Daily Technical Analysis: [17 NOV]

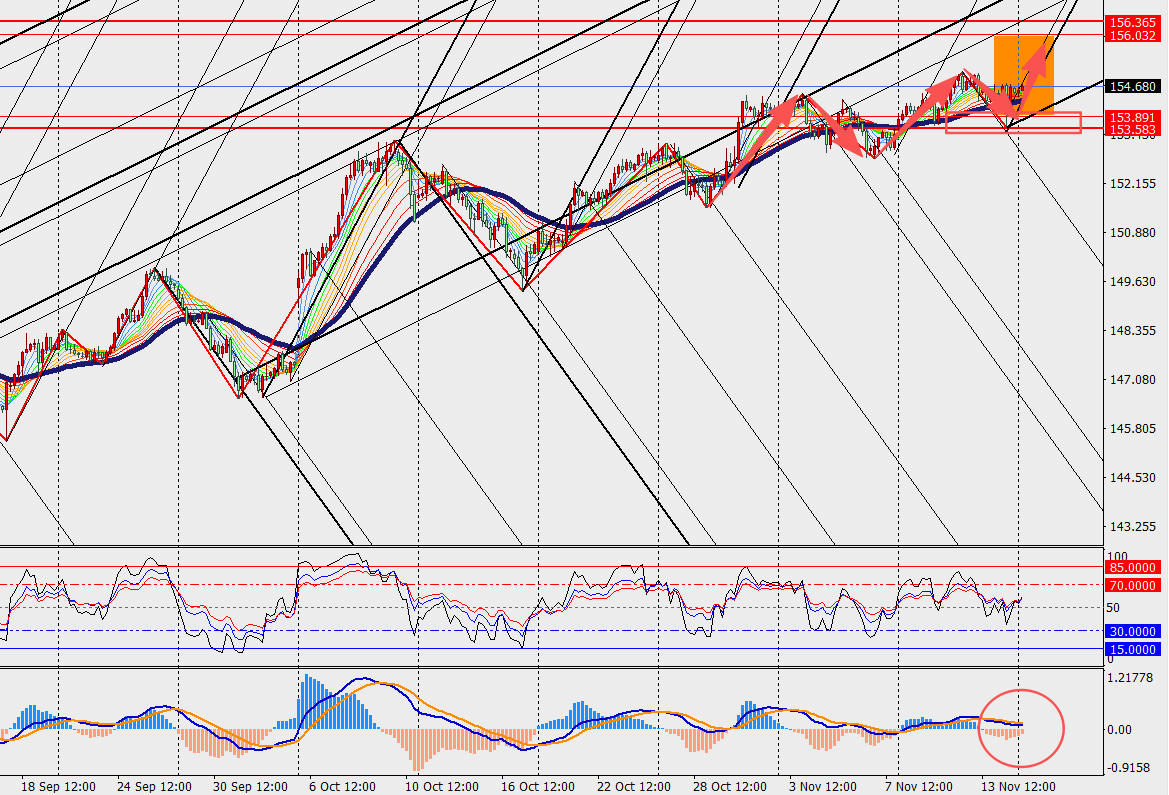

1. USD/JPY Analysis:

News Summary:

Japan’s economy posted its first contraction in six quarters, further complicating the Bank of Japan’s timetable for its next rate hike. Preliminary government data released on Monday showed that Japan’s real GDP shrank 0.4% quarter-on-quarter in the third quarter, marking the first decline since Q1 2024. On an annualized basis, the economy contracted by 1.8%. The weakness in economic activity may reinforce expectations that the Bank of Japan will wait until next year before taking any policy action.

Trend Analysis:

We can see USD/JPY is consolidating at high levels on the H4 chart and continues to trade above the 48 hours moving average. Meanwhile, the MACD double line and histogram bars are gradually converging above the zero line. The buy limit could be set, stop loss is necessary.

Today's Key Price Levels:

Key Support Levels: [153.70]

Key Resistance Levels: [156.00]

Pivot Points [154.20]

2. Gold Analysis:

News Summary:

From a historical comparison perspective, the current gold bull market may not yet be over. Both the magnitude and duration of this cycle’s rally remain below those of the two major uptrends in the 1970s and the 2000s. Given the present macro uncertainties, the long-term nature of global reserve reallocation, and the potential downward phase of the U.S. dollar cycle, the gold bull market does not appear to have reached its final stage—unless the Federal Reserve decisively ends the easing cycle or the U.S. economy re-enters a strong recovery characterized by falling inflation and accelerating growth.

Trend Analysis:

On the H4 chart, we can see gold has pulled back from its highs and is trading below the 48 hours moving average. However, the MACD double line and energy bars have begun to converge near the zero axis. The buy limit could be placed, stop loss is mandatory.

Today's Key Price Levels:

Key Support Levels: [4000]

Key Resistance Levels: [4100]

Pivot Points [4030]