マーケット情報

ニュース

分析

ユーザー

7x24

経済カレンダー

NULL_CELL

データ

- 名前

- 最新値

- 戻る

NULL_CELL

NULL_CELL

すべてのコンテスト

日本 短観小規模製造業普及指数 (第四四半期)

日本 短観小規模製造業普及指数 (第四四半期)実:--

予: --

戻: --

日本 短観大規模非製造業景気見通し指数 (第四四半期)

日本 短観大規模非製造業景気見通し指数 (第四四半期)実:--

予: --

戻: --

日本 短観大企業製造業景気見通し指数 (第四四半期)

日本 短観大企業製造業景気見通し指数 (第四四半期)実:--

予: --

戻: --

日本 中小企業製造業短観指数 (第四四半期)

日本 中小企業製造業短観指数 (第四四半期)実:--

予: --

戻: --

日本 短観大企業製造業普及指数 (第四四半期)

日本 短観大企業製造業普及指数 (第四四半期)実:--

予: --

戻: --

日本 大企業短観 設備投資額前年比 (第四四半期)

日本 大企業短観 設備投資額前年比 (第四四半期)実:--

予: --

戻: --

イギリス ライトムーブ住宅価格指数前年比 (12月)

イギリス ライトムーブ住宅価格指数前年比 (12月)実:--

予: --

戻: --

中国、本土 工業生産高前年比 (YTD) (11月)

中国、本土 工業生産高前年比 (YTD) (11月)実:--

予: --

戻: --

中国、本土 都市部の失業率 (11月)

中国、本土 都市部の失業率 (11月)実:--

予: --

戻: --

サウジアラビア CPI前年比 (11月)

サウジアラビア CPI前年比 (11月)実:--

予: --

戻: --

ユーロ圏 工業生産高前年比 (10月)

ユーロ圏 工業生産高前年比 (10月)実:--

予: --

戻: --

ユーロ圏 工業生産高前月比 (10月)

ユーロ圏 工業生産高前月比 (10月)実:--

予: --

戻: --

カナダ 既存住宅販売前月比 (11月)

カナダ 既存住宅販売前月比 (11月)実:--

予: --

戻: --

カナダ 国民経済信頼感指数

カナダ 国民経済信頼感指数実:--

予: --

戻: --

カナダ 新規住宅着工数 (11月)

カナダ 新規住宅着工数 (11月)実:--

予: --

アメリカ ニューヨーク連銀製造業雇用指数 (12月)

アメリカ ニューヨーク連銀製造業雇用指数 (12月)実:--

予: --

戻: --

アメリカ ニューヨーク連銀製造業景気指数 (12月)

アメリカ ニューヨーク連銀製造業景気指数 (12月)実:--

予: --

戻: --

カナダ コアCPI前年比 (11月)

カナダ コアCPI前年比 (11月)実:--

予: --

戻: --

カナダ 製造業受注残高前月比 (10月)

カナダ 製造業受注残高前月比 (10月)実:--

予: --

戻: --

アメリカ ニューヨーク連銀製造業価格取得指数 (12月)

アメリカ ニューヨーク連銀製造業価格取得指数 (12月)実:--

予: --

戻: --

アメリカ ニューヨーク連銀製造業新規受注指数 (12月)

アメリカ ニューヨーク連銀製造業新規受注指数 (12月)実:--

予: --

戻: --

カナダ 製造新規受注前月比 (10月)

カナダ 製造新規受注前月比 (10月)実:--

予: --

戻: --

カナダ コアCPI前月比 (11月)

カナダ コアCPI前月比 (11月)実:--

予: --

戻: --

カナダ トリミングされたCPI前年比(SA) (11月)

カナダ トリミングされたCPI前年比(SA) (11月)実:--

予: --

戻: --

カナダ 製造在庫前月比 (10月)

カナダ 製造在庫前月比 (10月)実:--

予: --

戻: --

カナダ CPI前年比 (11月)

カナダ CPI前年比 (11月)実:--

予: --

戻: --

カナダ CPI前月比 (11月)

カナダ CPI前月比 (11月)実:--

予: --

戻: --

カナダ CPI前年比(SA) (11月)

カナダ CPI前年比(SA) (11月)実:--

予: --

戻: --

カナダ コア CPI 前月比 (SA) (11月)

カナダ コア CPI 前月比 (SA) (11月)実:--

予: --

戻: --

カナダ CPI前月比(SA) (11月)

カナダ CPI前月比(SA) (11月)実:--

予: --

戻: --

連邦準備制度理事会のミラン理事が演説を行った

連邦準備制度理事会のミラン理事が演説を行った アメリカ NAHB 住宅市場指数 (12月)

アメリカ NAHB 住宅市場指数 (12月)--

予: --

戻: --

オーストラリア 総合PMI暫定値 (12月)

オーストラリア 総合PMI暫定値 (12月)--

予: --

戻: --

オーストラリア サービスPMIプレリム (12月)

オーストラリア サービスPMIプレリム (12月)--

予: --

戻: --

オーストラリア 製造業PMI暫定値 (12月)

オーストラリア 製造業PMI暫定値 (12月)--

予: --

戻: --

日本 製造業PMIプレリム(SA) (12月)

日本 製造業PMIプレリム(SA) (12月)--

予: --

戻: --

イギリス 3か月間のILO雇用変更 (10月)

イギリス 3か月間のILO雇用変更 (10月)--

予: --

戻: --

イギリス 失業申請者数 (11月)

イギリス 失業申請者数 (11月)--

予: --

戻: --

イギリス 失業率 (11月)

イギリス 失業率 (11月)--

予: --

戻: --

イギリス 3か月ILO失業率 (10月)

イギリス 3か月ILO失業率 (10月)--

予: --

戻: --

イギリス 3か月給与(週給、分配金含む)前年比 (10月)

イギリス 3か月給与(週給、分配金含む)前年比 (10月)--

予: --

戻: --

イギリス 3か月給与(週給、分配金を除く)前年比 (10月)

イギリス 3か月給与(週給、分配金を除く)前年比 (10月)--

予: --

戻: --

フランス サービスPMIプレリム (12月)

フランス サービスPMIプレリム (12月)--

予: --

戻: --

フランス 総合PMIプレリム(SA) (12月)

フランス 総合PMIプレリム(SA) (12月)--

予: --

戻: --

フランス 製造業PMI暫定値 (12月)

フランス 製造業PMI暫定値 (12月)--

予: --

戻: --

ドイツ サービス PMI プレリム (SA) (12月)

ドイツ サービス PMI プレリム (SA) (12月)--

予: --

戻: --

一致するデータがありません

Bitcoin (BTC) has registered a slight uptick in the last few hours after US President Donald Trump announced a successful airstrike on Iranian nuclear facilities, a move aimed at de-escalating rising tensions in the Middle East after several days of conflict between Iran and Israel.

Despite the short-term price reaction, BTC remains in a corrective phase, having struggled to break through the $110,000 resistance level over the past month with market sentiment being largely shaped by both global uncertainty and technical stagnation. Amid this backdrop, a crypto analyst with X pseudonym On-Chain College has highlighted two prospective price targets based on on-chain data.

Market Odds Favor Further Upside For Bitcoin – Analyst

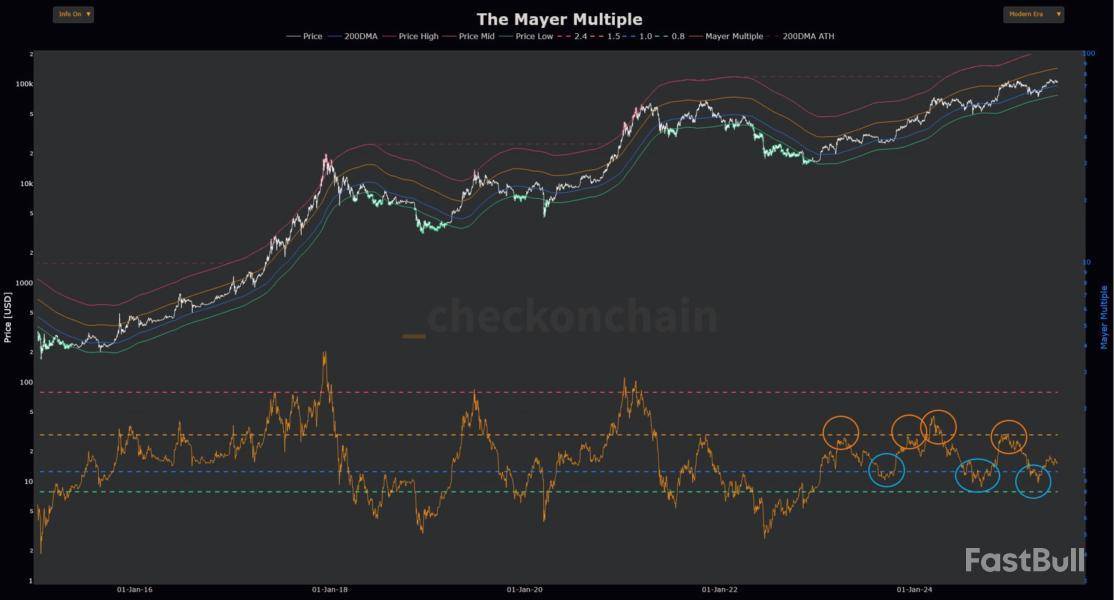

In a recent X post on June 21, On-Chain College shares a positive long-term Bitcoin price outlook using the Mayer Multiple, an on-chain metric that measures relationship between Bitcoin’s price and its 200-day moving average (200DMA). By tracking key valuation bands, the Mayer Multiple helps determine whether Bitcoin is overvalued, undervalued, or fairly valued, based on historical price behavior. Since the bull market commenced in Q4 2024, Bitcoin has consistently moved between 1.0x band i.e. the 200DMA (blue line) and the 1.5x band (orange line) representing the mid price range zone.

Notably, the Bitcoin price struggles in the past have generated speculations of potential market top at the current market high. However, the Mayer Multiple chart shows that BTC has only ever attained a cycle price peak after hitting the 2.5x band (red line). Therefore, there is still room for price growth in the current bull market. However, the immediate price targets for premier cryptocurrency lies at $96,000 (1.0x) or $144,000 (1.5x). Notably, there is significant potential to rediscover its bullish form and surge towards $144,000 in line with its defined-range bound movement. However, there are also equal chances of a return to $96,000 which On-Chain College states would aid in flushing out weak hands before a full-scale bullish price reversal.

Bitcoin Price Outlook

At the time of writing, Bitcoin is valued at $102,700 following a 1.50% decline in the last 24 hours. Meanwhile, the maiden cryptocurrency also reports losses of 2.94% and 8.08% on the weekly and monthly chart, respectively. According to CoinCodex, the general market sentiment remains neutral. However, CoinCodex analysts foresee an impending price breakout with an audacious projection of $136,472 within the next five days. Interestingly, it’s worth noting that this level may represent or come close to the cycle market top, as long-term forecasts include $138,379 in three months and $116,115 in six months.

Featured image from Pexels, chart from Tradingview

Billionaire Tim Draper has shared an upbeat statement amid Bitcoin's price plunge, arguing that the leading cryptocurrency by market cap is actually "valuable everywhere."

Draper highlighted the key properties of Bitcoin, such as decentralization, immutability, high liquidity, and its global nature.

The American billionaire has described it as the ultimate "hedge" against government spending.

Draper's statement comes after roughly $1 billion worth of crypto got liquidated over the past 24 hours.

As reported by U.Today, the legendary venture capitalist, who is known for his prescient bets on Hotmail and Skype, predicted that Bitcoin could end up surging to $10 million. This puts them in the same camp of uber-bulls with Strategy's Saylor.

Recently, he argued that the cryptocurrency could surge to infinity against the U.S. dollar, which could face hyperinflation if the entire system ends up breaking down.

Draper, an early Bitcoin investor, correctly predicted that the leading cryptocurrency would surge to $10,000. However, his next big prediction ended up being a big miss. The legendary venture capitalist was confident that Bitcoin would reach $250,000 by the end of 2022.

However, the leading cryptocurrency is still far from reaching the aforementioned target as of mid-2025. Yet, Draper appears to be convinced that Bitcoin will finally hit $250,000 this year, arguing that it has turned into an investment with an extremely low level of risk.

Even though gold has substantially outperformed Bitcoin this year, Draper recently opined that Bitcoin was a superior asset due to its borderless nature.

Michael Saylor, co-founder of Strategy (formerly MicroStrategy), has once again dropped a cryptic hint suggesting that his firm may soon add more Bitcoin to its already massive holdings.

In a June 22 post on X, Saylor shared a chart of Bitcoin’s performance, paired with the phrase, “Nothing Stops This Orange.”

Saylor Predicts Bitcoin Could Hit $21 Million in Two Decades

This social media post follows a familiar pattern of Saylor’s cryptic signals just before his firm files for additional Bitcoin buys with the US Securities and Exchange Commission (SEC).

Over the past weeks, Strategy’s Bitcoin position has aggressively grown following several strategic acquisitions.

This has resulted in the firm holding around 592,100 BTC, valued at over $60 billion. Strategy’s BTC reserve represents approximately 2.8% of Bitcoin’s total supply and makes it the world’s largest corporate holder of the asset.

Meanwhile, Saylor’s confidence in Bitcoin shows no signs of fading despite his firm’s substantial holding. The Bitcoin bull recently predicted that the top crypto could hit $21 million in price within the next 21 years.

“$21 million in 21 years,” Saylor said on X.

Despite the bullish tone, Saylor’s approach has drawn criticism.

Prominent investor Jim Chanos, best known for his bearish calls on companies like Enron, has publicly challenged Saylor’s claims regarding the firm’s use of debt.

In a video clip shared online, Saylor defended his strategy by saying that the company’s debt is “convertible,” “unsecured,” and “no recourse.” The Bitcoin bull also suggested that the top crypto’s value could fall 90% without impacting his firm’s repayment obligations.

However, Chanos disagreed strongly with this view, saying Strategy remains liable if the debt hasn’t converted to equity by maturity.

“There is of course recourse to Strategy if the convertible debt has not converted to equity, when due. How does he not know this?,” the investor questioned.

His criticism implies that Saylor may be overstating the safety of the firm’s debt position.

Chanos’s view is unsurprising considering his firm recently took an unusual stance of betting against Strategy while remaining long on Bitcoin.

This dual position highlights a growing view among some investors that while Bitcoin may thrive, Saylor’s aggressive corporate strategy could carry hidden risks.

Blockchain tracking service Whale Alert posted a major alert showing that 129,392 ETH was transferred from an unidentified wallet to Coinbase as the Ethereum price tumbled. On-chain data from Etherscan shows that this particular wallet had not been involved in the transfer of large ETH volumes since November 2022. This sudden reactivation and deposit into a centralized exchange opens up speculation of a looming selloff, especially given the timing of the transfer.

Massive ETH Transfer As Middle East Tensions Escalate

Whale transaction tracker Whale Alerts, which initially reported the transfer on the social media platform X, noted that at the time of the transfer, these 129,392 ETH were worth $312,981,377. The timing of the transfer is noteworthy because it occurred when the price of Ethereum failed to hold above $2,500 and had already begun to struggle to stay above $2,400.

Etherscan’s tracking of on-chain transactions indicates that the unknown wallet “0xd47b,” which was involved in the transfer, has been relatively inactive since late 2022. Particularly, its last transaction was an inflow of 6,469 ETH from another wallet linked to Coinbase.

The latest transfer into Coinbase leans more towards the possibility of a selloff through the exchange. Since then, the Ethereum price has lost a key support level at $2,450. Its price has fallen notably in the past 48 hours.

Although other factors are clearly contributing to the dip, particularly new geopolitical tensions after the US launched attacks on Iran, this whale deposit into Coinbase may have increased the downward pressure. Exchange inflows of this magnitude are a precursor to liquidation, particularly now that investor sentiment is on edge.

Bearish Setup Confirms Downside Targets

The technical picture for Ethereum is now turning bearish, at least in the short term. Technical analysis of Ethereum’s 4-hour chart on the TradingView platform shows a clear bearish breakdown setup after Ethereum broke below a crucial support line at $2,362. That support level has now been breached, and confirmation of the breakdown amplifies a bearish case moving forward.

The chart above, which includes overlays of the Ichimoku Cloud, shows a fading bullish momentum in the past few days. Previous failed attempts to break resistance have left Ethereum in a vulnerable zone, and the recent whale selloff may have delivered the final push needed to trigger this leg down.

If the current trajectory continues, Ethereum could be on its way to retesting lows below $2,000. According to the TradingView analysis, potential reversal targets are at $2,151 and $1,954, with a third possible level at $1,750 if the selloff is more than expected. At the time of writing, Ethereum is trading at $2,290, down by 5.5% and 10% in the past 24 hours and seven days, respectively.

Setting New Standard for Meme Coins

Neo Pepe’s presale has skyrocketed to over $2 million, currently at Stage 4 with a token price of $0.083153, surpassing expectations and signaling robust early-stage momentum, notably stronger than its predecessor, Pepe Coin. For investors tired of fleeting meme trends, you might want to get a little Neo Pepe. With a community-driven DAO governance model and transparent treasury management, Neo Pepe delivers genuine influence and accountability, cementing itself as the best pepe coin in the evolving crypto market.

Comparing Early Metrics for Neo Pepe ($NEOP) vs. Pepe Coin

Both coins are prominent meme tokens, but they differ significantly in their foundational strategies and performance:

Neo Pepe ($NEOP) has implemented an innovative 16-stage progressive presale, rewarding early investors with significantly better rates. With a fixed total supply of 1 billion tokens, Neo Pepe ensures scarcity and price predictability. Built on the Ethereum network, Neo Pepe guarantees compatibility across multiple platforms and offers unique features such as auto-liquidity mechanisms, deflationary tokenomics, and a fully operational community DAO.

On the other hand, Pepe Coin was launched spontaneously in April 2023 without a structured presale, driven primarily by social media virality. Pepe Coin quickly reached a market capitalization exceeding $5 billion, largely fueled by meme hype. Its high circulating supply of 420.69 trillion tokens, however, poses potential limitations for price appreciation. Like Neo Pepe, Pepe Coin also operates on the Ethereum ERC-20 token standard.

https://neopepe.ai/Early Metrics Indicate Higher Upside Potential for Neo Pepe Coin

Neo Pepe is positioning itself to become the top pepe coin and arguably the best crypto presale of 2025 due to several key strengths:

Neo Pepe employs immutable smart contracts, which have no upgrade paths or backdoors, significantly bolstering investor confidence. All decisions, including token burns and liquidity provision, require DAO approval, making the coin truly decentralized. Additionally, Neo Pepe’s deflationary tokenomics ensure clear token distribution, allocating 45% to presale, 25% to marketing, and the remainder to liquidity, development, ecosystem incentives, and giveaways. This balanced approach fosters stability and healthy growth. Furthermore, Neo Pepe’s auto-liquidity generation mechanism adds a 2.5% liquidity fee to each transaction, automatically enhancing market stability.

Top Reasons Long Term Investors Are Choosing $NEOP Over PEPE

Investors are increasingly attracted to Neo Pepe for its transparency and community governance. Unlike traditional meme coins, Neo Pepe’s treasury management and governance are transparent, community-led, and free from developer interference. The strategic 16-stage presale creates urgency and fosters sustainable growth dynamics by significantly rewarding early participants.

With a fixed total supply of 1 billion tokens, Neo Pepe’s scarcity provides predictable and favorable price movements compared to Pepe Coin’s enormous token supply. The DAO governance model ensures genuine community influence, allowing every holder to actively shape Neo Pepe’s future. Additionally, Neo Pepe’s technological foundation on the battle-tested Ethereum infrastructure ensures compatibility, security, and broad integration potential.

Neo Pepe Explained 🔥 New Presale Project Making Waves in Web3 | How to Join Safely

Catch Crypto Craze's fresh take on the Neo Pepe Presale, highlighting key benefits and unpacking exactly why investors are excited about this rising star in crypto.

It’s Time to Act—You Might Want to Get a Little Neo Pepe

As investor interest rapidly pivots from traditional meme coins to innovative, governance-centric projects, you might want to get a little Neo Pepe before it solidifies its position as the best crypto presale of 2025.

Ready to Join the Neo Pep’s Revolution?

Visit the Neo Pepe Official Website to explore more about the project. Review the Whitepaper to understand the tokenomics and strategic vision. Engage directly with the community on Telegram through Neo Pepe Coin, and stay updated by following Neo Pepe Coin on Twitter/X.

Neo Pepe isn't just another meme coin—it’s a serious contender with a clear path forward. If you believe in long-term value, community-driven projects, and substantial upside, you might want to get a little Neo Pepe today.

Get Started with Neo Pepe Coin

https://neopepe.ai/

株式、FX、コモディティ、先物、債券、ETF、仮想通貨などの金融資産を取引する際の損失のリスクは大きなものになる可能性があります。ブローカーに預け入れた資金が完全に失われる可能性があります。したがって、お客様の状況と財政的資源に照らして、そのような取引が適しているかどうかを慎重に検討していただく必要があります.

十分なデューデリジェンスを実施するか、ファイナンシャルアドバイザーに相談することなく、投資を検討するべきではありません。お客様の財務状況や投資ニーズを把握していないため、当社の ウェブコンテンツはお客様に適しない可能性があります。当社の財務情報には遅延があったり、不正確な情報が含まれている可能性があるため、取引や投資に関する決定については、お客様が全責任を負う必要があります。当社はお客様の資本の損失に対して責任を負いません。

ウェブサイトから許可を得ずに、ウェブサイトのグラフィック、テキスト、または商標をコピーすることはできません。このウェブサイトに組み込まれているコンテンツまたはデータの知的財産権は、そのプロバイダーおよび交換業者に帰属します。

ログインしていません

ログインしてさらに多くの機能にアクセス

FastBull プロ

まだ

購入

サインイン

サインアップ