マーケット情報

ニュース

分析

ユーザー

7x24

経済カレンダー

NULL_CELL

データ

- 名前

- 最新値

- 戻る

NULL_CELL

NULL_CELL

すべてのコンテスト

フランス HICP 最終前月比 (11月)

フランス HICP 最終前月比 (11月)実:--

予: --

戻: --

中国、本土 貸出残高の前年比伸び率 (11月)

中国、本土 貸出残高の前年比伸び率 (11月)実:--

予: --

戻: --

中国、本土 M2マネーサプライ前年比 (11月)

中国、本土 M2マネーサプライ前年比 (11月)実:--

予: --

戻: --

中国、本土 M0 マネーサプライ前年比 (11月)

中国、本土 M0 マネーサプライ前年比 (11月)実:--

予: --

戻: --

中国、本土 M1 マネーサプライ前年比 (11月)

中国、本土 M1 マネーサプライ前年比 (11月)実:--

予: --

戻: --

インド CPI前年比 (11月)

インド CPI前年比 (11月)実:--

予: --

戻: --

インド 預金残高前年比

インド 預金残高前年比実:--

予: --

戻: --

ブラジル サービス産業の前年比成長率 (10月)

ブラジル サービス産業の前年比成長率 (10月)実:--

予: --

戻: --

メキシコ 工業生産高前年比 (10月)

メキシコ 工業生産高前年比 (10月)実:--

予: --

戻: --

ロシア 貿易収支 (10月)

ロシア 貿易収支 (10月)実:--

予: --

戻: --

フィラデルフィア連銀総裁ヘンリー・ポールソン氏が演説

フィラデルフィア連銀総裁ヘンリー・ポールソン氏が演説 カナダ 建築許可MoM (SA) (10月)

カナダ 建築許可MoM (SA) (10月)実:--

予: --

戻: --

カナダ 卸売売上高前年比 (10月)

カナダ 卸売売上高前年比 (10月)実:--

予: --

戻: --

カナダ 卸売在庫前月比 (10月)

カナダ 卸売在庫前月比 (10月)実:--

予: --

戻: --

カナダ 卸売在庫前年比 (10月)

カナダ 卸売在庫前年比 (10月)実:--

予: --

戻: --

カナダ 卸売売上高前月比 (SA) (10月)

カナダ 卸売売上高前月比 (SA) (10月)実:--

予: --

戻: --

ドイツ 当座預金口座 (SA ではない) (10月)

ドイツ 当座預金口座 (SA ではない) (10月)実:--

予: --

戻: --

アメリカ 毎週の合計ドリル

アメリカ 毎週の合計ドリル実:--

予: --

戻: --

アメリカ 毎週の石油掘削総量

アメリカ 毎週の石油掘削総量実:--

予: --

戻: --

日本 短観小規模製造業普及指数 (第四四半期)

日本 短観小規模製造業普及指数 (第四四半期)実:--

予: --

戻: --

日本 短観非製造業大規模ディファレンス指数 (第四四半期)

日本 短観非製造業大規模ディファレンス指数 (第四四半期)実:--

予: --

戻: --

日本 短観大規模非製造業景気見通し指数 (第四四半期)

日本 短観大規模非製造業景気見通し指数 (第四四半期)実:--

予: --

戻: --

日本 短観大企業製造業景気見通し指数 (第四四半期)

日本 短観大企業製造業景気見通し指数 (第四四半期)実:--

予: --

戻: --

日本 中小企業製造業短観指数 (第四四半期)

日本 中小企業製造業短観指数 (第四四半期)実:--

予: --

戻: --

日本 短観大企業製造業普及指数 (第四四半期)

日本 短観大企業製造業普及指数 (第四四半期)実:--

予: --

戻: --

日本 大企業短観 設備投資額前年比 (第四四半期)

日本 大企業短観 設備投資額前年比 (第四四半期)実:--

予: --

戻: --

イギリス ライトムーブ住宅価格指数前年比 (12月)

イギリス ライトムーブ住宅価格指数前年比 (12月)実:--

予: --

戻: --

中国、本土 工業生産高前年比 (YTD) (11月)

中国、本土 工業生産高前年比 (YTD) (11月)実:--

予: --

戻: --

中国、本土 都市部の失業率 (11月)

中国、本土 都市部の失業率 (11月)実:--

予: --

戻: --

サウジアラビア CPI前年比 (11月)

サウジアラビア CPI前年比 (11月)実:--

予: --

戻: --

ユーロ圏 工業生産高前年比 (10月)

ユーロ圏 工業生産高前年比 (10月)--

予: --

戻: --

ユーロ圏 工業生産高前月比 (10月)

ユーロ圏 工業生産高前月比 (10月)--

予: --

戻: --

カナダ 既存住宅販売前月比 (11月)

カナダ 既存住宅販売前月比 (11月)--

予: --

戻: --

ユーロ圏 準備資産合計 (11月)

ユーロ圏 準備資産合計 (11月)--

予: --

戻: --

イギリス インフレ率の期待

イギリス インフレ率の期待--

予: --

戻: --

カナダ 国民経済信頼感指数

カナダ 国民経済信頼感指数--

予: --

戻: --

カナダ 新規住宅着工数 (11月)

カナダ 新規住宅着工数 (11月)--

予: --

戻: --

アメリカ ニューヨーク連銀製造業雇用指数 (12月)

アメリカ ニューヨーク連銀製造業雇用指数 (12月)--

予: --

戻: --

アメリカ ニューヨーク連銀製造業景気指数 (12月)

アメリカ ニューヨーク連銀製造業景気指数 (12月)--

予: --

戻: --

カナダ コアCPI前年比 (11月)

カナダ コアCPI前年比 (11月)--

予: --

戻: --

カナダ 製造業受注残高前月比 (10月)

カナダ 製造業受注残高前月比 (10月)--

予: --

戻: --

アメリカ ニューヨーク連銀製造業価格取得指数 (12月)

アメリカ ニューヨーク連銀製造業価格取得指数 (12月)--

予: --

戻: --

アメリカ ニューヨーク連銀製造業新規受注指数 (12月)

アメリカ ニューヨーク連銀製造業新規受注指数 (12月)--

予: --

戻: --

カナダ 製造新規受注前月比 (10月)

カナダ 製造新規受注前月比 (10月)--

予: --

戻: --

カナダ コアCPI前月比 (11月)

カナダ コアCPI前月比 (11月)--

予: --

戻: --

カナダ トリミングされたCPI前年比(SA) (11月)

カナダ トリミングされたCPI前年比(SA) (11月)--

予: --

戻: --

カナダ 製造在庫前月比 (10月)

カナダ 製造在庫前月比 (10月)--

予: --

戻: --

カナダ CPI前年比 (11月)

カナダ CPI前年比 (11月)--

予: --

戻: --

カナダ CPI前月比 (11月)

カナダ CPI前月比 (11月)--

予: --

戻: --

カナダ CPI前年比(SA) (11月)

カナダ CPI前年比(SA) (11月)--

予: --

戻: --

カナダ コア CPI 前月比 (SA) (11月)

カナダ コア CPI 前月比 (SA) (11月)--

予: --

戻: --

カナダ CPI前月比(SA) (11月)

カナダ CPI前月比(SA) (11月)--

予: --

戻: --

連邦準備制度理事会のミラン理事が演説を行った

連邦準備制度理事会のミラン理事が演説を行った アメリカ NAHB 住宅市場指数 (12月)

アメリカ NAHB 住宅市場指数 (12月)--

予: --

戻: --

オーストラリア 総合PMI暫定値 (12月)

オーストラリア 総合PMI暫定値 (12月)--

予: --

戻: --

オーストラリア サービスPMIプレリム (12月)

オーストラリア サービスPMIプレリム (12月)--

予: --

戻: --

オーストラリア 製造業PMI暫定値 (12月)

オーストラリア 製造業PMI暫定値 (12月)--

予: --

戻: --

日本 製造業PMIプレリム(SA) (12月)

日本 製造業PMIプレリム(SA) (12月)--

予: --

戻: --

イギリス 失業申請者数 (11月)

イギリス 失業申請者数 (11月)--

予: --

戻: --

イギリス 失業率 (11月)

イギリス 失業率 (11月)--

予: --

戻: --

イギリス 3か月ILO失業率 (10月)

イギリス 3か月ILO失業率 (10月)--

予: --

戻: --

一致するデータがありません

The Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. A recent report from Finder, based on the insights of 26 crypto industry experts, reveals a cautiously optimistic outlook for SHIB.

Finder, a US-based information service, released a new quarterly report featuring price predictions for Shiba Inu in 2025. The report is based on a comprehensive survey conducted in January 2025, during which 26 crypto industry specialists shared their insights on Shiba Inu’s potential price by the end of 2025 and its projected performance through 2035.

Diverging Opinions On SHIB Price In 2025

According to the panel, Shiba Inu is forecasted to reach an average price of $0.0000399 by year’s end, marking an 84.3% increase from its January starting point of about $0.00002165. For its long-term price projection, the panel predicts that the popular meme coin will see a steady rise in the following years, erasing one zero to reach $0.0001971 by 2030 and $0.0008543 by 2035.

Gracy Chen, the Chief Executive Officer (CEO) of Bitget, a crypto exchange, is among the most bullish voices among the panelists for the Shiba Inu price outlook. Chen cites SHIB’s positive technical indicators and recent support/resistance developments as signs of an ongoing bullish trend. She projects that the Shiba Inu price could hit a new target of $0.00006 by year-end. This represents 445.45%. Increase from the meme coin’s current market value of $0.000011.

Similarly, Ruadhan O, founder of Seasonal Tokens, sees SHIB closing 2025 at $0.00005, though he warns of Dogecoin’s enduring dominance in the space. He believes that Dogecoin will most likely take the spotlight away from SHIB, making it unlikely for it to reach a new all-time high this year.

Notably, not all panelists share the same bullish optimism for Shiba Inu. John Hawkins, a senior lecturer at the University of Canberra, projects that the price of SHIB will crash significantly, losing half of its value in 2025, falling to as low as $0.00001. His bearish prediction stems from the belief that meme coins could experience a similar decline to that of Non-Fungible Tokens (NFTs). Hawks points to broader macro trends like US President Donald Trump’s political influence and Bitcoin’s dominance as key barriers that would limit meme coins’ growth.

Shiba Inu And Dogecoin Rivalry Continues

Despite the majority of Finder’s panelists having significantly bullish projections for the Shiba Inu price, 79% of them agree that SHIB will never surpass Dogecoin in market capitalization. Sathvik Vishwanath, the CEO of Unocoin, believes SHIB’s substantial circulating supply currently and speculative nature limit its long-term bullish prospects. This is despite its rapidly evolving ecosystem, which includes innovative projects like ShibaSwap and the upcoming TREAT token.

When asked whether now is the right time to buy, sell, or hold SHIB tokens, the panel was divided: 57% recommended holding, 13% advised buying, and 30% suggested selling. In addition, opinions on Shiba Inu’s current valuation were mixed. 48% of the panel believed that SHIB was overpriced, while 44% stated that it was fairly priced.

Ronen Cojocaru, the CEO of 8081 Inc., was among the most bullish panelists. He forecasted that SHIB could hit $0.00000743 by year-end, although he acknowledged that Shiba Inu is currently overpriced.

The latest US initial jobless claims data came at 215,000, below the estimated expectation of 225,000, on April 17. The dip in jobless claims indicated that the US labor market remained stable, with fewer people being affected by the uncertainty of US tariffs. Initial jobless claims are a leading economic indicator that measures the health of the US economy and it often impacts investor sentiment around risk assets like Bitcoin (BTC).

Resiliency in the labor market comes on the back of Federal Reserve Chair Jerome Powell’s recent comment about the impact of tariffs. In a press conference at the economics club of Chicago on April 16, Powell said,

The Fed Reserve Chair also stated that the Fed has no plans to intervene with market bailouts or implement rate cuts in the near future. This stance aligns with his earlier comments from April 4, 2025, when he noted it was "too soon" to consider rate reductions, reflecting the Fed's cautious approach amid ongoing economic uncertainty.

However, the European Central Bank cut interest rates to 2.25% from 2.50% in order to combat economic pressure from US trade tariffs. According to data, the ECB has taken borrowing costs to its lowest level since late 2022, with the current rate cut marking its seventh reduction in a span of a year.

Related: Bitcoin gold copycat move may top $150K as BTC stays 'impressive'

Bitcoin remains at an inflection point, says analyst

For risk assets like Bitcoin, the recent US jobless claims data leans bearish in the short term, as a strong labour market reduces the likelihood of rate cuts, which supports speculative investments.

BTC prices have consolidated in a tight range over the past few days, failing to break above the $86,000 level. In light of that, anonymous crypto trader Titan of Crypto said that Bitcoin is at an “inflection point”.

An inflection point in trading is a critical juncture where the market's direction or momentum may shift significantly. It’s a moment where the balance between buyers and sellers reaches a tipping point, often leading to a reversal or acceleration in the trend. The trader said,

Order flow trader Magus noted that Bitcoin is consolidating between $83,700 and $85,200. For the bullish momentum to persist, BTC must break above $85,000 soon, as the long-term chart signals potential bearish risks if this level isn't surpassed.

Related: Bitcoin price levels to watch as Fed rate cut hopes fade

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Venture capital firm Andreessen Horowitz, or a16z, announced a $55 million investment in LayerZero, a Web3 company that runs a crosschain messaging protocol. The investment was disclosed in an April 17 X post by Ali Yahya, a general partner in the firm.

A16z has made previous investments in LayerZero, including an initial investment in March 2022 and a subsequent investment during LayerZero’s Series B funding round in April 2023. The companies have not disclosed the funding round's valuation.

The Canada-based LayerZero was valued at $3 billion during its Series B funding round, which saw participation from 33 investors. In addition to a16z, Circle Ventures, OKX Ventures, OpenSea Ventures, Sequoia Capital, and many others participated at the time.

In January 2025, LayerZero reached a settlement with the FTX Estate over a long-running dispute stemming from allegations that it exploited the exchange’s liquidity crisis by “negotiating a fire-sale transaction,” according to the Estate. In June 2024, LayerZero launched its own token, LayerZero (ZRO).

Crosschain protocols, chain-agnosticism gain traction

Crosschain messaging protocols allow programs to share information across ecosystems and can be a critical function for decentralized applications (DApps) or traders who want seamless swaps across blockchains.

Some protocols competing in the same space as LayerZero include Wormhole, Stargate, Superbridge, Connext, and many others.

Wormhole may be one of the largest competitors to LayerZero, having raised $225 million at a $2.5 billion valuation in November 2023. Like LayerZero, Wormhole hosted an airdrop for its token, Wormhole (W), although the airdrop attracted scammers and spoof tokens. Chainlink also has a crosschain interoperability protocol that allows for messaging between blockchains.

More and more companies are realizing the value of being omnichain or at least chain-agnostic. Phantom, which at first was a Solana-centric wallet, now supports six major blockchains, including Bitcoin and Ethereum. Magic Eden, an NFT-infrastructure company, also started as Solana-centric but has launched marketplaces for multiple blockchains now.

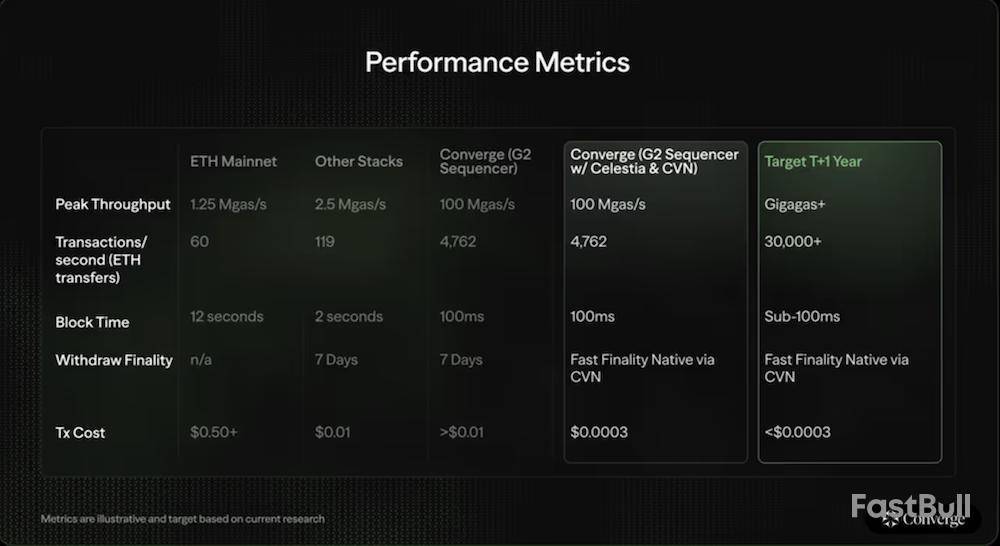

Ethena Labs, the developer of the USDe synthetic dollar (USDe), and financial technology company Securitize, released a preliminary roadmap for their upcoming Converge network, a high-throughput blockchain focused on real-world assets and decentralized finance (DeFi).

According to the announcement, a testnet will be live in the coming weeks, with a mainnet launch later in 2025.

Converge will feature a 100 milliseconds (ms) native block time, with plans to reduce block times to 50ms by Q4 2025. The developers also plan to achieve at least one gigagas of potential throughput during 2025. Gigagas is a measure of billions of gas units processed by a blockchain network in one second.

Ethena and Securitize are launching the network to support permissioned real-world tokenized applications and permissionless DeFi applications as the line between traditional and decentralized finance continues to blur.

Traditional finance converging with the crypto world

Traditional financial institutions are increasingly using decentralized finance protocols and interacting with tokenized real-world assets like stablecoins and tokenized bonds.

The merging of TradFi and DeFi has drawn mixed reactions from the crypto community, with some saying it was inevitable that the two worlds came together, and others warning of institutional capture.

In a Jan. 21 interview, Franklin Templeton CEO Jenny Johnson told Bloomberg that US President Donald Trump would integrate crypto and traditional finance by establishing clear regulations.

“We need to have some sort of regulatory clarity so that you could bring these together because, fundamentally, it will drive out costs, and there is great innovation that the technology enables,” Johnson said.

Shibtoshi, the founder of the SilentSwap privacy-preserving trading platform, recently told Cointelegraph that some institutions are currently hesitant to adopt decentralized finance solutions.

The DeFi founder said that a lack of privacy, legal liability issues, and unclear regulations have stymied institutional adoption, but added that the tools to address these concerns already exist.

"Institutions have realized the benefits of a securely decentralized system. As early as 2021, reports said nearly one in three institutional investors in crypto were already using DeFi," Shibtoshi told Cointelegraph.

CoinDesk Bitcoin Price Index is up $539.10 today or 0.64% to $84878.80

Note: CoinDesk Bitcoin Price Index (XBX) at 4 p.m. ET close

Data compiled by Dow Jones Market Data

VANCOUVER, BC / ACCESS Newswire / April 17, 2025 / Cypher Metaverse Inc. (CSE:CODE) ("Cypher" or the "Company") today announces that the filing of its audited annual financial statements, management's discussion and analysis and related CEO and CFO certifications for the financial year ended December 31, 2024 (the "Required Filings"), will be delayed beyond the filing deadline of April 30, 2025, and as a result will be in default of its obligations under Part 4 of National Instrument 51-102 Continuous Disclosure Obligations. The delay in the completion of the Required Filings is as a result of a change in the auditor of Cypher. Cypher's former auditor, PKF Antares Professional Corporation, has provided notice that they would be resigning as auditor of the Company. As a result, Cypher is working expeditiously to engage a replacement auditor of the Company and, as a result, has delayed filing of the Required Filings to ensure its new auditor can finalize their audit review once appointed.

The Company has made an application to the British Columbia Securities Commission (the "BCSC") for a management cease trade order (the "MCTO"), which would restrict all trading in securities of the Company, whether direct or indirect, by management of the Company. The MCTO does not generally affect the ability of shareholders who are not insiders of the Company to trade their securities. There is no certainty that the MCTO will be granted.

The Company is working expeditiously to replace its auditor and to complete the audit of its 2024 annual financial statements as soon as possible. Cypher plans to remedy the default and file the Required Filings as soon as it is able to do so and expects such filing to occur on or prior to June 30, 2025. The Company also intends to satisfy the provisions of the alternate information guidelines of Section 10 of National Policy 12-203 Management Cease Trade Orders as long as it is in default of the filing requirements.

The Company confirms that there are no insolvency proceedings against it as of the date of this press release. The Company also confirms that there is no other material information concerning the affairs of the Company that has not been generally disclosed as of the date of this press release.

About Cypher Metaverse Inc.

Cypher focuses on identifying and investing in early-stage opportunities across the digital landscape, participating in blockchain projects, including proof of work mining, proof of stake cryptocurrencies, and decentralized finance. The Company engages in digital experiences, collectively referred to as "the Metaverse" which include non-fungible token-based gaming experiences.

The Company leverages its strategic relationships to drive innovation and growth, creating new possibilities and opportunities. Further information about Cypher can be found on the Company's website at www.cypher-meta.com, along with its SEDAR+ profile accessible at www.sedarplus.ca.

Cautionary Note Regarding Forward-Looking Information

This news release contains forward-looking information and forward-looking statements (collectively, "forward-looking information"). Such forward-looking information is provided to inform the Company's shareholders and potential investors about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Any such forward-looking information may be identified by words such as "anticipate", "proposed", "estimates", "would", "expects", "intends", "plans", "may", "will", and similar expressions, although not all forward-looking information contain these identifying words.

More particularly and without limitation, the forward‐looking information in this news release includes (i) expectations regarding the Company's business plans and operations; (ii) expectations concerning the MCTO; and (iii) expectations regarding the timing of filing the Required Filings. Forward-looking information is based on a number of factors and assumptions that have been used to develop such information, but which may prove to be incorrect. Although the Company believes that the expectations reflected in such forward-looking information are reasonable, undue reliance should not be placed on forward-looking information because the Company can give no assurance that such expectations will prove to be correct. The forward-looking information in this news release reflects the Company's current expectations, assumptions and/or beliefs based on information currently available to the Company.

Whether actual results, performance, or achievements will conform to Cypher's expectations and predictions is subject to a number of known and unknown risks and uncertainties, which could cause actual results and experience to differ materially from Cypher's expectations. Such material risks and uncertainties include: (i) risks and uncertainties associated with the digital currency industry and decentralized finance; (ii) political, economic, regulatory and other uncertainties in respect of digital currencies; and (iii) consumer sentiment towards blockchain technology generally, decrease in the price of other cryptocurrencies.

Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or expressly qualified by this cautionary statement.

Contact Information

For further information, please contact:

George Tsafalas | President & CEO | |

1 (778) 373-8578 | |

info@cypher-meta.com | |

www.cypher-meta.com | |

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy of this release.

SOURCE: Cypher Metaverse Inc.

View the original press release on ACCESS Newswire

Leading U.S. crypto exchange Coinbase has just been hit with a massive Bitcoin inflow totaling over $130 million, sparking fresh speculation around possible whale activity and market shifts. The movement was flagged by blockchain monitoring platform Whale Alert, which tracked two consecutive BTC transfers on April 17.

According to the data, a total of 1,546 BTC was sent to Coinbase in less than an hour. The transactions originated from the same mysterious wallet "3Pfmv9Cibqx3", suggesting a single entity was behind both moves.

The first transfer included 746 BTC, valued at approximately $63.1 million. The second, just minutes later, involved 800 BTC, worth around $67.7 million.

This wallet has a history of large-scale Bitcoin movements across exchanges, and its latest activity has reignited discussions around potential whale strategies.

Whales making chess moves?

The timing of the transactions is especially notable given the current market conditions. While Bitcoin’s trading volume has dropped by 20.01% over the last 24 hours, its price is climbing modestly, now sitting at $85,337, up 1.07%, per CoinMarketCap.

These kinds of large transfers to exchanges often serve as indicators of: impending sell-offs, institutional repositioning or liquidity plays ahead of major price movements

Some in the crypto community speculate this could signal a shift in whale sentiment, potentially toward short-term profit-taking amid recent market uncertainty. As one user commented, “It’s often a liquidity play before major moves.”

Despite ongoing volatility in the broader crypto space, Bitcoin has shown remarkable price resilience around the $85K level. Analysts remain divided on whether this whale activity signals a cooldown or a calculated setup for future gains.

Veteran trader Peter Brandt recently likened Bitcoin’s price action to “little boxes on the hillside,” suggesting consolidation that could precede a breakout.

Whether this massive Coinbase inflow marks the start of a market selloff or a strategic asset shuffle, one thing is clear—whales are moving, and the market is paying attention.

株式、FX、コモディティ、先物、債券、ETF、仮想通貨などの金融資産を取引する際の損失のリスクは大きなものになる可能性があります。ブローカーに預け入れた資金が完全に失われる可能性があります。したがって、お客様の状況と財政的資源に照らして、そのような取引が適しているかどうかを慎重に検討していただく必要があります.

十分なデューデリジェンスを実施するか、ファイナンシャルアドバイザーに相談することなく、投資を検討するべきではありません。お客様の財務状況や投資ニーズを把握していないため、当社の ウェブコンテンツはお客様に適しない可能性があります。当社の財務情報には遅延があったり、不正確な情報が含まれている可能性があるため、取引や投資に関する決定については、お客様が全責任を負う必要があります。当社はお客様の資本の損失に対して責任を負いません。

ウェブサイトから許可を得ずに、ウェブサイトのグラフィック、テキスト、または商標をコピーすることはできません。このウェブサイトに組み込まれているコンテンツまたはデータの知的財産権は、そのプロバイダーおよび交換業者に帰属します。

ログインしていません

ログインしてさらに多くの機能にアクセス

FastBull プロ

まだ

購入

サインイン

サインアップ