マーケット情報

ニュース

分析

ユーザー

7x24

経済カレンダー

NULL_CELL

データ

- 名前

- 最新値

- 戻る

NULL_CELL

NULL_CELL

すべてのコンテスト

イギリス 貿易収支 (10月)

イギリス 貿易収支 (10月)実:--

予: --

戻: --

イギリス サービス産業指数前月比

イギリス サービス産業指数前月比実:--

予: --

戻: --

イギリス 建設出力前月比 (SA) (10月)

イギリス 建設出力前月比 (SA) (10月)実:--

予: --

戻: --

イギリス 工業生産高前年比 (10月)

イギリス 工業生産高前年比 (10月)実:--

予: --

戻: --

イギリス 貿易収支 (SA) (10月)

イギリス 貿易収支 (SA) (10月)実:--

予: --

戻: --

イギリス EU貿易収支(SA) (10月)

イギリス EU貿易収支(SA) (10月)実:--

予: --

戻: --

イギリス 製造業生産高前年比 (10月)

イギリス 製造業生産高前年比 (10月)実:--

予: --

戻: --

イギリス GDP前月比 (10月)

イギリス GDP前月比 (10月)実:--

予: --

戻: --

イギリス GDP前年比(SA) (10月)

イギリス GDP前年比(SA) (10月)実:--

予: --

戻: --

イギリス 工業生産高前月比 (10月)

イギリス 工業生産高前月比 (10月)実:--

予: --

戻: --

イギリス 建設生産高前年比 (10月)

イギリス 建設生産高前年比 (10月)実:--

予: --

戻: --

フランス HICP 最終前月比 (11月)

フランス HICP 最終前月比 (11月)実:--

予: --

戻: --

中国、本土 貸出残高の前年比伸び率 (11月)

中国、本土 貸出残高の前年比伸び率 (11月)実:--

予: --

戻: --

中国、本土 M2マネーサプライ前年比 (11月)

中国、本土 M2マネーサプライ前年比 (11月)実:--

予: --

戻: --

中国、本土 M0 マネーサプライ前年比 (11月)

中国、本土 M0 マネーサプライ前年比 (11月)実:--

予: --

戻: --

中国、本土 M1 マネーサプライ前年比 (11月)

中国、本土 M1 マネーサプライ前年比 (11月)実:--

予: --

戻: --

インド CPI前年比 (11月)

インド CPI前年比 (11月)実:--

予: --

戻: --

インド 預金残高前年比

インド 預金残高前年比実:--

予: --

戻: --

ブラジル サービス産業の前年比成長率 (10月)

ブラジル サービス産業の前年比成長率 (10月)実:--

予: --

戻: --

メキシコ 工業生産高前年比 (10月)

メキシコ 工業生産高前年比 (10月)実:--

予: --

戻: --

ロシア 貿易収支 (10月)

ロシア 貿易収支 (10月)実:--

予: --

戻: --

フィラデルフィア連銀総裁ヘンリー・ポールソン氏が演説

フィラデルフィア連銀総裁ヘンリー・ポールソン氏が演説 カナダ 建築許可MoM (SA) (10月)

カナダ 建築許可MoM (SA) (10月)実:--

予: --

戻: --

カナダ 卸売売上高前年比 (10月)

カナダ 卸売売上高前年比 (10月)実:--

予: --

戻: --

カナダ 卸売在庫前月比 (10月)

カナダ 卸売在庫前月比 (10月)実:--

予: --

戻: --

カナダ 卸売在庫前年比 (10月)

カナダ 卸売在庫前年比 (10月)実:--

予: --

戻: --

カナダ 卸売売上高前月比 (SA) (10月)

カナダ 卸売売上高前月比 (SA) (10月)実:--

予: --

戻: --

ドイツ 当座預金口座 (SA ではない) (10月)

ドイツ 当座預金口座 (SA ではない) (10月)実:--

予: --

戻: --

アメリカ 毎週の合計ドリル

アメリカ 毎週の合計ドリル実:--

予: --

戻: --

アメリカ 毎週の石油掘削総量

アメリカ 毎週の石油掘削総量実:--

予: --

戻: --

日本 短観非製造業大規模ディファレンス指数 (第四四半期)

日本 短観非製造業大規模ディファレンス指数 (第四四半期)--

予: --

戻: --

日本 短観小規模製造業普及指数 (第四四半期)

日本 短観小規模製造業普及指数 (第四四半期)--

予: --

戻: --

日本 短観大規模非製造業景気見通し指数 (第四四半期)

日本 短観大規模非製造業景気見通し指数 (第四四半期)--

予: --

戻: --

日本 短観大企業製造業景気見通し指数 (第四四半期)

日本 短観大企業製造業景気見通し指数 (第四四半期)--

予: --

戻: --

日本 中小企業製造業短観指数 (第四四半期)

日本 中小企業製造業短観指数 (第四四半期)--

予: --

戻: --

日本 短観大企業製造業普及指数 (第四四半期)

日本 短観大企業製造業普及指数 (第四四半期)--

予: --

戻: --

日本 大企業短観 設備投資額前年比 (第四四半期)

日本 大企業短観 設備投資額前年比 (第四四半期)--

予: --

戻: --

イギリス ライトムーブ住宅価格指数前年比 (12月)

イギリス ライトムーブ住宅価格指数前年比 (12月)--

予: --

戻: --

中国、本土 工業生産高前年比 (YTD) (11月)

中国、本土 工業生産高前年比 (YTD) (11月)--

予: --

戻: --

中国、本土 都市部の失業率 (11月)

中国、本土 都市部の失業率 (11月)--

予: --

戻: --

サウジアラビア CPI前年比 (11月)

サウジアラビア CPI前年比 (11月)--

予: --

戻: --

ユーロ圏 工業生産高前年比 (10月)

ユーロ圏 工業生産高前年比 (10月)--

予: --

戻: --

ユーロ圏 工業生産高前月比 (10月)

ユーロ圏 工業生産高前月比 (10月)--

予: --

戻: --

カナダ 既存住宅販売前月比 (11月)

カナダ 既存住宅販売前月比 (11月)--

予: --

戻: --

ユーロ圏 準備資産合計 (11月)

ユーロ圏 準備資産合計 (11月)--

予: --

戻: --

イギリス インフレ率の期待

イギリス インフレ率の期待--

予: --

戻: --

カナダ 国民経済信頼感指数

カナダ 国民経済信頼感指数--

予: --

戻: --

カナダ 新規住宅着工数 (11月)

カナダ 新規住宅着工数 (11月)--

予: --

戻: --

アメリカ ニューヨーク連銀製造業雇用指数 (12月)

アメリカ ニューヨーク連銀製造業雇用指数 (12月)--

予: --

戻: --

アメリカ ニューヨーク連銀製造業景気指数 (12月)

アメリカ ニューヨーク連銀製造業景気指数 (12月)--

予: --

戻: --

カナダ コアCPI前年比 (11月)

カナダ コアCPI前年比 (11月)--

予: --

戻: --

カナダ 製造業受注残高前月比 (10月)

カナダ 製造業受注残高前月比 (10月)--

予: --

戻: --

カナダ 製造新規受注前月比 (10月)

カナダ 製造新規受注前月比 (10月)--

予: --

戻: --

カナダ コアCPI前月比 (11月)

カナダ コアCPI前月比 (11月)--

予: --

戻: --

カナダ 製造在庫前月比 (10月)

カナダ 製造在庫前月比 (10月)--

予: --

戻: --

カナダ CPI前年比 (11月)

カナダ CPI前年比 (11月)--

予: --

戻: --

カナダ CPI前月比 (11月)

カナダ CPI前月比 (11月)--

予: --

戻: --

カナダ CPI前年比(SA) (11月)

カナダ CPI前年比(SA) (11月)--

予: --

戻: --

カナダ コア CPI 前月比 (SA) (11月)

カナダ コア CPI 前月比 (SA) (11月)--

予: --

戻: --

カナダ CPI前月比(SA) (11月)

カナダ CPI前月比(SA) (11月)--

予: --

戻: --

一致するデータがありません

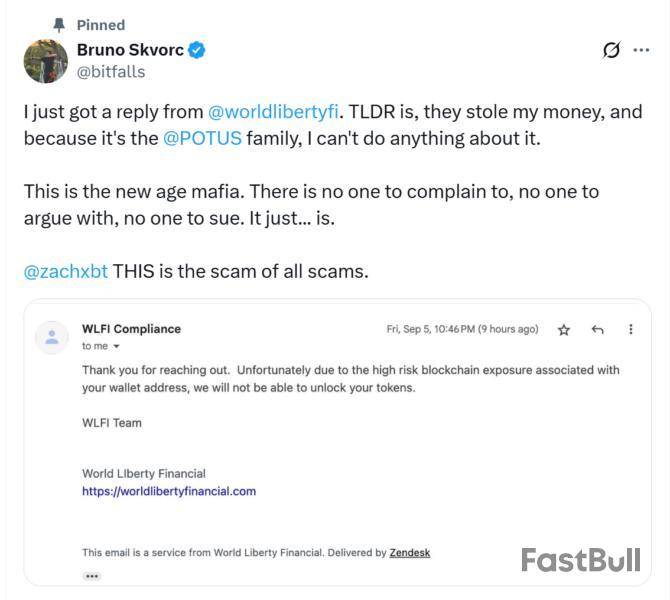

A crypto developer has accused World Liberty Financial (WLFI), a crypto project with ties to US President Donald Trump, of stealing his funds by refusing to unlock his tokens.

In a Saturday post on X, Polygon DevRel Bruno Skvorc shared an email from WLFI’s compliance team, which flagged his wallet address as “high risk” due to blockchain exposure. The team said his tokens would not be released.

“TLDR is, they stole my money,” Skvorc wrote. “And because it’s the @POTUS [The president of the United States] family, I can’t do anything about it. This is the new age mafia. There is no one to complain to, no one to argue with, no one to sue.”

In response to another user, Skvorc claimed that he is one of six investors who were subject to 100% token lockups from the beginning. “It was not ‘high risk’ to accept money from this address, but it is high risk to unlock owed money into it,” he wrote.

Compliance tools to blame?

The incident sparked criticism of the compliance tools used by projects like WLFI. Onchain sleuth ZachXBT chimed in, explaining that automated tools often flag addresses as “high risk” for trivial or incorrect reasons, including interacting with DeFi contracts or exchanges.

“I helped a team manually review addresses for a presale because popular compliance tools labeled them high risk due to unrelated activity several hops away,” ZachXBT said. “These tools are deeply flawed.”

In Skvorc’s case, the flags were traced to a past transaction via crypto mixer Tornado Cash, indirect links to sanctioned entities like Garantex and Netex24, and a previous interaction with a now-blacklisted dashboard.

Based in Croatia, Skvorc is a blockchain developer who worked on Ethereum 2.0. He is also the founder of RMRK, a company integrating multi-resource NFTs into gaming metaverses.

Justin Sun’s WLFI tokens frozen

On Friday, Tron founder Justin Sun also revealed that his WLFI token allocation has been frozen. His wallet was blacklisted after blockchain trackers flagged a $9 million transaction, triggering accusations that he had started selling.

In a post on X, Sun called the freeze “unreasonable” and urged World Liberty Financial to unlock his tokens. He said the decision went against the core values of blockchain and called tokens “sacred and inviolable.”

Publicly traded companies have now collectively accumulated over 1,000,000 BTC, in a historic milestone in Bitcoin adoption. This stash represents nearly 5% of Bitcoin’s fixed 21 million supply, as institutional conviction around the asset continues to grow.

From corporate treasuries of prominent firms to Bitcoin mining firms and ETF issuers, the presence of publicly listed companies in the market has significantly expanded over the past few years.Metaplanet, Mallers, and More

Leading the pack of corporate Bitcoin holders is Strategy, the company co-founded by Michael Saylor, which began stacking coins in August 2020. Today, Strategy controls 636,505 BTC, which makes it the clear frontrunner among corporate treasuries.

The gap to second place is massive as MARA Holdings owns 52,477 BTC, with just 705 BTC added in August. Despite this, new challengers are quickly building sizable positions. For instance, Jack Mallers’ XXI already commands 43,514 BTC, while the Bitcoin Standard Treasury Company holds 30,021 BTC.

Other heavyweight names include Bullish, which has secured 24,000 BTC, alongside Metaplanet at 20,000 BTC. Publicly traded players such as Riot Platforms, Trump Media & Technology Group, CleanSpark, and Coinbase also emerged as increasingly important participants in this rapidly growing corporate accumulation trend.The Hidden Crisis

Bitcoin’s surging popularity on Wall Street is ironicallysqueezingthe very backbone of its network – miners. While institutional inflows have propelled BTC prices higher, on-chain activity has not kept pace, which has left transaction fees at historic lows, according to CoinMetrics.

This imbalance is particularly damaging in a post-halving environment, where block rewards have already been slashed and fees now account for less than 1% of miner revenue.

With profitability increasingly tied to price appreciation alone, miners face mounting financial pressure and are often forced to liquidate holdings or shut down operations entirely. The risk extends beyond economics since reduced miner participation also threatens decentralization and could concentrate network security in the hands of dominant pools like Foundry and Antpool, which already control nearly half of total hashpower.

The 2028 halving will cut rewards to just 1.5625 BTC per block, which is expected to pose an even bigger challenge. Without new uses that boost demand for blockspace, Bitcoin’s security could weaken, and its “digital gold” narrative may drift away from the incentives that keep the network safe.

Hyperliquid, a popular decentralized cryptocurrency exchange with a native L1 blockchain, has announced the details of a major incoming upgrade. The launch of the USDH stablecoin is the backbone element of the upgrade, while a radical fee cut and a listing procedure revamp are set to make Hyperliquid the go-to solution for on-chain trading.

80% lower fees, democratic listing: Hyperliquid eyes major upgrade

According to an announcement on the project's Discord, Hyperliquid, a mainstream decentralized exchange backed by its own Layer-1 blockchain, is close to the activation of a profound architecture upgrade. Once live, the upgrade will advance traders' experience and introduce new opportunities.

800.HL@degennQuantSep 05, 2025HYPERLIQUID IS RELEASING $USDH

A Hyperliquid-first, Hyperliquid-aligned, and compliant USD stablecoin. pic.twitter.com/9oonRulXZD

First, the exchange is set to see the biggest spot trading fee cut in its history. Maker fees and taker rebates will be cut by 80%, making trading more cost-effective for all spot quote asset holders. This measure is designed to bring new liquidity to the platform.

Then, the team has ambitions to make spot quote assets permissionless, starting from the testnet version. It means that everyone will eventually be able to list their own cryptocurrency on Hyperliquid's spot model. Besides making the design of the exchange more democratic, it will also result in new liquidity and users joining the platform.

The release of the USDH stablecoin is the most debated change envisioned by the upcoming upgrade's agenda. The new asset will go live on Hyperliquid's L1, being a "Hyperliquid-first" and "Hyperliquid-aligned" stablecoin.

While the USDH ticker is reserved for Hyperliquid's stablecoin, the exact team to lead its development is yet to be chosen. The decision will be up to Hyperliquid validators, the announcement says.

USDH stablecoin taking shape: Proposal by community

One of the first proposals for the USDH stablecoin's deployment was published by Max Fiege, a Hyperliquid enthusiast and DeFi developer.

His team — named Native Markets — designed USDH as a GENIUS-compliant HyperEVM-based asset with fiat rails by Stripe's Bridge. Fiege confirmed that MC Lader, the former president and COO of Uniswap Labs, is ready to curate the development of the new product.

Noel.hl (theo arc)@NarwhalTanSep 05, 2025There’s no second best.

His name is @fiege_max .

Hyperliquid. pic.twitter.com/z9G6u5JCUy

USDH operations should be beneficial for Hyperliquid Foundation and its ecosystem, not for competing centralized exchanges. A meaningful part of its revenue should be brought back to Assistance Fund, the author added.

Today, Hyperliquid's HYPE price jumped to September's high at $47.78, being 7% up in a week.

Chainlink price is facing renewed selling pressure after the bulls failed to hold critical levels. As of press time, LINK is being sold across exchanges at $22.17, with a 2.87% discount over yesterday. The market cap stands at $15.04 billion, while 24-hour trading volume sits at $1.17 billion. Wondering how the LINK price has performed over the past 24 hours? The token has ranged between $22.06 and $23.18, showing volatility around support.

It is worth mentioning that, despite the struggles on the price chart, Chainlink continues to push forward on the fundamentals front. The Chainlink Reserve recently added 43,937.57 LINK, boosting its total holdings to 237,014.07 LINK. More importantly, Chainlink has also secured an integration with the Bureau of Economic Analysis, which will feed core U.S. macroeconomic data.

Why is LINK Price Dropping?

A mix of profit-taking and rejection near resistance has led to this downturn. The previous rally attracted sellers eager to book their gains, especially as LINK price struggled to hold above $23. Market conditions have tilted toward caution, with sentiment going defensive despite positive fundamental news.

Chainlink Price Analysis

Now that we are well aware of the latest price trends, let us dive into price analysis, without further ado. The latest rejection at $24.85 triggered a wave of stop-loss orders and algorithmic selling, thereby dragging the Chainlink price below the $23.00 support. That breakdown has charged-up sellers, who are now eyeing $21.04.

Talking about indicators, most of which are bearish. The MACD histogram sits at -0.49, which further confirms the downtrend. LINK also trades below its 30-day SMA at $23.47. On top of that, the price is testing the 38.2% Fibonacci retracement at $23.48, which has become the immediate resistance. However, a close above this level could ease selling pressure and pave the way for consolidation.

The Bollinger Bands show narrowing volatility, with price hugging the lower band around $22. This setup often precedes sharp moves, meaning the next sessions could see either a breakdown toward $21.04 or a rebound if bulls reclaim $23.48. If the uptrend remains intact, the Chainlink price could also target the $26.49 mark.

FAQs

Why did Chainlink’s price drop today?LINK fell due to profit-taking and stop-loss triggers after failing to hold $23. Bears now target $21.04.

What is the key resistance level for LINK?The immediate resistance is at $23.48, a rebound above it could stabilize prices.

Is Chainlink still fundamentally strong?Yes, with the Chainlink Reserve expanding and U.S. economic data feeds integrating, its fundamentals remain robust despite price volatility.

Civic will conduct an AMA on X on September 9 at 16:00 UTC to examine methods of delivering enhanced proof capabilities while limiting data disclosure.

Refer to the official tweet by CVC:

Civic@civickeySep 05, 2025Your data shouldn’t be the product🔒@provenauthority joins us LIVE on Tuesday 9/9 to chat about how to prove more while sharing less. pic.twitter.com/vXAaICkvTJ

CVC Info

Civic is a blockchain-based technology company that focuses on digital identity verification. The company's main goal is to provide every person on Earth with a digital identity that they can use to interact privately and securely with the world.

The company's flagship product, Civic Pass, is an integrated permissioning tool that helps business customers enable secure access to their on-chain assets.

The Civic Ecosystem is based on the Civic Token (CVC), an ERC-20 token on the Ethereum blockchain. Tokens are required for carrying out operations related to personal identification.

Lisk will hold “The Mixer” on September 9 at 16:30 UTC in Nairobi. The event aims to bring together founders, partners, builders, and media representatives from the Web3 ecosystem. It offers an opportunity for informal networking, idea exchange, and community engagement.

Refer to the official tweet by LSK:

Lisk@LiskHQSep 05, 2025â³ Two days until we're On the Ground in Kenya! 🇰🇪

In Nairobi next week? Join us on Tuesday 9th for The Mixer — an evening bringing together founders, partners, builders, and media voices from across the ecosystem.

📅 Sept 9 | 7:30pm | Nairobi

Come hang out for an evening of… pic.twitter.com/Rk8RK7Ft2Q

LSK Info

Lisk (LSK) is a blockchain application platform that was established in early 2016. It was created by Max Kordek and Oliver Beddows, and it's based on its own blockchain network and token, known as LSK. The goal of Lisk is to make it easier for developers to build blockchain applications in JavaScript and to deploy their own sidechain linked to the Lisk network.

Lisk aims to solve the problem of network congestion and scalability on the blockchain by implementing sidechains, which are essentially parallel chains that carry the load of running decentralized apps. The sidechain concept allows developers to create customizable blockchains for their own specific set of rules, without affecting the performance of the main blockchain. This way, every decentralized application runs on its own blockchain, reducing the load on the network.

Additionally, Lisk offers a Software Development Kit (SDK) that simplifies the process of building and deploying blockchain applications. With this approach, Lisk hopes to make blockchain technology more accessible to developers and to speed up the adoption of the technology across various industries. It also provides a unique consensus protocol known as Delegated Proof of Stake (DPoS), where stakeholders can vote for delegates to secure the network and validate transactions.

Immutable will unlock 24,520,000 IMX tokens on October 3rd, constituting approximately 1.26% of the currently circulating supply.

IMX Info

Immutable X is the first layer two (L2) scaling solution for non-fungible tokens (NFTs) on Ethereum, with instant trading, massive scalability and zero gas fees for minting and trading, all without compromising user or asset security.

Immutable X utilizes Zero-Knowledge Rollups technology to process transactions off the main Ethereum network, increasing throughput and reducing gas costs. This technology enables the creation, trading, and transaction of NFTs on a much larger scale than is possible on Layer 1 Ethereum.

The IMX token is the native ERC20 utility token of the Immutable X protocol, which users can earn by conducting pro-network activities such as trading, and which can be used to pay fees, perform governance or stake on the protocol.

株式、FX、コモディティ、先物、債券、ETF、仮想通貨などの金融資産を取引する際の損失のリスクは大きなものになる可能性があります。ブローカーに預け入れた資金が完全に失われる可能性があります。したがって、お客様の状況と財政的資源に照らして、そのような取引が適しているかどうかを慎重に検討していただく必要があります.

十分なデューデリジェンスを実施するか、ファイナンシャルアドバイザーに相談することなく、投資を検討するべきではありません。お客様の財務状況や投資ニーズを把握していないため、当社の ウェブコンテンツはお客様に適しない可能性があります。当社の財務情報には遅延があったり、不正確な情報が含まれている可能性があるため、取引や投資に関する決定については、お客様が全責任を負う必要があります。当社はお客様の資本の損失に対して責任を負いません。

ウェブサイトから許可を得ずに、ウェブサイトのグラフィック、テキスト、または商標をコピーすることはできません。このウェブサイトに組み込まれているコンテンツまたはデータの知的財産権は、そのプロバイダーおよび交換業者に帰属します。

ログインしていません

ログインしてさらに多くの機能にアクセス

FastBull プロ

まだ

購入

サインイン

サインアップ