Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

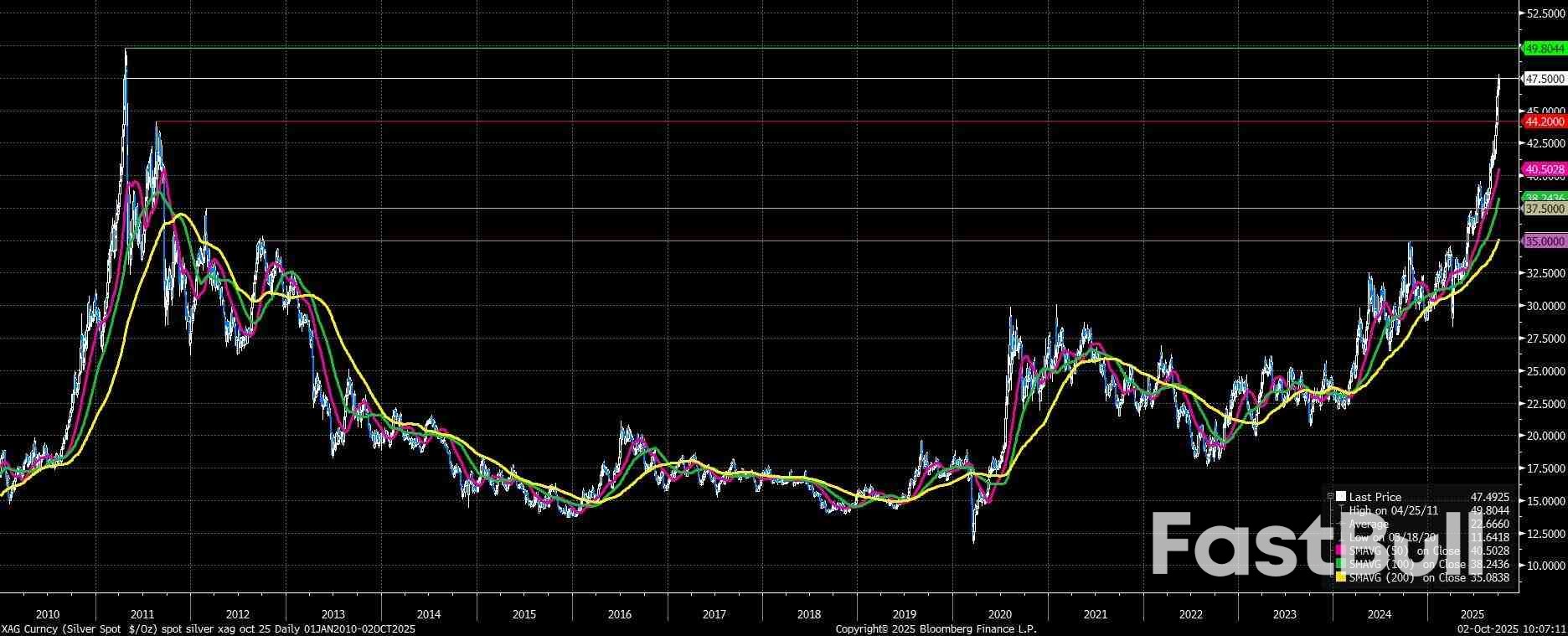

This move, across the PM complex, has been driven by largely by three factors – increased demand from central banks (especially in EM) seeking to diversify their reserve holdings.

This move, across the PM complex, has been driven by largely by three factors – increased demand from central banks (especially in EM) seeking to diversify their reserve holdings; investor worries about the inflation outlook, chiefly the risk of higher inflation becoming embedded; and, the unsustainable fiscal path on which most DM economies continue, with government spending, frankly, out of control.

Perhaps one of the most interesting things about the recent rally is the way in which silver has been trading almost tick-for-tick with gold. This is somewhat unusual given how silver is typically much more risk-sensitive than its golden cousin, and suggests that physical demand (aka hoarding) for precious metals is one of the biggest drivers of upside right now.

On that note, while the rally has come a very long way this year, there are several indications that the move has more room to run. In terms of physical demand, in particular, while holdings of silver in ETFs have risen substantially in 2025, they are still some considerable way ff the highs seen in early-2021, again suggesting potential for further upward pressure on price if demand continues to increase.

From a fundamental perspective, there is little which leads me to believe that any of the three main drivers of the rally mentioned earlier are likely to shift substantially any time soon. EM reserve allocators are likely to increasingly diversify reserves, especially as President Trump's ‘America First' policies continue; the risk of inflation expectations becoming un-anchored continues to linger, especially as the Fed cut rates and embark on a ‘run it hot' strategy; while, government spending shows no sign of slowing any time soon, chiefly in the US, where the deficit already stands at roughly 7% of GDP, a level only previously seen during recessions.

That said, no asset tends to go up in a straight line forever, and in many ways pullbacks within a longer-run rally are a healthy and normal part of market functioning, which actually result in a more durable overall trend.

Right now, spot silver is running into a little resistance around $47.50/oz, which coincides with the levels seen in 2011, just prior to the spike to record highs seen in April of that year. If the market is able to convincingly clear this level, then a move back to those record highs, and probably north of $50/oz for the first time, seems almost a given. Taking into account the distinct lack of any notable levels between these two points, such a move, were it to occur, could be explosive and rapid in nature.

To the downside, given the rapid nature of the recent rally, notable support doesn't really emerge until the 50-day moving average at $40.50/oz, beneath which the 2012 highs at $37.50/oz lurk. Prior to this recent bull trend, $35/oz had been a ‘cap' on price for some time, and obviously is a notable level as a result, though my view is that a test of that level seems a very long shot indeed at this moment in time.

Overall, then, the fundamental bull case for silver continues to hold water, while momentum clearly remains with the bulls for the time being. To lean on an old market adage, ‘the trend is your friend' very much seems to apply here, with further upside likely on the cards short-term, and any dips representing medium-term buying opportunities.

The unemployment rate increased from 6.2 to 6.3% in August. While an increase in the jobless rate is never a good thing, we’d be hesitant to read too much into today’s number. The increase in the number of unemployed people was 11,000 higher than in July, but still 136,000 lower than in June. That puts this uptick into perspective.

But employment expectations have steadily weakened over recent years, which means that job growth is under pressure. In September, the Employment Expectations Index by the European Commission ticked down to the lowest level since 2021. Manufacturers are becoming less negative about hiring prospects, but the service sector saw solid job prospects falter last month.

And businesses are pushing for productivity gains as wages have increased significantly over recent years. Yet despite all of that, the labour market continues to see unemployment near all-time lows for now.

That said, the job market in the eurozone is also quite divided between the south and north. The south is seeing stronger job growth – especially in the private sector – with more structural declines in unemployment. Weaker economic growth in the north of the eurozone is also reflected in more upward pressure on unemployment. This means that while the average eurozone job market performance is quite strong, weak spots can easily be found right now.

Malaysia is on the right trajectory to strengthen its position in the global semiconductor industry, with ongoing policy support and industry efforts to build design and innovation capabilities, according to American multinational semiconductor company Analog Devices Inc (ADI).

“Malaysia is making all the right moves,” said George Chia, Asean regional business director of ADI, during a media roundtable on Thursday. “Penang has traditionally been a driving force in backend operations, and now Malaysia is trying to really move up the stack into integrated circuit (IC) design and innovation.”He noted that Malaysia enjoys a head start over other regional peers, with a stronger ecosystem and government push to develop local expertise.“Other countries are still initiating efforts to understand the semiconductor landscape. Malaysia has already made significant progress,” he added.

Chia said ADI, which is a company listed on Nasdaq, is expanding its presence in Penang, where the group has set up a new building to prepare for further growth. He stressed that the company is investing in people, highlighting that its factory workforce in Penang is made up predominantly of locals.“We are investing in people. Talent is the key question everywhere, especially in semiconductors and electronics,” he said.

“Every country is competing for semiconductor and IC design engineers, and Malaysia is no different. That is why we are working hard to build a strong talent pipeline through Science, Technology, Engineering, and Mathematics (STEM) awareness and education.”He added that multinational companies, local firms and policymakers must work together to ensure a strong pipeline of skilled workers for the industry.

Earlier on Thursday, ADI signed a Memorandum of Understanding with the Malaysian Institute of Microelectronic Systems Bhd (Mimos), the country's national applied research agency, to advance Malaysia’s IC design capabilities and strengthen the ecosystem for small and medium-sized enterprises (SMEs).

Under the collaboration, ADI will provide technical expertise and guidance on circuit design, solution development and best practices, while Mimos will contribute its localisation knowledge and industry insights.“Our collaboration with Mimos is really about sharing our technology and solutions with their ecosystem of local companies,” Chia said. “Mimos is already engaging SMEs with applied research. By combining that with ADI’s technology, we can enable more local firms to move up the value chain.”

He pointed to the recent milestone of Malaysia’s first locally designed AI chip, MARS1000 by SkyeChip, as a sign of progress, noting that such breakthroughs could spur other firms to innovate and compete at higher levels.Chia stressed that Malaysia’s next phase must focus on board-level and analog design, rather than relying only on assembly and testing.“We need to elevate the design capability to really have ‘made by Malaysia’ companies,” he said.

There’s little doubt that Ukraine has an interest in escalating NATO-Russian tensions through these means, including by employing anti-government Russian and Belarusian nationals in this reported plot, but it’s debatable whether Poland is involved in this and the extent to which it might be if so.

Russia’s Foreign Intelligence Service (SVR) warned that Ukraine’s GUR and the Polish intelligence services (none of the several existing ones were specified) are cooking up a false flag attack in Poland, which might “involve a simulated attack on critical infrastructure”, in order to blame Russia and Belarus.According to them, “Kiev hopes to incite European countries to respond to Russia with the harshest possible force, preferably militarily.”

In reverse order, it does indeed appear to be the case that Kiev wants to manipulate NATO members into initiating direct military force against Russia, whether in the special operation zone or elsewhere such as on the territory of its Belarusian mutual defense ally or in its exclave of Kaliningrad. This explains why Zelensky repeated his no-fly zone demands after the suspicious Russian drone incident in Poland and called for closing the Danish Straits to Russian shipping after similarly suspicious incidents in Scandinavia.

Of relevance, SVR claimed that the aforesaid Polish incident and an associated Romanian one were Ukrainian provocations, though it’s still unclear exactly what happened. In any case, it’s also relevant to mention the reports amplified by Russian Foreign Ministry spokeswoman Maria Zakharova that Ukraine is preparing a false flag drone provocation against NATO as well as Zelensky’s partial responsibility for Trump’s flip-flip on Ukraine, all of which lend credence to suspicions about Ukraine’s motives.

Moving along, the part of their report about how “militants from the ‘Freedom of Russia Legion’ and the Belarusian ‘K. Kalinovsky Regiment’” have been selected for this next provocation might also be true since they’re known to be Ukrainian proxies, so each’s nationals could indeed be implicated in this plot. That would in turn make it more likely that NATO, including the US, is misled about who’s responsible. As for their claim of Poland’s joint involvement in orchestrating this, however, that’s much more debatable.

Conservative-nationalist Polish President Karol Nawrocki and his National Security Bureau weren’t informed by liberal-globalist Prime Minister Donald Tusk’s government that the damage incurred by a home during last month’s drone incident was caused by a wayward Polish missile. They only found out after a source leaked this to the press, which followed Tusk’s government blaming that damage on Russia at an emergency UNSC meeting, thus suggesting that he wanted to manipulate Nawrocki and his allies.

As assessed here, the purpose was to deceive him into authorizing Polish participation in a no-fly zone over Ukraine in order to raise NATO-Russian tensions, with these convoluted means being employed due to his reluctance to further embroil Poland in the conflict. Circling back to SVR’s report, either their source about Poland’s joint involvement in this latest plot is wrong or subversives within its “deep state” are going behind Nawrocki’s back, but the point is that it’s unrealistic to imagine that he’s in on it.

As a reminder, some of SVR’s reports didn’t pan out such as their ones about US plans to replace Zelensky, which were critiqued here in summer 2024. It should also go without saying that Russia truly has no reason to risk an escalation of tensions with NATO by attacking Poland as explained here, here, and here in summer 2023. Nevertheless, given the credible possibility that Ukraine is plotting a false flag attack on Poland, Nawrocki and his own “deep state” allies should urgently launch an investigation.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up