Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

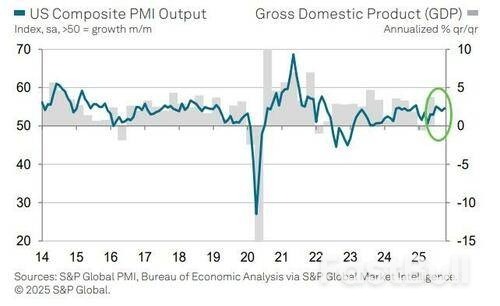

...new-orders and prices-paid soaring.

After yesterday's mixed picture on Manufacturing (PMI up, ISM down), analysts expected both Services surveys this morning to show an upward bounce.

S&P Global's Services PMI disappointed but did rise from September's 54.2 to 54.8 (but that was less than expected and less than the 55.2 preliminary print)

ISM's Services PMI beat expectations, rising from 50.0 to 52.4, well above the 50.8 expectations.

And this is happening amid a rise in 'hard' data (though admittedly based on housing and marginal labor data given the vacuum since the shutdown)

Under the hood, Prices surged to their highest in three years, new orders expanded at their fastest pace in a year and employment improved (though remained below 50)...

"October's final PMI data add to signs that the US economy has entered the fourth quarter with strong momentum," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

"Growth in the vast services economy has picked up speed to accompany an improved performance in the manufacturing sector.

In total, business activity is growing at a rate commensurate with GDP rising at an annualized pace of around 2.5% after a similarly solid expansion was signalled for the third quarter."

While growth is being driven principally by the financial services and tech sectors, Williamson says the survey is also picking up signs of improving demand from consumers.

However, the surge in prices paid is having some consequences

"However, there are signs that new business is coming at the cost of service providers having to soak up continued high input price growth to remain competitive.

Customers are often pushing back on price rises, especially in consumer-facing markets.

While good news in terms of inflation, this lack of pricing power hints at weak underlying demand and lower profits. "

Business expectations about the year ahead have also fallen sharply and are now running at one of the lowest levels seen over the past three years, as Williamson notes "signs of spending caution from customers is accompanied by heightened political and economic uncertainty."

However, Williamson points out that lower interest rates have helped offset some of the drags to business confidence, for which the October FOMC rate cut will have likely helped further.

Certainly nothing here to shift The Fed strongly from its easing path but Treasury yields are on the rise (likely driven by the inflation jump)

Homeless people will for the first time be able to open accounts with the UK's five biggest banks, in a pilot scheme marking the launch of the government's financial inclusion strategy.

The Treasury said its new national plan was meant to ensure financial services "worked for everyone", as it also revealed programmes that could help rebuild the credit scores of domestic abuse victims, support families with no savings and roll out financial education in primary schools across the UK.

One of the key schemes will see the high street lenders Lloyds, NatWest, Barclays, Nationwide and Santander waive the need for people to have a fixed address in order to open a bank account. The move will help vulnerable people avoid the chicken-and-egg problem of needing a bank account to apply for work and rental accommodation across the UK.

It will involve partnerships with the homelessness charity Shelter, which will vouch for prospective customers based on information on the charity's database, while accompanying individuals to face-to-face meetings at a local bank branch. The scheme expands on a partnership with HSBC, which has opened 7,000 accounts for people experiencing homelessness since its start in 2019.

The City minister, Lucy Rigby, said: "This plan is about opening doors – helping people experiencing homelessness into work, helping survivors of abuse rebuild their credit and helping families save for a rainy day.

"No one should be locked out of the chance to build a better future. Our strategy gives people the tools to get on and boosts the economy by supporting more people back into work."

The Treasury said it was also rolling out plans to help victims of domestic abuse repair credit ratings that have been damaged as a result of perpetrators having forced partners to take on debt on their behalf.

Credit agencies including Experian, Equifax and TransUnion will start reviewing how they could rescore victim's credit ratings, before reporting back to government. Charities said it would give survivors a fair chance to rebuild their financial independence.

"For far too long, domestic abusers have stolen victim-survivors' futures – forcing them into debt and destroying their credit scores with life-shattering consequences," said Sam Smethers, the chief executive of the Surviving Economic Abuse charity.

"This strategy provides a golden opportunity to help survivors rebuild their lives by restoring their credit scores. It's one we must seize so that credit reports reflect victim-survivors' creditworthiness, not the economic abuse they have experienced."

The financial inclusion strategy, which follows a years-long review by a Treasury-led financial inclusion committee, is aimed at boosting support for vulnerable people who have struggled to access banking and build financial resilience.

It comes as statistics reveal that more than 11.5 million people in the UK have less than £100 in savings, severely reducing their ability to recover from emergencies and unexpected costs such as boiler breakdowns or an extended illness.

The Treasury's strategy will also look at how to provide support for employers hoping to offer payroll savings schemes, where money is automatically deducted from wages and placed into an accessible savings pot on the workers' behalf before it hits their main bank accounts.

While the Treasury said these schemes have been popular with workers, some companies have been reluctant to take part for fear of inadvertently breaching minimum wage laws. The government said it would be "providing them with the certainty they need through the strategy to roll out such schemes far and wide".

Ministers said they would also inject financial education into the national curriculum as part of broader reforms announced by the Department for Education (DfE). Teachers will soon be teaching key financial concepts such as calculating interest as part of the maths curriculum, followed by additional financial literacy in a new compulsory "citizenship" course.

The DfE said it would ensure that primary pupils learned more about "fundamentals of money, recognising that children are now consumers often before they reach secondary school".

as of 5 November 2025. Past performance is not a reliable indicator of future performance.

as of 5 November 2025. Past performance is not a reliable indicator of future performance.

as of 5 November 2025. Past performance is not a reliable indicator of future performance.

as of 5 November 2025. Past performance is not a reliable indicator of future performance.

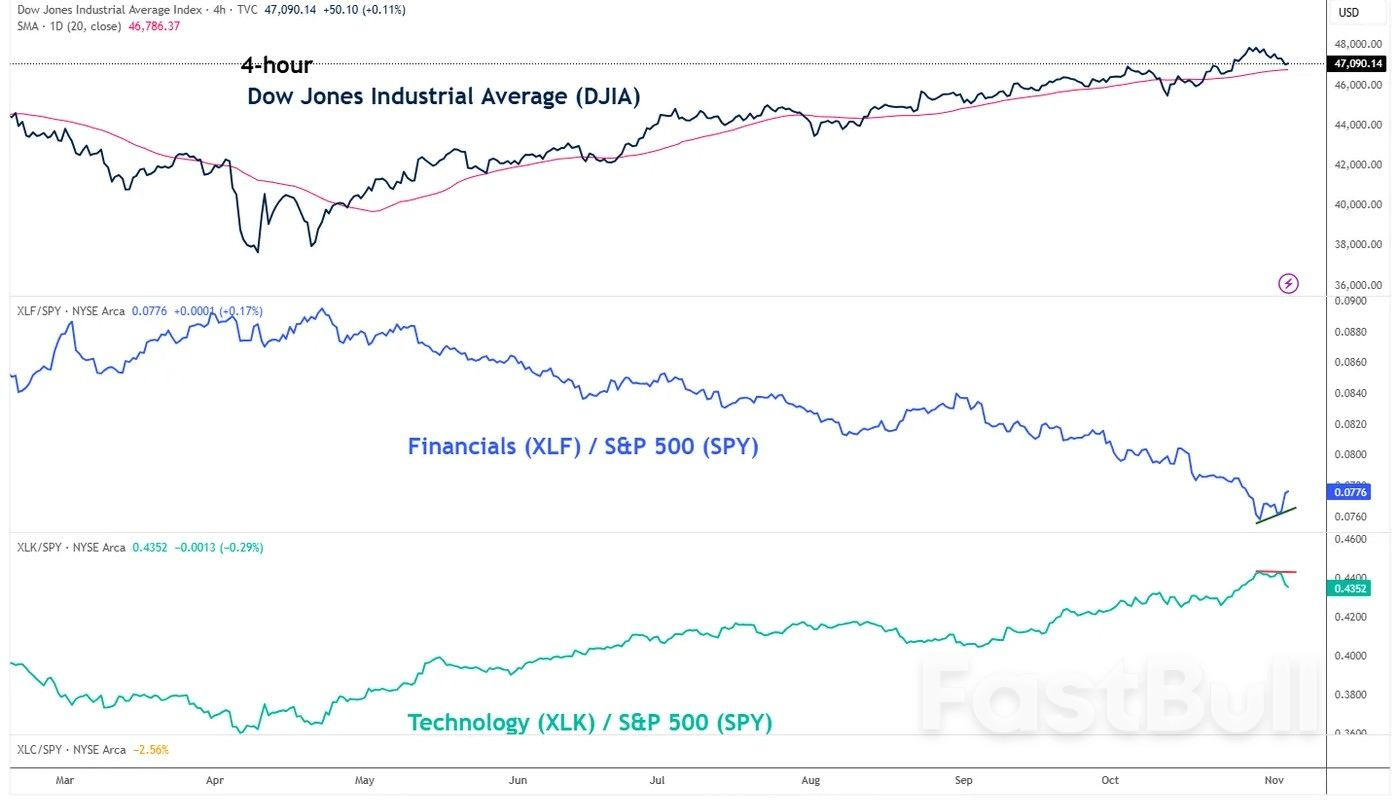

Fig. 1: Relative strength of US S&P 500 Financials & Technology sectors ETFs as of 4 Nov 2025

Fig. 1: Relative strength of US S&P 500 Financials & Technology sectors ETFs as of 4 Nov 2025 Fig. 2: US Wall Street 30 CFD Index minor trend as of 5 Nov 2025

Fig. 2: US Wall Street 30 CFD Index minor trend as of 5 Nov 2025

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up