Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)A:--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)A:--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the travel and vacation providers industry, including Marriott Vacations and its peers.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 19 travel and vacation providers stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 4.5% above.

Luckily, travel and vacation providers stocks have performed well with share prices up 13.1% on average since the latest earnings results.

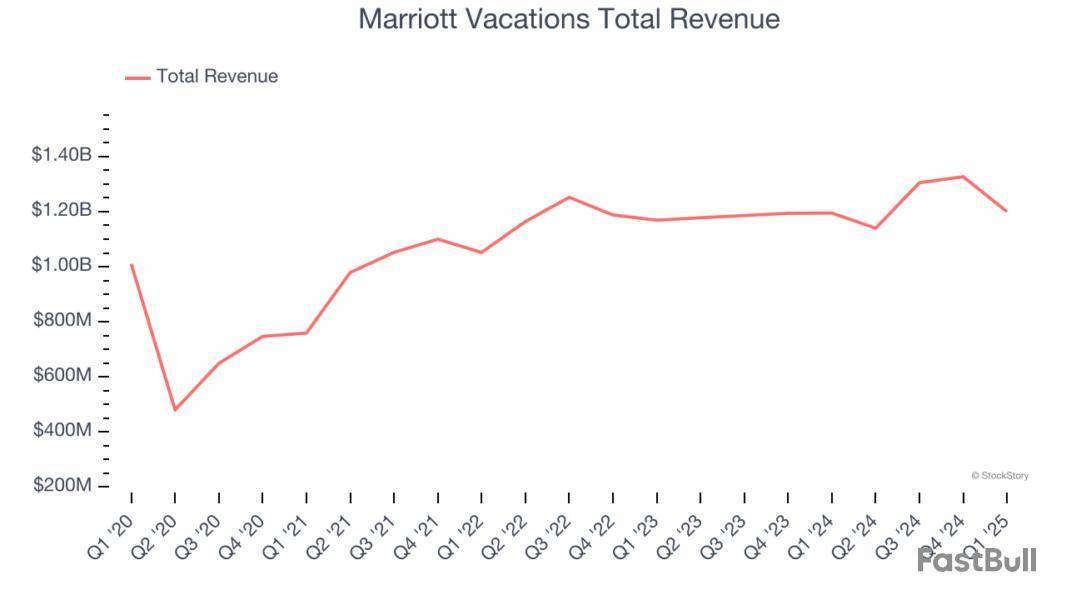

Spun off from Marriott International in 1984, Marriott Vacations is a vacation company providing leisure experiences for travelers around the world.

Marriott Vacations reported revenues of $1.2 billion, flat year on year. This print fell short of analysts’ expectations by 0.7%, but it was still a strong quarter for the company with an impressive beat of analysts’ EPS estimates and a decent beat of analysts’ EBITDA estimates.

The stock is up 23.7% since reporting and currently trades at $71.99.

Is now the time to buy Marriott Vacations? Access our full analysis of the earnings results here, it’s free.

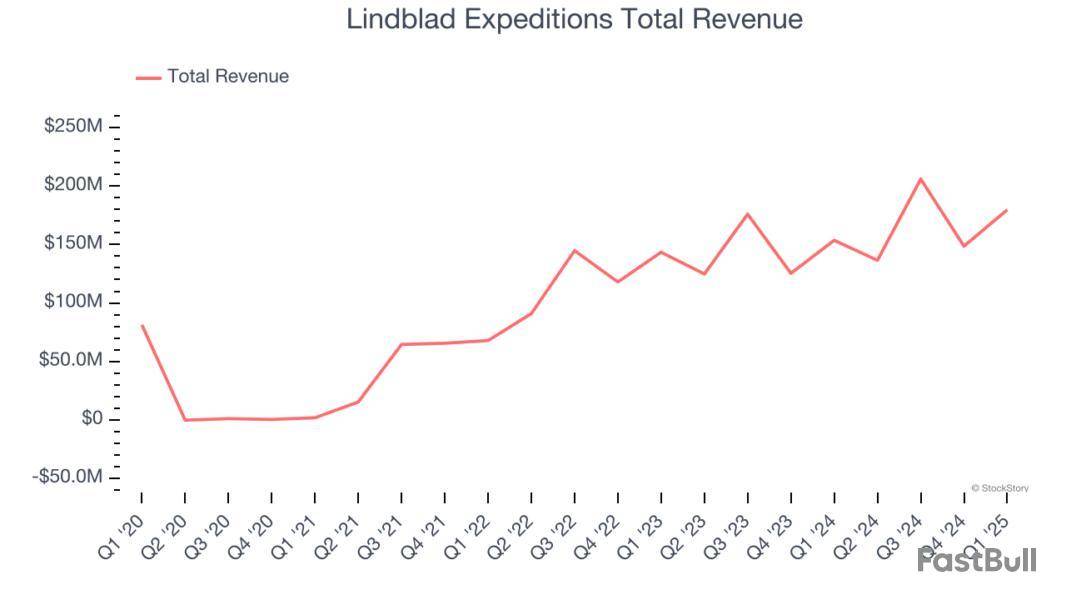

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $179.7 million, up 17% year on year, outperforming analysts’ expectations by 18.8%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Lindblad Expeditions scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 21.8% since reporting. It currently trades at $11.10.

Is now the time to buy Lindblad Expeditions? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Hilton Grand Vacations

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.15 billion, flat year on year, falling short of analysts’ expectations by 7.6%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Hilton Grand Vacations delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 19.2% since the results and currently trades at $40.09.

Read our full analysis of Hilton Grand Vacations’s results here.

Established in 1981, Wyndham is a global hotel franchising company with over 9,000 hotels across nearly 95 countries on six continents.

Wyndham reported revenues of $316 million, up 3.6% year on year. This print met analysts’ expectations. Zooming out, it was a mixed quarter as it also produced a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 5.9% since reporting and currently trades at $79.99.

Read our full, actionable report on Wyndham here, it’s free.

Founded in 1957, Hyatt Hotels is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Hyatt Hotels reported revenues of $1.72 billion, flat year on year. This result surpassed analysts’ expectations by 2%. It was a very strong quarter as it also put up a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ EPS estimates.

The stock is up 17.7% since reporting and currently trades at $132.66.

Read our full, actionable report on Hyatt Hotels here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Looking back on travel and vacation providers stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Soho House and its peers.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 20 travel and vacation providers stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 4.5% above.

Luckily, travel and vacation providers stocks have performed well with share prices up 11.8% on average since the latest earnings results.

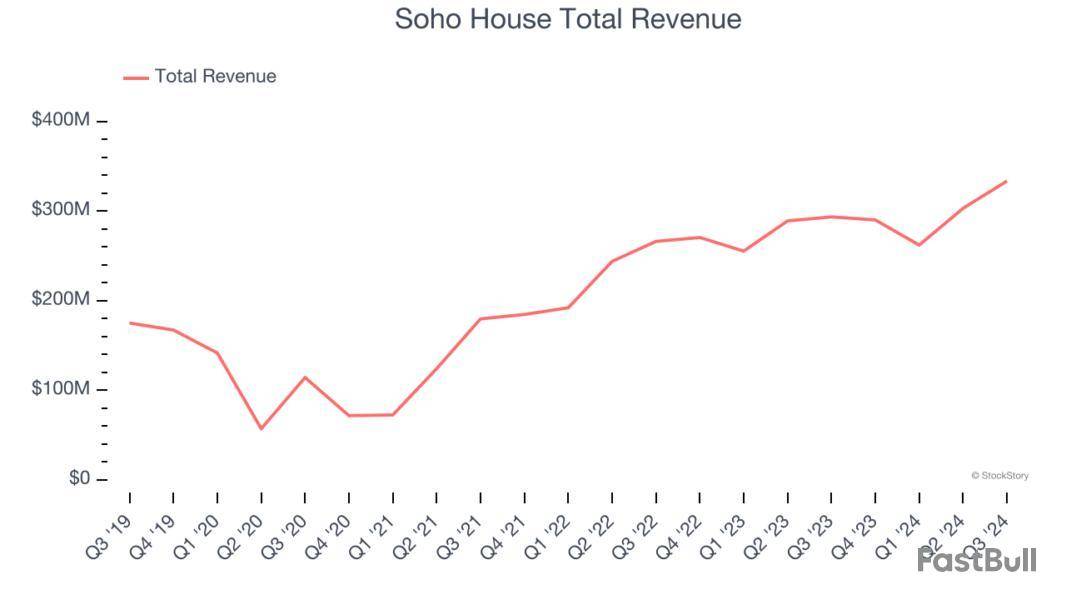

Boasting fancy locations in hubs such as NYC and Miami, Soho House is a global hospitality brand offering exclusive private member clubs, hotels, and restaurants.

Soho House reported revenues of $333.4 million, up 13.6% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a miss of analysts’ members estimates.

"Our third quarter results reflect the strength of our membership model. Membership revenues grew 17% year-on-year, while we achieved our highest ever quarterly Total revenues and Adjusted EBITDA. At the end of the period, we opened Soho Mews House in London, our 45th House, with great feedback from members. We have continued to see significant demand for other recent openings, including Sao Paulo, Mexico City and Portland,” said Andrew Carnie, CEO of Soho House & Co.

Soho House delivered the weakest full-year guidance update of the whole group. Interestingly, the stock is up 39.8% since reporting and currently trades at $6.88.

Read our full report on Soho House here, it’s free.

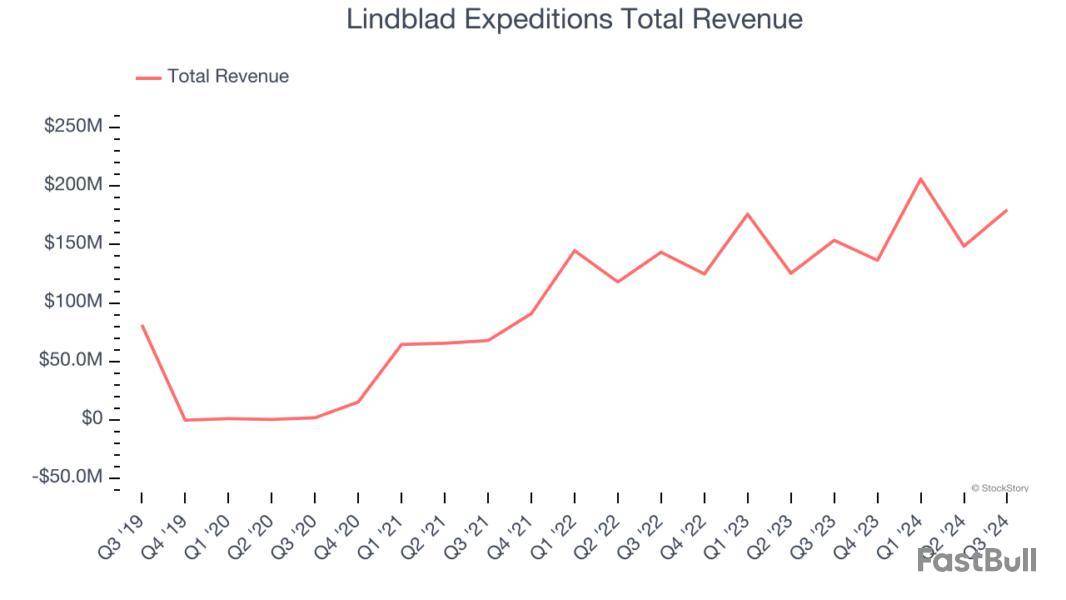

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $179.7 million, up 17% year on year, outperforming analysts’ expectations by 18.8%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Lindblad Expeditions pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 19.6% since reporting. It currently trades at $10.89.

Is now the time to buy Lindblad Expeditions? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Hilton Grand Vacations

Spun off from Hilton Worldwide in 2017, Hilton Grand Vacations is a global timeshare company that provides travel experiences for its customers through its timeshare resorts and club membership programs.

Hilton Grand Vacations reported revenues of $1.15 billion, flat year on year, falling short of analysts’ expectations by 7.6%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Hilton Grand Vacations delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 17% since the results and currently trades at $39.35.

Read our full analysis of Hilton Grand Vacations’s results here.

Founded in 1957, Hyatt Hotels is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Hyatt Hotels reported revenues of $1.72 billion, flat year on year. This print surpassed analysts’ expectations by 2%. It was a very strong quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EPS estimates.

The stock is up 17.6% since reporting and currently trades at $132.53.

Read our full, actionable report on Hyatt Hotels here, it’s free.

With attractions ranging from glacier tours in the Canadian Rockies to an oceanfront geothermal lagoon in Iceland, Pursuit Attractions and Hospitality operates iconic travel experiences, experiential marketing services, and exhibition management across North America and Europe.

Pursuit reported revenues of $37.58 million, down 86.3% year on year. This result came in 3.5% below analysts' expectations. Overall, it was a softer quarter as it also logged a significant miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

Pursuit had the slowest revenue growth among its peers. The stock is down 7.9% since reporting and currently trades at $27.33.

Read our full, actionable report on Pursuit here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Consumer stocks were advancing pre-bell Wednesday as the Consumer Staples Select Sector SPDR Fund and Consumer Discretionary Select Sector SPDR Fund were up 0.1% recently.

Alibaba's e-commerce service, AliExpress, was found to be in breach of its obligation under the EU's Digital Services Act to assess and mitigate risks associated with the dissemination of illegal products, preliminary findings by the European Commission showed. Shares of Alibaba Group Holding were down more than 1% premarket.

Hyatt Hotels shares were 0.3% higher after the company said it completed the acquisition of Playa Hotels & Resorts (PLYA), expanding its portfolio of all-inclusive resorts to meet growing guest demand.

JD.com founder Richard Liu outlined plans to revitalize the company after what he called five years of stagnation, multiple news outlets reported, citing Chinese media and a company spokesperson. Shares of JD.com were down 0.8% premarket.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up