Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Caroline Pham, acting chair of the Commodities Futures Trading Commission (CFTC), confirmed a report from CoinDesk that the agency is in direct talks with regulated exchanges to launch spot crypto trading, including leveraged offerings, as soon as next month.

Pham confirmed the report in a post on X, writing, "True," in reference to the CoinDesk report published Sunday morning, even as the federal government shutdown delays other crypto policy initiatives.

According to the report, Pham has held talks with CFTC-regulated designated contracts markets (DCMs) exchanges, a list that includes finance giants CME, Cboe Futures Exchange, and ICE Futures along with crypto-native firms like Coinbase Derivatives and prediction markets Kalshi and Polymarket US, about launching spot crypto trading products involving margin, leverage, and financing.

"As we continue to work with Congress on bringing legislative clarity to these markets, we are also using existing authorities to swiftly implement recommendations in the President's Working Group on Digital Asset Markets report," Pham told CoinDesk in a statement.

The initiative marks a significant shift in how U.S. regulators are approaching crypto markets. Rather than waiting for Congressional action to grant the CFTC explicit authority over spot crypto markets, Pham is leveraging existing provisions of the Commodity Exchange Act that require retail trading of commodities with leverage, margin, or financing to occur on regulated exchanges.

Leveraged spot crypto trading would allow investors to borrow funds to amplify their positions in digital assets like bitcoin and ether, potentially multiplying both gains and losses. In these products, traders typically put up a portion of the total trade value as collateral, known as margin, while the exchange or broker provides financing for the remainder. For example, with 5x leverage, a trader could control $5,000 worth of bitcoin with just $1,000 of their own capital.

While such products have been widely available on offshore crypto exchanges for years, offering them on CFTC-regulated platforms would bring institutional-grade oversight, risk management standards, and investor protections to leveraged crypto trading in the U.S. market for the first time.

Turnover at the CFTC?

Though the CFTC typically has five commissioners, usually representing different political affiliations, Pham is currently the sole commissioner, with the other seats vacant, giving her increased authority to steer the federal agency.

Pham is moving forward despite the government shutdown's delay of the expected confirmation of Trump nominee Mike Selig, currently chief counsel for the SEC's Crypto Task Force, as head of the agency. Selig was selected by Trump after the President's previous nominee, Brian Quintenz, was dropped from consideration after some high-profile members of the crypto industry lobbied against his appointment, including a16z crypto and Gemini founders Tyler and Cameron Winklevoss.

According to the CoinDesk report, Pham is expected to join global crypto payments firm MoonPay as chief legal officer and chief administrative officer following her CFTC tenure. Pham's confirmation post did not specifically address the MoonPay plans mentioned in the CoinDesk report; The Block could not immediately reach Pham or the CFTC for comment.

The initiative also aligns with a September joint guidance from the SEC and CFTC, which clarified that registered exchanges are not prohibited from facilitating trading of certain spot commodity products, including crypto assets.

"The joint statement from the SEC and CFTC today gives major U.S. exchanges the green light to offer spot trading on leading digital assets," Two Prime Digital Assets CEO Alexander Blume said in an email to The Block at the time. "This opens the door for even more mainstream adoption, granting direct access to these commodity assets at venues where trillions of dollars already reside."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

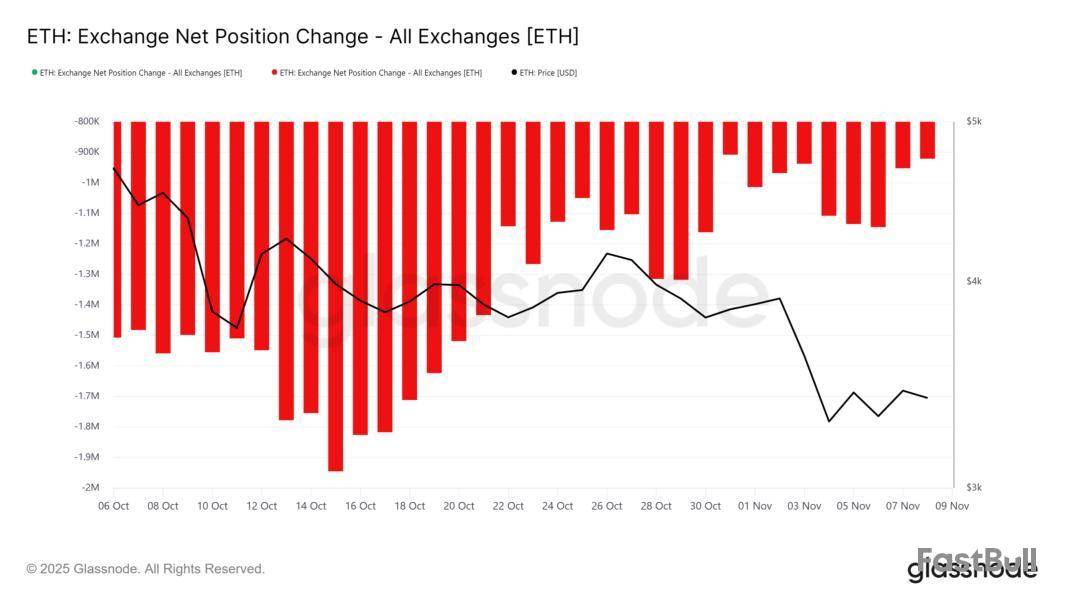

Ethereum has failed to regain momentum following a 15.8% decline earlier this month. The altcoin king continues to struggle with weak recovery signals, trading sideways as investors cautiously adjust their positions.

Although selling pressure has eased, Ethereum’s price recovery remains limited due to broader market headwinds.

Ethereum Investors’ Selling Recedes

Data from the exchange net position change indicator shows a gradual decline in Ethereum outflows over the past few days. This trend suggests investors are slowing their selling activity, which could favor a potential stabilization in price.

A consistent reduction in exchange outflows typically reflects cooling bearish sentiment among traders. However, the current phase marks a pause rather than a reversal. The drop in selling volume has yet to translate into notable accumulation, a key condition for sustained recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Relative Strength Index (RSI) paints a cautious picture of Ethereum’s momentum. The indicator remains below the neutral 50 mark, signaling persistent bearish pressure despite a slight rebound from oversold conditions. This suggests that sellers still hold dominance, and ETH’s path to recovery remains uncertain.

For Ethereum to reclaim bullish momentum, the RSI must climb above 50 and sustain higher readings. Such a move would indicate renewed investor confidence and stronger buying activity, which could help drive price recovery.

ETH Price May End Up Consolidating

Ethereum is trading at $3,512, holding slightly above the $3,489 support level after recent volatility. Despite minor improvements, the altcoin king remains below key resistance levels, struggling to recover fully from this month’s 15.8% decline.

ETH price must breach the $3,607 resistance to confirm a shift in trend. Current indicators suggest it may continue consolidating within the $3,489 to $3,287 range as momentum remains neutral.

If market conditions improve next week, Ethereum could bounce back and test $3,607 again. A successful breakout could push the price toward $3,802. This would signal renewed bullish strength and invalidate the current bearish outlook.

Bitcoin, gold, and silver prices are trending on shaky grounds as bullish momentum weakens, progressively putting BTC, XAU, and XAG at the cusp of corrections.

Analysts say Bitcoin is acting as if it has found its IPO price, with original sellers exiting, venture capital liquidity drying up, and fear rising. If this is the case, the pioneer crypto could very well be looking for a bottom.

Support at $100,300 Remains the Lifeline for Bitcoin Price

Researcher Jordi Visser says Bitcoin appears to have found its IPO price, signaling early signs of a market bottom. The tongue-in-cheek post aligns with remarks from other analysts suggesting a shift to market maturity.

From a technical standpoint, however, the pioneer crypto risks a breakdown before the next bullish wave. After breaking below the ascending trendline, BTC dropped to test the $100,300 support level.

The $100,300 support level is critical, serving as the mean threshold or midline of the demand zone between $102,120 and $98,200. A break and close below it on the daily timeframe, therefore, would confirm the continuation of the downtrend. Traders looking to take short positions on BTC/USDT should consequently wait for confirmation below $100,300.

With the RSI (Relative Strength Index) below 50, buyer momentum remains weak, and the price could pull back. Below $100,300, the BTC price could drop to $93,708, which is nearly 10% below current levels.

However, as $100,300 continues to hold as a support level, the Bitcoin price could push north, potentially breaking above immediate resistance at $104,300. To confirm an uptrend, however, bulls are already waiting above $108,173 to interact with the BTC price.

The ensuing buyer momentum above the aforementioned level could see the Bitcoin price rise to $111,999. In a highly bullish case, BTC could ascend to flip $117,552 into support. For a shot at a new all-time high, however, BTC must record a daily candlestick close above $123,891.

The RSI is also showing signs of an imminent buy signal, which will be executed once the purple line (RSI) itself) crosses above its signal line (yellow).

Gold Price Failed Every Time It Tested This Resistance

The gold price has tested this falling trendline since late October, and each time it has, it has corrected. Based on this history, the recent test may not be any different, and the XAU price could fall to $3,983.

If the $3,983 support level fails to hold, the gold price could extend a leg south to $3,964, or in the dire case, fall to $3,938.

Bearish sentiment for the gold price was exacerbated by the sell signal executed when the RSI crossed below its signal line.

Conversely, if bullish momentum increases at current levels, the gold price could break above the midline of the ascending parallel channel, which confluences with the descending trendline.

This breakout, confirmed with a one-hour candlestick close above $4,014, would put the XAU/USD trading pair back on course for more gains, defined within this ascending parallel channel.

Such a directional bias could see the gold price reclaim the $4,040 threshold, levels last tested in late October. In a highly bullish case, the XAU/USD pair could rise to $4,061.

Silver’s Two-Week Support Faces Stress Test

Since October 25, the ascending trendline has provided significant support for the silver price, which has consolidated along it as it pushed higher. Now, with multiple resistances looming, this longstanding support is subjected to what can only be a stress test.

While the 50-day SMA (Simple Moving Average) offers initial support at $48.05, overhead pressure due to the 100- and 200-day SMAs at $48.89 and $48.49, respectively, could cap silver’s short-term upside potential.

If the ascending trendline breaks as support, the silver price could provide another buying opportunity at $47.36, which coincides with the 78.6% Fibonacci retracement level. The dire case is a fall off the cliff to $45.45, nearly 6% below current levels.

The RSI position at 52 also suggests not-so-strong buying pressure, increasing the odds of a pullback.

On the other hand, if the 50-day SMA at $48.05 serves as a buyer congestion level, buying pressure from this support could catalyze further upside.

A decisive break and close above the resistance confluence at $48.86, earmarked by the most critical Fibonacci retracement level of 61.8%, could encourage more buy orders, sending XAG/USD above $49.23.

In a recent social media post, prominent venture capitalist Jason Calacanis has stated that he would never touch Michael Saylor's Strategy even if the stock were to crash.

Calacanis also argues that there should be no Bitcoin bailouts if the company happens to go underwater.

The caustic comments of the early Uber investor come after the Wall Street Journal reported that digital asset treasury companies are "crumbling."

Earlier, Calacanis argued that investors have to avoid Saylor and buy Bitcoin directly. Back then, the angel investor said that he was 95% certain that he would end up being right.

He has also claimed that Strategy's bet was too "convoluted," but he has stopped short of describing it as a Ponzi scheme in his most recent social media post.

"Whenever you see a company using creative new metrics or innovative capital structures, consider that worthy of deeper investigation. Could be nothing, could be brilliant, or could be something bad," Calacanis said back in April.

For now, there is only a 3% chance of Strategy being forced to liquidate its holdings.

Will Strategy bounce back?

As reported by U.Today, Jim Chanos, founder of Kynikos Associates, recently announced that the firm had unwound its anti-MSTR trade after pocketing hefty returns. The stock of the leading Bitcoin treasury firm had crashed by a whopping 45% after Chanos initially announced his bet against Saylor in mid-May.

In late October, Strategy had to boost yield on its preferred shares in order to increase faltering demand.

Some believe that Chanos's latest move might be a sign that cryptocurrency treasury companies will finally see some sort of bullish reversal after facing steep losses.

For now, however, they remain under rather severe pressure, and those companies whose crypto holdings are currently in the red will struggle to sell more shares.

After a disappointing performance during the week, the price of Bitcoin has continued its sluggish action over the weekend. According to data from CoinGecko, the premier cryptocurrency has been hovering around the $102,000 level over the past 24 hours.

While this current choppy price action seems like an improvement from the severe downturn witnessed in recent days, it doesn’t particularly bring calm to the world’s largest cryptocurrency. Interestingly, the latest on-chain data suggests that the Bitcoin price might still be at risk of further correction in the coming days.

Why BTC Price Might Find Bottom Around $95,000

In a November 8 post on the social media platform X, on-chain analyst Burak Kesmeci predicted the local bottom for the price of Bitcoin. According to the crypto pundit, the flagship cryptocurrency could fall to as low as $95,000 before seeing relief and perhaps rebounding to new price highs.

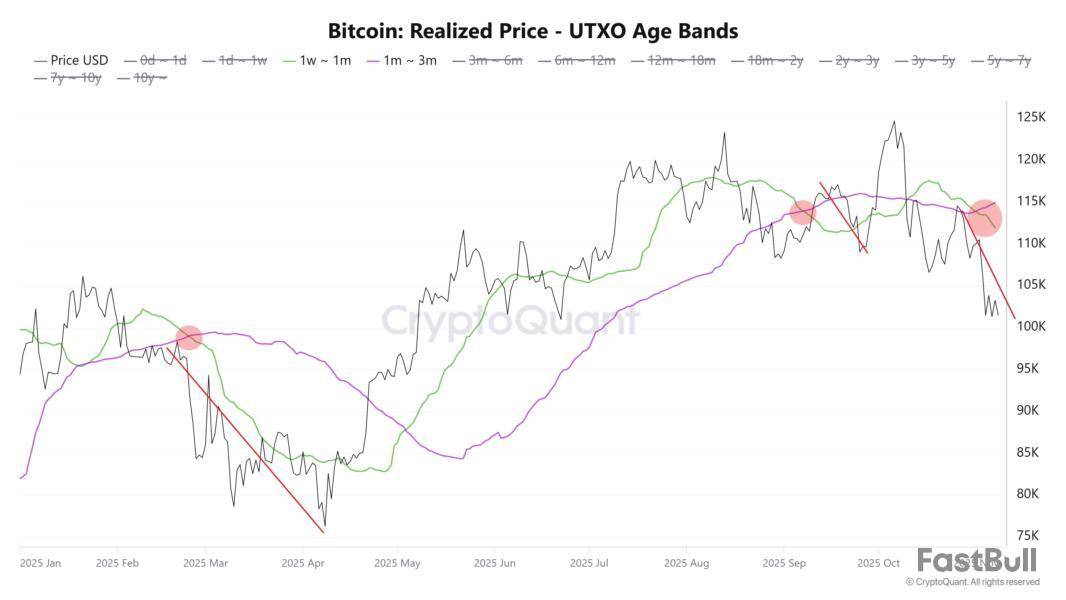

The relevant metric here is the Realized Price of Unspent Transaction Output (UTXO) age bands, which evaluate the holding pattern of different investor classes through their different realized prices. The UTXO age bands metric tracks the average price at which Bitcoin holders purchased their coins compared to how long they’ve held the assets.

The age bands under focus in Kesmeci’s analysis are the 1-week to 1-month group (green line) and the 1-month to 3-month cohort (purple line), which offer insight into short-term holders’ behavior and overall market sentiment. According to the on-chain analyst, the green line has crossed below the purple line three times in 2025.

Kesmeci noted that this cross often preceded short-term corrections, including the ones seen on February 24 ($99,000 to $76,000) and September 8 ($117,000 to $109,000). Similarly, this cross occurred on November 1, with the Bitcoin price falling from $110,000 to $99,000.

Furthermore, the average dip suffered by the Bitcoin price on these three occasions stands at around 13.3%, with a 45-day consolidation period. Based on this historical pattern, Kesmeci expects the Bitcoin price bottom to form around the $95,000 and $96,000 region after the most recent crossing of the 1-week to 1-month band below the 1-month to 3-month band.

Kesmeci concluded:

In short, long-term investors are in the red, and this is an undesirable situation for a bull cycle. However, if history repeats itself, Bitcoin may “catch its breath” once more in this region and prepare the ground for a new rise.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands around $102,440, reflecting a nearly 1% decline in the past day.

Spanish crypto influencer Álvaro Romillo, founder of the alleged Ponzi scheme Madeira Invest Club (MIC), has been detained without bail by a Spanish court on charges of perpetrating a $300 million fraud.

Romillo was arrested in Spain on Thursday after being deemed a flight risk when Spanish officials discovered a Singapore bank account, funded with €29 million ($33.5 million) from businesses linked to Romillo, according to local news reports. National Court judge José Luis Calama ordered Romillo imprisoned without bail after Romillo testified before the court, answering questions for two hours.

The Central Operational Unit of Spain's Civil Guard believes Romillo's MIC perpetrated a Ponzi scheme that defrauded 3,000 victims for a total of €260 million (over $300 million). Spanish authorities began probing MIC in late 2024, announcing three complaints in Oct. 2024. Over the past year, Romillo has cooperated with authorities, appearing at court hearings, while law enforcement seized assets including dozens of luxury cars .

Only when prosecutors discovered the foreign bank accounts was Romillo arrested out of fear that he would flee the country, according to reports. The fraud could wind up with Romillo sentenced "to 9 years in prison, and even up to 18 years in prison if it is considered that they constitute a mass offense," a report obtained by Cadena SER stated.

MIC solicited deposits (around €2,000 minimum per investor) to buy digital “artwork” contracts and shares in luxury goods, like yachts, Ferraris, and gold, with guaranteed buyback and fixed profits that were unusually high, at around 20% per year. Romillo told the court during his appearance Friday that he intended to pay investors back and has even returned money to 2,700 parties, though he did so in cash and claimed to have no way to account for the payments.

Romillo had also previously admitted to funding the 2024 election campaign of far-right Spanish MEP Luis "Alvise" Pérez, leader of the SALF party, with a €100,000 under-the-table cash donation. Pérez is under investigation in a separate case from the larger MIC investigation.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

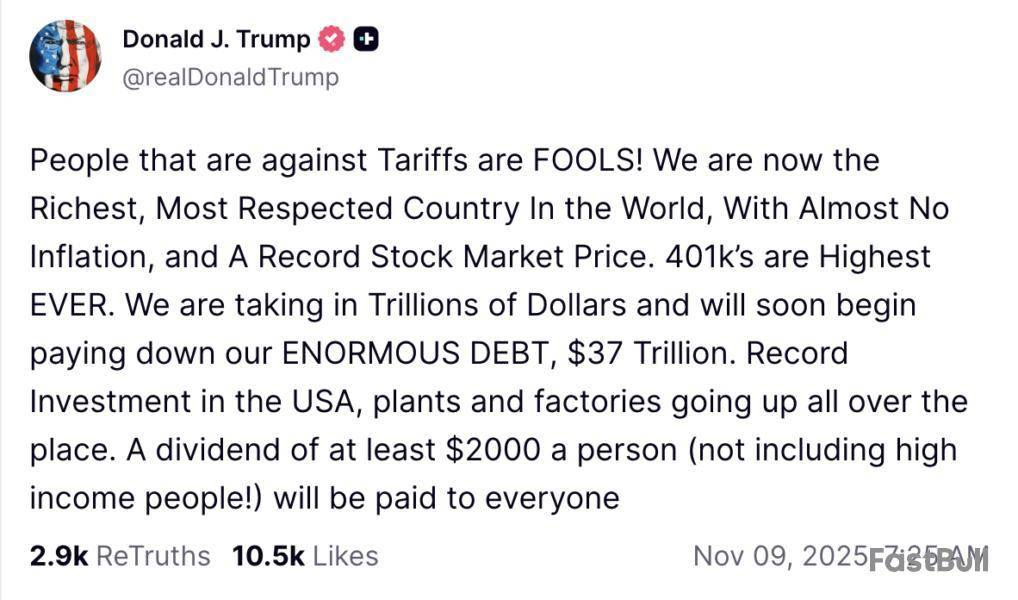

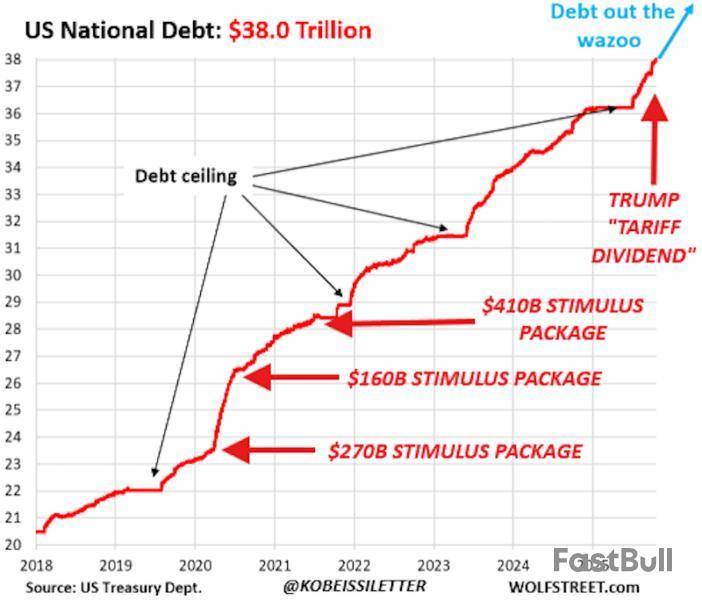

United States President Donald Trump announced on Sunday that most Americans will receive a $2,000 “dividend” from the tariff revenue and criticized the opposition to his sweeping tariff policies.

“A dividend of at least $2000 a person, not including high-income people, will be paid to everyone,” Trump said on Truth Social.

The US Supreme Court is currently hearing arguments about the legality of the tariffs, with the overwhelming majority of prediction market traders betting against a court approval.

Kalshi traders place the odds of the Supreme Court approving the policy at just 23%, while Polymarket traders have the odds at 21%. Trump asked:

Investors and market analysts celebrated the announcement as economic stimulus that will boost cryptocurrency and other asset prices as portions of the stimulus flow into the markets, but also warned of the long-term negative effects of the proposed dividend.

The proposed economic stimulus will boost asset markets, but at a steep cost

Investment analysts at The Kobeissi Letter forecast that about 85% of US adults should receive the $2,000 stimulus checks, based on distribution data from the economic stimulus checks during the COVID era.

While a portion of the stimulus will flow into markets and raise asset prices, Kobeissi Letter warned that the ultimate long-term effect of any economic stimulus will be fiat currency inflation and the loss of purchasing power.

“If you don’t put the $2,000 in assets, it is going to be inflated away or just service some interest on debt and sent to banks,” Bitcoin analyst, author, and advocate Simon Dixon said.

“Stocks and Bitcoin only know to go higher in response to stimulus,” investor and market analyst Anthony Pompliano said in response to Trump’s announcement.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up