Trader Exposes XBO Invest's Withdrawal Fees and the Hidden Bankruptcy Trap

A high-volume trader from Slovenia, Franc, filed a complaint with BrokersView against XBO Invest. He said he first encountered the platform in 2024 through a Facebook advertisement that appeared to be placed under the name of Ljubljana Stock Exchange. Believing it to be a legitimate investment opportunity, he opened an account. As his early trades showed profits, he gradually increased his deposits, with total funds surpassing €100,000. However, the real problems only surfaced when he attempted to withdraw his money.

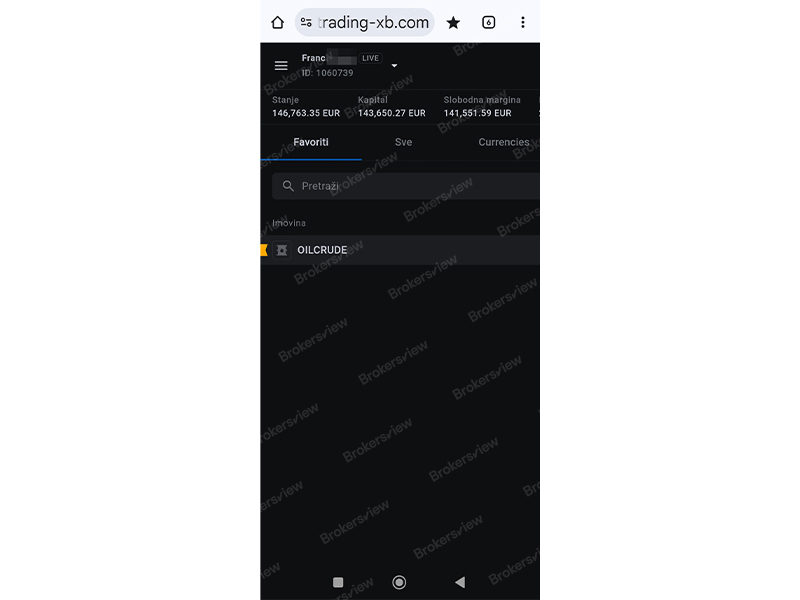

The complainant submitted mobile screenshots from the Trading-xb.com platform: account ID, live balance, equity, and free margin were all displayed, with the balance exceeding €140,000. His account remained "active", but several fund-related items had already been "removed" by the platform.

According to Franc, when he first submitted a withdrawal request, the broker demanded a so-called "withdrawal fee". He paid €16,100, hoping to retrieve at least a portion of his funds.

But nothing happened.

Soon after, XBO Invest began raising additional requirements: administrative fees, regulatory-related costs, document review fees, even a criminal record certificate. As his complaint progressed, he repeatedly emphasized that the platform "always found excuses", and each payment resulted only in further delays.

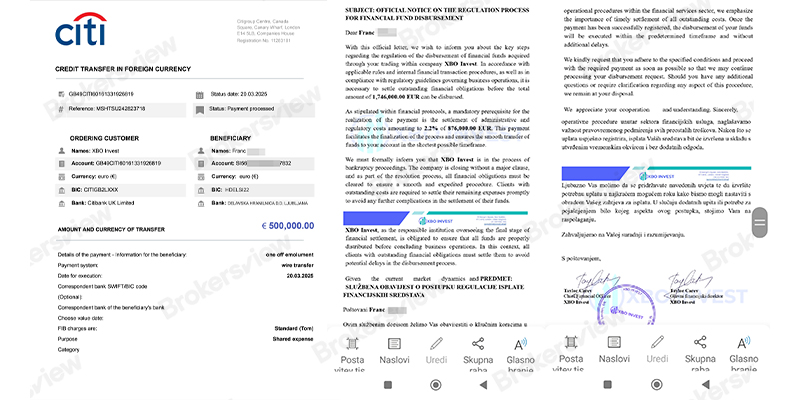

When he refused to continue paying, the broker sent him purported banking documents—including a "CREDIT TRANSFER" slip from Citibank UK Limited, indicating €500,000 had been "Payment processed". Yet, no funds ever arrived, and he could no longer reach the platform for clarification.

Instead, XBO Invest demanded an additional €90,000 to finalize the release of funds—an amount already far beyond his original investment.

In addition to the fees, Franc also uploaded an "official notice" email from XBO Invest, in which the platform claimed it was undergoing "bankruptcy proceedings" and required settlement of "administrative and regulatory costs" before releasing his funds.

The email mentioned a "2.2% fee" and a calculation base of "€876,000.00".

At this point, the pattern is unmistakably familiar: a classic scam structure driven by constant fee requests, pushing victims deeper into losses as their "sunk cost" grows. As Franc repeatedly stressed, "They didn’t give me a single penny."

The external verification of XBO Invest raises even more red flags.

BrokersView has long listed this broker as a "Scam broker" and highlighted the warning issued by the British Columbia Securities Commission (BCSC) back in April 2025, which made clear that XBO Invest was offering financial services without authorization. In addition, BrokersView noted that although the platform claimed to be based in the UK, no valid registration could be found in the FCA database.

Importantly, all of these warnings can be publicly verified online—indicating that Franc’s experience is not an isolated case, but part of a broader pattern of risk.

At present, the claim amount recorded in Franc’s complaint is $116,100, while the actual losses and frozen funds he described are even higher, including the broker’s claimed €500,000 profit and the balance shown in his account.

For the complainant, after years of attempts, repeated payments, and layers of paperwork, what remains is still an empty space that may never be recovered.

BrokersView Reminds You

If you encounter similar situations—platforms demanding additional fees before you can withdraw, providing seemingly official banking slips that never result in actual transfers, or asking for more payments under the pretext of "regulatory requirements" or "bankruptcy procedures"—stop sending money immediately and file a complaint on BrokersView.