels of unemployment; keeping rates too low can fuel inflation. The Fed remains at a crossroads.

"Looking ahead, policy is not on a predetermined path," Cook said in her prepared remarks. "We are at a moment when risks to both sides of the dual mandate are elevated."

Right now, Cook said, the labor market is showing some signs of a slowdown but there is no reason for alarm.

"The latest available indicators," she said in her remarks, "suggest that the labor market remains solid, though gradually cooling."

Yet, she noted that past experience shows the employment picture can shift suddenly and the labor market can "deteriorate very quickly."

It's a risk that the Fed must take into account when deciding how long to keep interest rates at a higher level. Rates would be kept higher in order to put a lid on inflation. The Fed has a dual mandate to promote maximum employment and price stability.

Opting to cut rates could mean that some are more worried about job market risks ahead than the threat of higher inflation.

In her speech, Cook acknowledged that it was a challenging time to offer an economic outlook due to the government shutdown.

Federal agencies that provide key economic numbers aren't producing much of the necessary data. Those agencies include the Bureau of Labor Statistics, the Census Bureau and the Bureau of Economic Analysis.

"The longer the shutdown lasts, the more data could be disrupted," she said.

Inflation could remain elevated for the next year, Cook says

When it comes to inflation, she said, much uncertainty remains about how much higher tariffs will contribute to higher prices, and inflation, down the line.

Many firms, Cook said in her speech, have not raised prices as they run down their inventories. Others say they are waiting until tariff uncertainty is resolved before hitting consumers with price increases.

"As such, I expect inflation to remain elevated for the next year," Cook said. "Nonetheless, the effect of tariffs on prices, in theory, should represent a one-time increase."

Not everyone is doing well in this economy. Cook pointed out that "there appear to be worsening outcomes for vulnerable and low-to-middle-income households."

In the labor market, she said, youth and Black unemployment rates, both of which tend to be more cyclical than total unemployment, have steadily risen since this spring through the latest readings in August.

"The deteriorating labor market experienced by these two vulnerable groups mirrors other emerging strains in some households' financial health and balance sheets," she said.

Cook said the current economic conditions are "sometimes called a 'two-speed' economy, when the well-off are doing well, while LMI (low-to-middle-income) and vulnerable households are not."

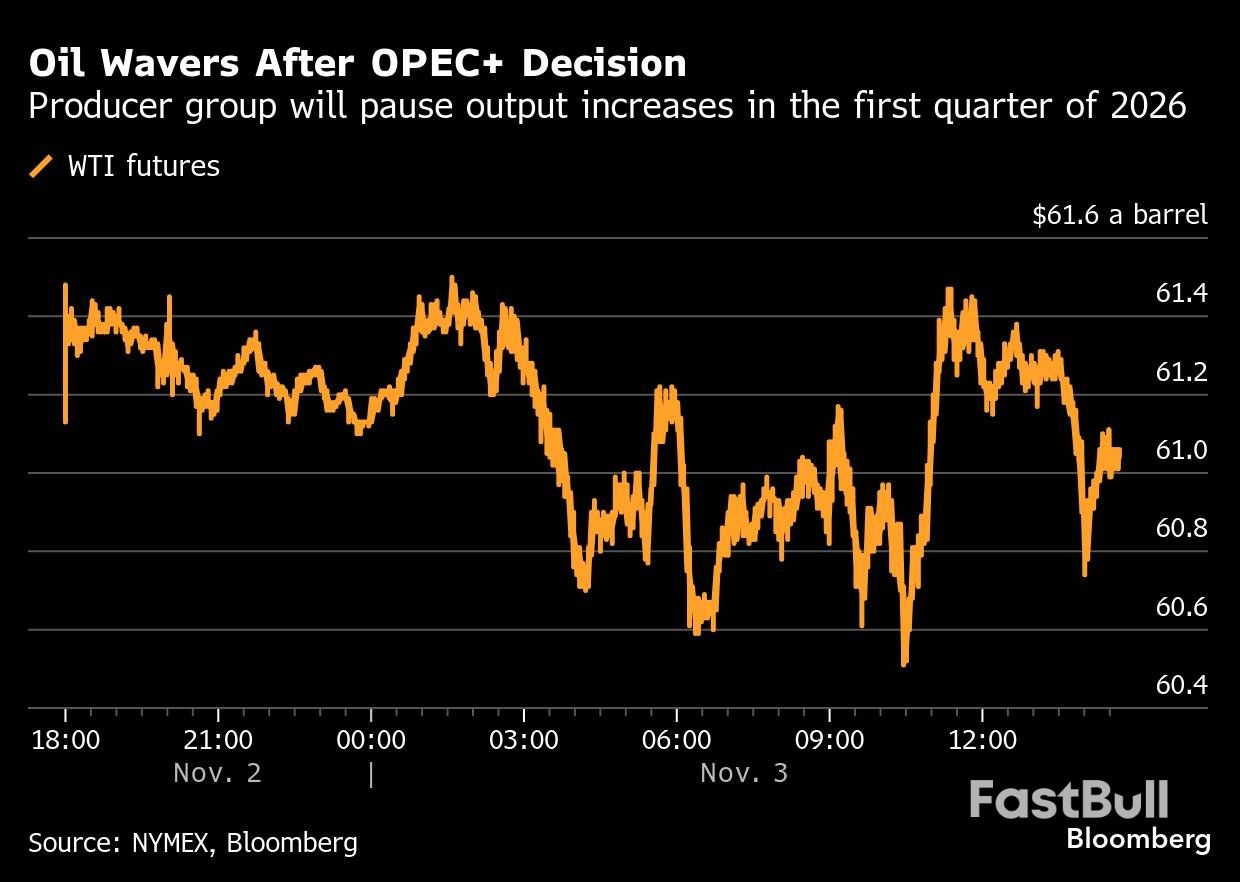

Oil was little changed Monday as traders weighed the OPEC+ alliance's plan to pause its output revival next quarter on anticipation demand will slow, while the market is seen headed for oversupply.

West Texas Intermediate rose about 0.1% to settle above $61 a barrel after fluctuating between small gains and losses through the day, extending a string of marginal increases. The Organization of the Petroleum Exporting Countries and its partners said the decision on Sunday to halt production hikes from January reflects an expectation for a seasonal slowdown. The move comes against a backdrop of widespread forecasts for excess supplies next year that could weigh down prices.

The US benchmark has slumped about 9% over the past three months as OPEC+ ramped up output in an apparent effort to regain market share, while producers outside the group also increased production. Prices recently bounced from a five-month low after tighter US sanctions on two major Russian oil producers over the war in Ukraine raised some questions about supply from Moscow.

"The decision to halt quota hikes during 1Q does not materially change our production forecasts but still sends an important signal," Morgan Stanley analysts including Martijn Rats and Charlotte Firkins wrote. "The group is still adjusting supply in response to market conditions."

The eight key members of OPEC+ are left with roughly 1.2 million barrels a day of their current supply tranche still to restore. Actual output increases have fallen short of advertised volumes, as some members offset earlier overproduction and others struggle to pump more.

Following the OPEC+ move, Morgan Stanley raised its near-term price forecast for Brent while also maintaining a warning for a "substantial surplus." The United Arab Emirates, meanwhile, on Monday added to the chorus of producers who have come out to downplay glut concerns.

Traders will also be monitoring disruptions to flows after a Ukrainian drone attack in the Black Sea left a tanker ablaze and damaged loading facilities in the port city of Tuapse. Oil intake at the refinery at Tuapse halted after the attack, according to a person familiar with the matter.

At the same time, top energy producers warned at the Adipec conference in Abu Dhabi that supply will be hit by the latest set of sanctions on Russia. The restrictions are serious and dampening supply, said BP Plc boss Murray Auchincloss.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up