Breaches, Suspension and Regulatory Questions: A Trader's Complaint Against Equity Edge

BrokersView has taken note of a complaint filed by a trader who claimed that their account was terminated and suspended by prop trading firm Equity Edge for alleged "violations," without any clear explanation or supporting evidence provided by the platform.

According to the complainant, after passing several evaluation stages, their account was suddenly disabled with a notice citing "violations." When they requested specific details or audit records, the only response received was a vague message such as "system detected irregular activity," without any concrete transaction identifiers or verifiable evidence.

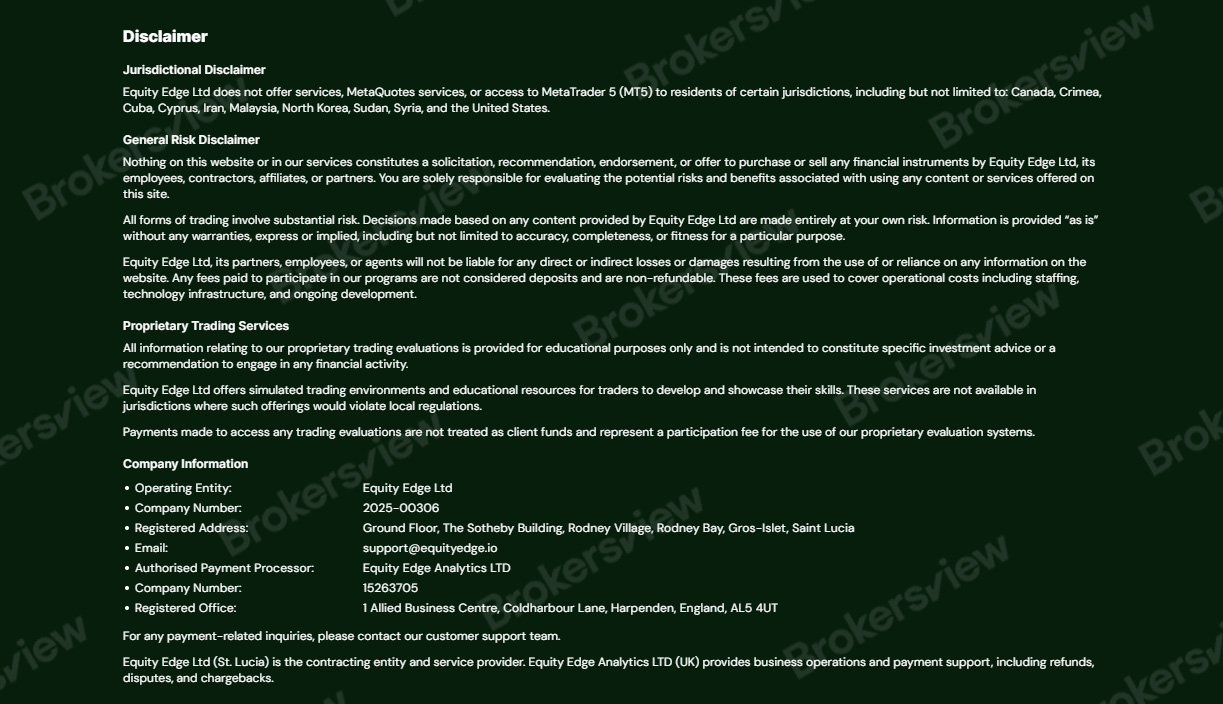

At present, BrokersView has not found any detailed profile or regulatory record for Equity Edge in our database. Based on the publicly available disclaimer on the firm's website, Equity Edge lists several restricted jurisdictions, including but not limited to Canada, Cyprus, and the United States. The disclaimer also states that its evaluation or simulated trading services are for educational purposes only, that participation fees are non-refundable and not considered client funds, and that all website content is provided "as is," without any guarantee of accuracy or completeness.

Background Check: Offshore Registration and Limited Oversight

According to user reports, the main operating entity of Equity Edge is Equity Edge Ltd, incorporated in Saint Lucia (registration number 2025-00306), which fits the profile of a typical offshore company with minimal regulatory oversight. The firm also operates a UK-based subsidiary named Equity Edge Analytics Ltd (registration number 15263705), primarily handling payment processing. However, the UK entity reportedly has only £1 in paid-up capital, is registered to a virtual office address, and has not yet filed any financial statements.

The platform is considered unregulated, holding no trading or financial services licenses in either Saint Lucia or the United Kingdom. This aligns with the firm's own disclaimer, which confirms that all trading activities occur in a simulated environment and do not constitute real brokerage services or investment advice.

The same user also highlighted several red flags:

- Paid-up capital of only £1, despite claiming to have issued 1,000 unpaid shares.

- Sole director structure.

- Offshore setup with no transparent financial reporting.

- Previous user feedback pointing to delayed payments and lack of transparency.

BrokersView Reminds You

In recent years, prop trading has become increasingly popular worldwide, offering individual traders the prospect of "low-cost, high-reward" opportunities. However, a lack of regulation, ambiguous contracts, and opaque evaluation rules have made many such platforms potential gray zones.

For traders considering participation in these programs, BrokersView recommends verifying the following key aspects before committing:

- Clear regulatory status and license information.

- Authentic company registration details and physical office location.

- Independent audit reports or transparent payout history.

- Existence of consistent user complaints or unresolved cases online.

BrokersView will continue to monitor developments and any potential regulatory updates regarding Equity Edge. If you have experienced similar issues with Equity Edge or other proprietary trading firms, you are encouraged to submit your case through the BrokersView Complaint Center.