Arbitrage Claims or Withdrawal Dodging? Untangling the CWG Markets Compliance Clash

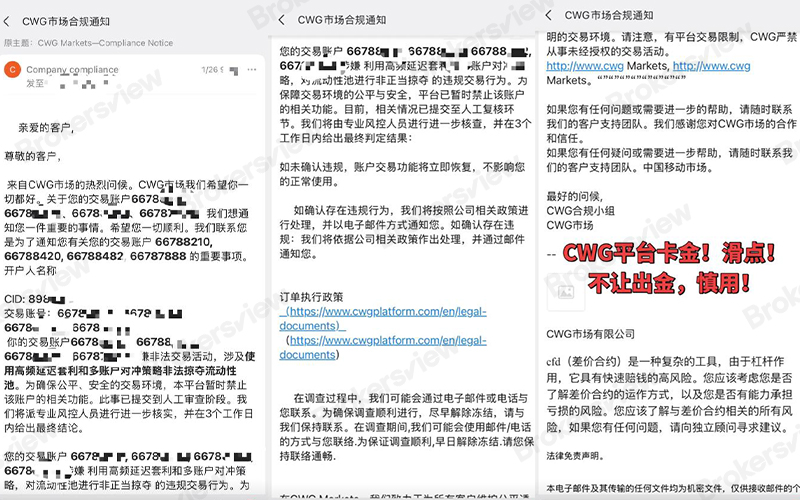

Recently, a user posted a social media post titled "CWG Platform Stuck Funds! Slippage! No Withdrawals, Use with Caution!", accusing the broker CWG Markets of refusing his/her withdrawal requests.

According to screenshots provided by the user, CWG Markets' compliance department sent a sternly worded email. The message stated that the user's multiple trading accounts were suspected of "illegal trading activities," specifically accusing him/her of using "high-frequency latency arbitrage" and "multi-account hedging strategies" to unfairly exploit the liquidity pool. The broker claimed that to ensure a fair and secure trading environment, account functions had been temporarily suspended, and the case was submitted for manual review. The email promised that professional risk control personnel would provide a final conclusion within three working days: if a violation is confirmed, it will be handled according to company policy; if not, functions will be restored.

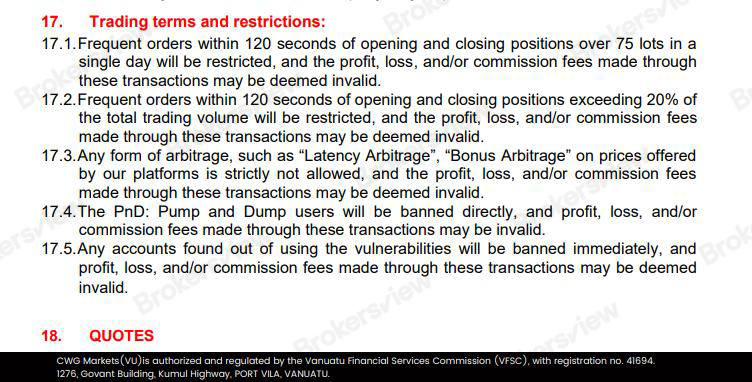

BrokersView reviewed CWG Markets' Trading Terms and Restrictions (Article 17). Clauses 17.1 and 17.2 specify that positions exceeding 75 lots in a single day or 20% of the total trading volume will be restricted if the duration between opening and closing is less than 120 seconds. Furthermore, Clause 17.3 prohibits any form of arbitrage, including "latency arbitrage" and "bonus arbitrage," stating that profits derived from such transactions may be deemed invalid.

Due to the lack of specific holding times and order details, it is currently difficult to determine whether the user actually violated the aforementioned "120-second rule" or engaged in latency arbitrage. As of now, the platform has not made the final investigation results public. Whether this dispute stems from "malicious retention of funds" or "legitimate risk control" remains inconclusive.

However, this is not the first time CWG Markets has faced such a crisis of trust. In June 2025, BrokersView reported frequent withdrawal complaints regarding this platform. At that time, a client reported that a withdrawal request for over $20,000 had been delayed without cause for seven months. Despite the client insisting that the gains resulted from standard trading practices, the platform used various excuses to refuse payment and freeze funds. Even after multiple attempts to contact the official email and account manager, the investor received no satisfactory explanation.

Even more controversial were the allegations that CWG implemented a "guilt by association" policy. Some investors complained that they had followed all rules and maintained transparent deposit/withdrawal records, yet their funds were frozen because another client under the same Introducing Broker (IB) was suspected of a violation. This "one-size-fits-all" risk control logic was criticized for ignoring the independence of individual accounts and being clearly unjust to compliant traders. During that period, the community was rife with accusations of "malicious profit deduction" and even labels of the platform being a "scam."

The Trust Game Under Regulatory Backing

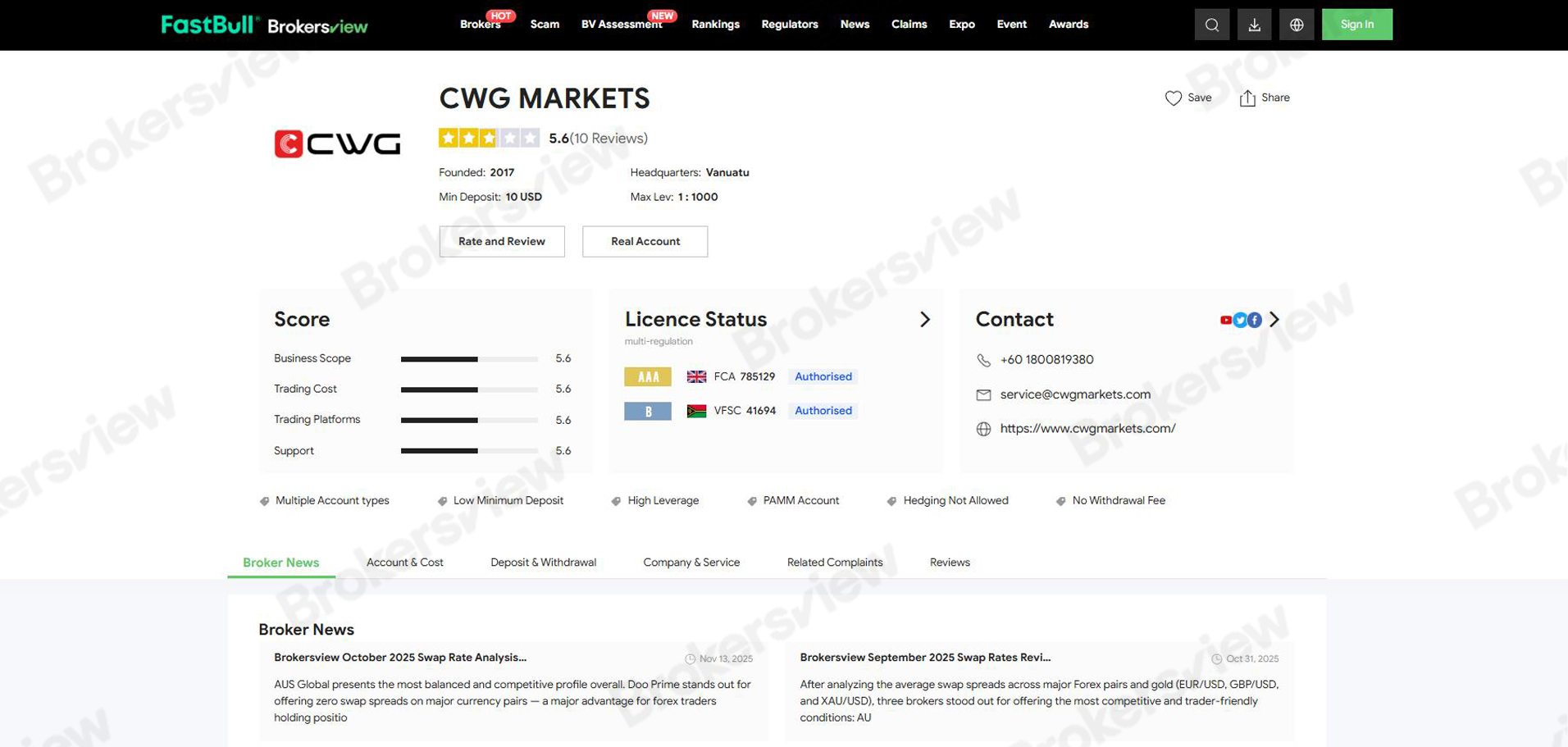

BrokersView's regulatory data shows that CWG Markets holds a license from the Financial Conduct Authority (FCA) in the UK, as well as an offshore license from the Vanuatu Financial Services Commission (VFSC).

This "dual identity" makes the current dispute particularly complex. On one hand, an FCA license typically signifies high compliance standards; on the other hand, recurring withdrawal disputes and stringent risk control terms leave investors feeling uneasy. For traders, understanding the rules and practicing compliant trading is vital. For the platform, finding the balance between enforcing risk control and protecting the user experience remains an unresolved challenge.

BrokersView Reminds You

If you encounter a similar dispute, please ensure you retain complete trading logs and communication records. If you have a dispute with a broker, you can file a complaint to BrokersView, and we will assist you in protecting your legitimate rights.